How to Calculate Credit Card Interest

Contents

Find out how to calculate credit card interest so you can make informed decisions about your finances.

Checkout this video:

What is credit card interest?

If you have a credit card, chances are you’ve been charged interest on it at some point. Interest is the price you pay for borrowing money, and it’s expressed as a percentage of the total amount you owe. For example, if you have a credit card with a balance of $1,000 and an interest rate of 15%, you’ll owe $150 in interest after one year.

Simple interest

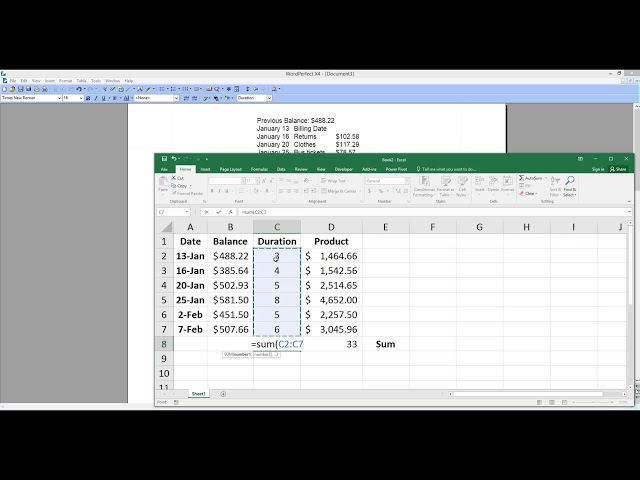

Simple interest is the amount of money you’ll accrue on your credit card balance based on your APR and daily balance. To calculate simple interest, multiply your daily balance by the number of days in the billing cycle, then multiply that by your APR, and divide by 365.

Here’s an example: Let’s say you have a balance of $1,000 and an APR of 15%. Your billing cycle is 30 days long. To calculate the interest you’ll pay in a single billing cycle, multiply your daily balance ($1,000) by the number of days in the billing cycle (30), then multiply that by your APR (0.15), and divide by 365. The result is $2.74 in interest for that month.

Compound interest is different from simple interest because it’s calculated based on the previous periods’ interest plus principal—essentially, it’s accruedinterest on top of accrued interest. In other words, with compound interest, you payinterest not only on your original debt but also on the accumulatinginterest from prior periods.

To calculate compound interest, start by multiplying your daily balance by the numberof days in the billing cycle. Then, add any new purchases made during thatbilling cycle to that figure to get your average daily balance for the period.Next, multiply your average daily balance figure by the number of days inthe year (365) and then again by your APR—and divide everything by 365 to getyour monthly compound interest charge.

Here’s an example: For simplicity’s sake we’ll use the same figures as before—a$1,000 balance with a 15% APR—but this time we’ll assume there was a $100purchase made during the last billing period so now our average dailybalance is $1,100. To calculate compound interest we start with our dailybalance ($1,100) and multiply it by the number of days in our billing cycle(30). That gives us $33,000; to that we add any new purchases made duringthat same period ($100), bringing us to an average daily balance of$33,100 for the month. We then take that figure and multiply it againby our APR (0.15) as well as by 365—and divide everything by 365 to arrive atour monthly compound interest charge: $9.86

Compound interest

Compound interest is the addition of interest to the principal sum of a loan or deposit, or in other words, interest on interest. It is the result of reinvesting interest, rather than paying it out, so that over time the amount really begins to grow.

Most credit cards compound interest daily. That means every day, your credit card issuer will calculate the amount of interest you owe based on your current balance and APR. Then, that interest will be added to your balance for the following day.

For example, say you have a credit card with a $1,000 balance and a 20% APR. Each day, you’ll owe $1 in interest (20% of $1,000 divided by 365 days). So, at the end of one year — assuming you don’t make any additional charges or payments — you’ll still owe $1,000 on your card. But now it will cost you $367 in total interest to pay off that debt ($1 multiplied by 365 days).

If you continue carrying a balance and compound interest builds up over time, it can be very difficult — and expensive — to get rid of your debt.”

