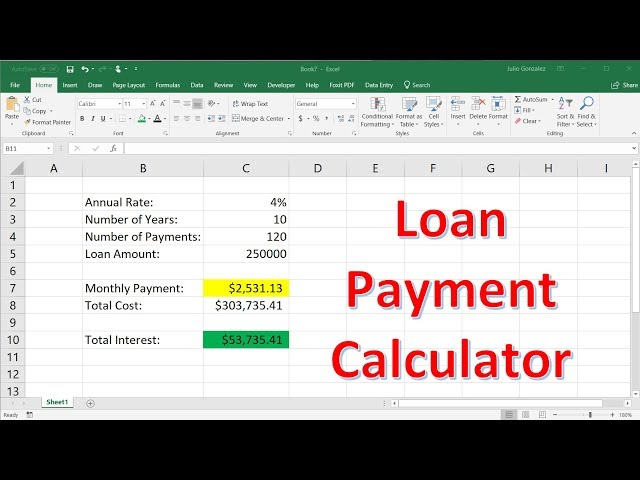

How to Calculate Loan Amount in Excel

Contents

How to Calculate Loan Amount in Excel – Follow these simple steps to calculate the loan amount you can afford based on your current income and debts.

Checkout this video:

Introduction

In order to calculate the loan amount in Excel, you will need to know the interest rate, the length of the loan, and the amount of each payment. You can use the following formula to calculate the loan amount:

loan amount = interest rate * number of payments / (1 – (1+interest rate)^(-number of payments))

To use this formula, you will need to know the interest rate, the length of the loan, and the amount of each payment. You can use the following steps to calculate the loan amount:

1. Find the interest rate:

The interest rate is usually stated as a percentage. For example, if you are quoted an interest rate of 6%, this means that your interest will be 6% of your loan amount.

2. Find the number of payments:

The number of payments is usually stated in years. For example, if you are quoted a 5-year loan, this means that you will make 60 payments (5 years x 12 months).

3. Find the amount of each payment:

The amount of each payment is usually stated as a dollar amount. For example, if you are quoted a payment amount of $500, this means that your payments will be $500 per month.

The Loan Amount Function

Excel offers a built-in function for calculating the amount of a loan, called “loan amount.” To use this function, enter the following into a cell:

=loan amount(interest rate, number of payments, payment amount)

For example, if you have an interest rate of 5%, and you want to make payments over the course of 5 years (60 months), and your payment amount is $500 per month, your loan amount calculation would be as follows:

=loan amount(5%, 60, 500)

This would return a value of $50,000, which is the total amount of the loan.

The Loan Amount Formula

To calculate the loan amount in Excel, you will use the PMT function. The PMT function is a built-in function in Excel that is categorized as a financial function. It can be used as a worksheet function (WS) in Excel. As a worksheet function, the PMT function can be entered as part of a formula in a cell of a worksheet.

The syntax for the PMT function is:

PMT( rate, nper, pv, [fv], [type] )

rate – The interest rate of the loan.

nper – The number of payments for the loan.

pv – The present value of the loan; also called the principal.

fv – [Optional] The future value of the loan; also called the balance after nper payments have been made. If omitted, fv defaults to 0 (zero), and you must include the fv parameter if you want to calculate credit card interest accrued with your monthly payment (calculate future value). If fv is omitted and type is omitted or type is equal to 0, then pmt assumes that future values are 0 (zero).

type – [Optional] The number 0 or 1 and indicates when payments are due:

0 or omitted – Payments are due at the end of each period.

1 – Payments are due at the beginning of each period.

How to Use the Loan Amount Function

To calculate the loan amount, you can use the Loan Amount function. This function takes three arguments: the rate, the number of payments, and the present value. The rate is the interest rate of the loan. The number of payments is the total number of payments that will be made on the loan. The present value is the amount of money that you currently have to pay back on the loan.

To use this function, first open up Microsoft Excel. Then, type in “=Loan Amount(” into a cell. After that, input the rate, then the number of payments, and finally the present value. Finally, press Enter to calculate your payment amount.

How to Use the Loan Amount Formula

The loan amount formula is used to calculate the total amount of a loan. The formula is:

Loan Amount = Principal x (1 + Interest Rate)^Number of Periods

where:

Principal is the original amount of the loan.

Interest Rate is the interest rate per period.

Number of Periods is the number of periods over which the loan will be paid.

Conclusion

Assuming that you have all the relevant information, calculating a loan amount in Excel is a relatively simple process. The first step is to determine the interest rate charged on the loan. This can be found in the loan agreement or by contacting the lender. Once you have the interest rate, you can use the Excel function “PMT” to calculate the monthly payment amount.

The “PMT” function takes three inputs – the interest rate, the number of periodic payments (in this case, monthly payments), and the principal amount of the loan. The function will return the amount of each monthly payment. In order to calculate the total loan amount, you simply need to multiply the monthly payment by the number of payments you will make (typically 36 or 60).

Keep in mind that this calculation does not take into account any fees or additional charges that may be included in your loan agreement. Be sure to read over your agreement carefully before signing anything to be sure you understand all of the terms and conditions.