How to Check Your Business Credit Score

Contents

Your business credit score is one of the most important factors in determining your company’s financial health. Here’s how to check your business credit score and what you can do to improve it.

Checkout this video:

Get a business credit report

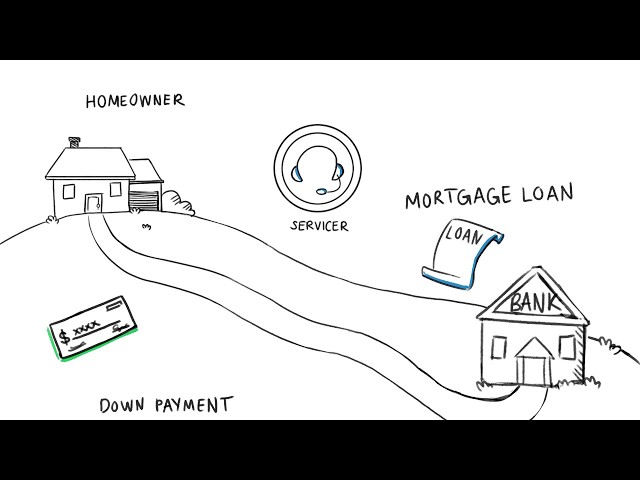

A business credit report is a report that details the creditworthiness of a business. It is used by financial institutions to make lending decisions and by businesses to monitor their own creditworthiness. There are three major credit reporting agencies in the United States: Experian, Equifax, and TransUnion. You can get a free business credit report from all three agencies.

Visit a business credit reporting website

There are a few different business credit reporting websites that you can use to check your business credit score. We recommend using Experian, Dun & Bradstreet, or Equifax.

To get started, simply create an account with one of these websites. Once you have an account, you will be able to access your business credit report.

When you check your report, be sure to look for any negative marks or blemishes. These can negatively impact your score and may make it more difficult to get approved for loans or lines of credit in the future. If you see any negative marks on your report, be sure to dispute them as soon as possible.

Get a copy of your business credit report

You can get a copy of your business credit report from any of the three major credit reporting agencies: Experian, Equifax, and TransUnion. You can also request a copy from any of the business credit reporting agencies, such as D&B or Ansonia.

When you request your report, you’ll need to provide some basic information about your business, including your business name, address, and tax identification number. You may also be required to provide a personal guarantee, which means you’re responsible for repaying any debt that your business incurs.

Once you have your report, take a close look at it to make sure all the information is accurate. If you find any errors, dispute them with the credit reporting agency.

Check your business credit score

Your business credit score is important. It is used by lenders to determine whether or not to give you a loan. It is also used by landlords to decide whether or not to rent to you. There are a few things you can do to check your score and make sure it is in good standing.

Check for errors on your report

The first step is to obtain a copy of your business credit report from the major business credit reporting agencies. You are entitled to a free annual report from each of these agencies, so take advantage of this right. Once you have your reports, go through them carefully to look for any errors. If you find any, be sure to dispute them with the credit agency.

Understand what factors affect your score

There are a number of factors that can affect your business credit score. The first is your payment history. This includes whether you pay your bills on time or not. It also includes any late payments, collections, or bankruptcies.

The second factor is the amount of debt you have. This includes both the amount of debt you have and the proportion of that debt that is currently being used. The more debt you have, and the more of it that is being used, the lower your score will be.

The third factor is the length of your credit history. The longer you have been in business, and the longer you have been using credit, the better your score will be.

The fourth factor is the types of credit you have used. A variety of different types of credit, such as lines of credit, loans, and credit cards, can improve your score.

The fifth factor is inquiries into your credit. Every time someone requests a copy of your credit report, it is counted as an inquiry. Too many inquiries can lower your score.

Work to improve your score

You should also actively work to improve your business credit score. Here are a few things you can do:

-Pay your bills on time and in full. This is the number one factor that affects your business credit score, so it’s important to keep up with payments. Set up reminders or automatic payments to make sure you always pay on time.

-Keep balances low on credit cards and other revolving credit. High balances relative to your credit limit can hurt your score.

-Maintain a good mix of different types of credit, such as revolving lines of credit, business loans, and vendor accounts.

-Monitor your personal credit report and scores. Although personal credit isn’t a factor in determining business credit scores, strong personal credit can give lenders confidence in you and your business.

-Check your business credit reports regularly. You’re entitled to a free report from each of the three major business credit bureaus every 12 months (you can get them all at once or spread out throughout the year). Reviewing your reports regularly can help you catch mistakes or signs of identity theft early on so you can take steps to resolve them.