How is credit card interest calculated?

Credit card companies typically use one of two methods to calculate interest charges on your outstanding balance: the average daily balance method or the daily balance method. The method your issuer uses can affect the amount of interest you pay.

Average daily balance method

The average daily balance method is the most common way that credit card companies calculate interest charges. To calculate your interest charge using this method, your credit card company will take the beginning balance of your statement period, add any new charges and subtract any payments or credits made during the period, and divide that by the number of days in the period. This gives you your average daily balance. The credit card company will then multiply your average daily balance by the daily periodic rate—which is your annual percentage rate (APR) divided by 365—to come up with the interest charge for the period.

Previous balance method

Most credit card companies calculate interest charges using what’s called the “previous balance method.” With this method, the credit card company takes the balance from your last statement, adds any new charges, and subtracts any payments or credits you’ve made since the last statement. The total is then multiplied by the daily periodic rate (DPR) to arrive at the interest charge for the month.

Here’s an example:

Say you have a credit card with an 18% APR and a balance of $500 on your last statement. During the month, you charge an additional $200 to the card, for a new balance of $700. You also make a payment of $50 during the month.

The credit card company would first add any new charges to your previous balance, for a total owed of $700. They would then subtract your payment from this amount, for a new balance of $650. The credit card company would multiply this balance by the DPR (0.0005), which would equal $0.325 in interest charges for that month.

Adjusted balance method

Under the adjusted balance method, your credit card company calculates your interest charges based on your account balance at the end of each billing cycle. To calculate your interest charges using this method, your credit card issuer subtracts any credits or payments you made during the billing cycle from your balance at the beginning of that billing cycle. It then applies a daily periodic rate to this adjusted balance.

For example, say you have a $1,000 balance on your credit card with a 14% annual percentage rate and you made a $50 payment during the billing cycle. Your card issuer would first subtract the $50 payment from the $1,000 starting balance, resulting in an adjusted balance of $950. It would then apply a daily periodic rate of 0.038% to this figure (14% annual percentage rate divided by 365 days), resulting in daily interest charges of approximately 36 cents ($950 x 0.038% = $3.57 per month).

How to avoid paying credit card interest

There are a few things you can do to avoid paying interest on your credit card balance. One is to pay your balance in full every month. This way, you will only be charged the annual percentage rate (APR) on purchases made that month and won’t be charged any interest. Another way to avoid interest is to take advantage of 0% APR offers.

Pay your balance in full every month

Paying your balance in full every month is the best way to avoid interest charges. When you carry a balance on your credit card from one month to the next, you are charged interest on that balance. The amount of interest you are charged depends on your annual percentage rate (APR).

You can avoid paying interest charges by paying your balance in full before the end of each billing cycle. If you carry a balance, be sure to pay as much as you can each month to reduce the amount of interest you will pay over time.

Use a 0% APR credit card

If you have debt on a high-interest credit card, one of the best ways to pay it down is to transfer the balance to a 0% APR credit card. This will allow you to avoid paying interest on your debt for a set period of time, giving you a big advantage when it comes to paying down your balance.

There are a few things to keep in mind when you’re looking for a 0% APR credit card:

-Make sure the 0% APR period is long enough for you to pay off your debt. The longer the better, but 12-18 months is usually sufficient.

-Watch out for balance transfer fees. Some cards will charge a fee (usually 3-5%) to transfer your balance, which can eat into your savings. Look for a card with no balance transfer fee, or one that waives the fee if you make your transfer within 60 days of opening your account.

-Remember that after the 0% APR period ends, any remaining balance will start accruing interest at the regular rate. Make sure you have a plan in place to pay off your debt before that happens.

If used responsibly, 0% APR credit cards can be a great tool for getting out of debt. Just make sure you do your research and find a card that’s right for you.

Get a personal loan

One way to avoid paying credit card interest is to get a personal loan. You can use a personal loan to pay off your credit card balance in full, and then you’ll only owe interest on the personal loan. Personal loans typically have much lower interest rates than credit cards, so you’ll save money in the long run.