How to Freeze Your Credit with Experian

Contents

Experian is one of the three major credit bureaus in the U.S., and you can freeze your credit with them to help protect your identity.

Checkout this video:

Introduction

When you freeze your credit, you place a security freeze on your credit report, which is a tool to prevent identity thieves from using your personal information to open new accounts in your name. A credit freeze is also sometimes called a security freeze or a fraud alert.

You can place a credit freeze on your Experian credit report online, by mail or by phone. You will need to provide certain information to verify your identity, including your name, address, date of birth and Social Security number. Once Experian processes your request, we will send you a confirmation letter with a unique PIN (personal identification number) or password that you can use to temporarily lift or permanently remove the security freeze from your Experian credit report.

What is a credit freeze?

A credit freeze is a way to help protect your credit from identity theft. It allows you to restrict access to your credit report, making it harder for identity thieves to open new accounts in your name. A credit freeze is also sometimes called a security freeze.

There are two types of credit freezes: a security freeze and a fraud alert. A security freeze is the more restrictive of the two and it prevents anyone from accessing your credit report without your permission. A fraud alert allows businesses to get a copy of your credit report but they must take additional steps to verify your identity first.

The steps to freezing your credit with Experian are as follows:

1. Log in to your Experian account or create an account if you don’t have one already.

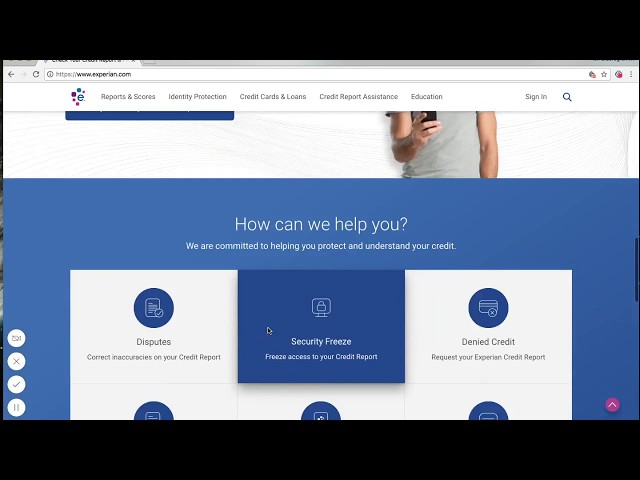

2. Click on the “Security Freeze” link under the “Protecting Your Experian Credit Report” section.

3. Select the reason for freezing your credit from the drop-down menu.

4. Enter your personal information, including your Social Security number, date of birth, and address.

5. Choose a PIN that you will use to unfreeze your credit in the future. Write this down in a safe place!

6. Click on the “Submit” button and your request will be processed within 24 hours.

How to place a credit freeze with Experian

You have the right to place a “security freeze” on your credit file, which will prohibit Experian from releasing any information from your credit report without your express authorization. A security freeze is designed to prevent credit, loans and services from being approved in your name without your consent.

If you are concerned about identity theft or fraud, placing a security freeze on your Experian credit file may prevent attempts to open new accounts in your name. However, it is important to note that a security freeze does not prevent all forms of identity theft.

If you placed a security freeze on your credit file and need to allow Experian to release your credit report for a specific period of time, you can “thaw” or temporarily lift the freeze. Once the designated thaw period expires, the freeze will automatically be reapplied to your Experian credit file.

There is no charge to place or remove a security freeze on your Experian credit file. To request a security freeze, you must send a certified letter by mail to each of the following:

-Experian Security Freeze

-P.O. Box 9554

-Allen, TX 75013

How to lift a credit freeze

If you decide you want to apply for credit in the future, you can lift your Experian credit freeze by contacting us online or by phone and requesting a lift. You will need to provide your unique PIN, which we will send to the address we have on file for you.

Once we receive your request, we will lift the credit freeze within one business day. If you request a lift by phone, we will lift the credit freeze immediately if you provide your PIN.

FAQs

Q: What is a credit freeze?

A: A credit freeze is a way to help prevent new accounts from being opened in your name. With a credit freeze in place, most creditors will not be able to access your credit report, which means they may not approve new applications for credit in your name.

Q: How do I place a credit freeze on my Experian report?

A: You can place a credit freeze on your Experian report online, by phone, or by mail.

Q: How much does it cost to place a credit freeze on my Experian report?

A: In most states, it costs $5-$10 to place a credit freeze on your Experian report. In some states, it may be free for victims of identity theft.

Q: How long does a credit freeze last?

A: A credit freeze remains in place until you lift it or remove it.