How to Apply for an FHA Loan in Georgia

Contents

Applying for an FHA loan in Georgia may seem like a daunting task, but with a little research and preparation, it doesn’t have to be. This article will walk you through the process of how to apply for an FHA loan in Georgia.

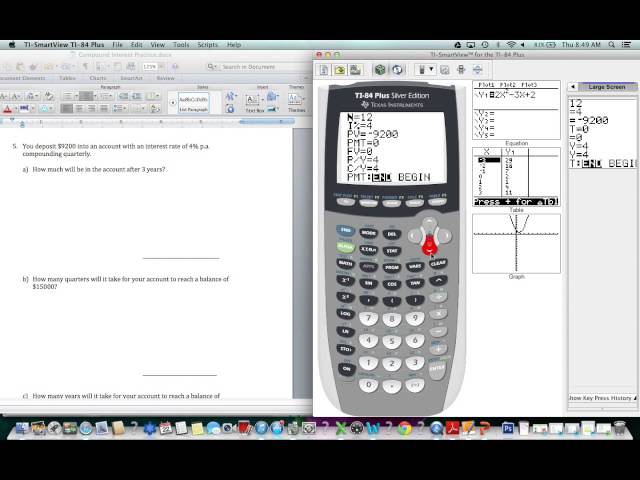

Checkout this video:

Overview of FHA Loans

FHA loans are mortgages insured by the Federal Housing Administration, and they are a great option for first-time homebuyers or people with less-than-perfect credit. In order to apply for an FHA loan in Georgia, you’ll need to find an FHA-approved lender and submit a loan application. Once you’re approved, you’ll be able to start shopping for a home within your price range.

What is an FHA Loan?

An FHA loan is a mortgage loan that is backed by the Federal Housing Administration (FHA). Borrowers with FHA loans pay for mortgage insurance, which protects the lender from a loss if the borrower defaults on the loan. fha home loans near me

While most conventional loans require a down payment of at least 3 percent, FHA loans only require a 3.5 percent down payment. In addition, borrowers with credit scores of 580 or higher can qualify for an FHA loan with a down payment as low as 3.5 percent.

If your credit score is between 500 and 579, you can still qualify for an FHA loan but you will need to put down 10 percent instead of 3.5 percent.

How do FHA Loans Work?

An FHA loan is a mortgage that’s insured by the Federal Housing Administration (FHA). They are popular especially among first time home buyers because they allow down payments of 3.5% for credit scores of 580+. However, borrowers must pay mortgage insurance premiums, which protects the lender if a borrower defaults.

FHA loans are available in all 50 states and territories like Puerto Rico, Guam, and U.S. Virgin Islands. However, there are limits to how much you can borrow. In most counties in Georgia, the limit is $314,827 for a single-family home. Higher limits are allowed in areas with higher home prices, like major metropolitan areas and Hawaii.

To qualify for an FHA loan in Georgia, your home must be your primary residence and you must live in it full-time. You’ll also need a valid Social Security number, eligible citizenship or immigration status, and to be of legal age to sign a mortgage in Georgia.

Who is Eligible for an FHA Loan?

To be eligible for an FHA loan, the borrower must be a legal resident of the United States and a U.S. citizen, have a valid Social Security number, and be of legal age to sign a mortgage in the state where the property is located. In addition, the borrower must have steady employment history and income as well as good credit.

There are some exceptions to these eligibility requirements. For instance, non-U.S. citizens with an unexpired work visa may be eligible for an FHA loan if they meet all other requirements. Borrowers with less than two years of employment may also qualify if they can show a steady employment history or have enough income from other sources to cover the mortgage payments. Finally, self-employed borrowers may also be eligible for FHA loans if they can provide proof of consistent income and demonstrate that their business is stable.

Applying for an FHA Loan in Georgia

Applying for an FHA loan in Georgia is a process that starts with finding a mortgage lender. You can use this guide to help you find a lender in your area. Once you have found a lender, you will need to fill out an application and provide the required documentation. After your application has been processed, you will be able to shop for a home that fits your budget and needs.

Find a Lender

The first step in applying for an FHA loan in Georgia is to find a lender that has been approved by the Department of Housing and Urban Development (HUD) to participate in the program. Not all lenders are HUD-approved, so you will need to shop around to find one that is willing to work with you.

HUD maintains a list of approved lenders on its website, so you can start your search there. Alternatively, you can work with a mortgage broker who may have access to more lenders and be able to help you find the best deal.

Once you have found a few potential lenders, it is time to compare their offers. Be sure to look at more than just the interest rate when making your decision. Other factors such as loan terms, fees, and customer service should also be considered.

When you have selected a lender, it is time to begin the application process. The first step is to fill out a standard mortgage application form. This form will ask for information about your employment, income, debts, and assets. You will also need to provide documentation such as pay stubs or tax returns to verify your information.

After your application has been submitted, the lender will order a credit report and an appraisal of the property you are interested in purchasing. They will then review these items along with your application to determine if you are eligible for an FHA loan in Georgia. If approved, you will be provided with a loan estimate which outlines the terms of your loan and what your monthly payments will be.

Get Pre-Approved

As you begin shopping for a house, you will work with a loan officer who will help you get pre-approved for a mortgage. The pre-approval process allows you to get an idea of how much home you can afford and what type of interest rate to expect. To get pre-approved, your loan officer will need to know:

-Your employmenthistory

-Your income

-Your credit score

-The amount of debt you currently have

-Your monthly expenses

Complete a Loan Application

You can complete an FHA loan application online, through your chosen lender’s website, or by visiting their office in person. Once you have an account with the lender, you’ll supply them with information about yourself, your employment and income history, and your current financial situation.

The FHA requires that all borrowers be at least 18 years old and have a valid Social Security number. You will also need to provide proof of any outstanding debts, as well as your current housing situation. If you’re applying for a loan to purchase a home, you’ll also need to provide information about the property you’re interested in.

Submit Additional Documentation

After you have completed your loan application and submitted your supporting documentation, your loan package will be sent to an underwriter. The underwriter will carefully review all of the information in your application to determine whether or not you qualify for the loan. If you are approved, the underwriter will issue a “commitment letter” to the lender. This letter outlines the terms of the loan and how much money you are qualified to borrow. If there are any conditions that must be met before you can close on the loan, they will be listed in the commitment letter.

What to Expect During the Loan Process

If you’re a first-time home buyer in Georgia, you may be interested in an FHA loan. An FHA loan is a mortgage that’s insured by the Federal Housing Administration. This type of loan can be a good option if you don’t have a lot of money for a down payment or if you have limited credit history. Here’s what you need to know about the loan process.

Loan Underwriting

During the loan underwriting process, your loan officer will review your financial information to determine whether or not you are eligible for a loan. If you are approved, they will provide you with a loan estimate detailing the terms of your loan. This estimate will include the interest rate, monthly payment, and closing costs. Once you have reviewed and accepted the terms of your loan, the underwriter will send your file to the mortgage company for final approval.

Loan Approval

The FHA loan approval process is not entirely credit-driven, however, your credit score is still an important part of the loan approval process. The minimum credit score for an FHA loan in Georgia is 580, which is lower than the minimum credit score for a conventional loan. In order to get an FHA loan with a 580 credit score, you will need a minimum down payment of 3.5%. If you have a credit score of below 580, you may still be able to get an FHA loan, but you will need a down payment of at least 10%.

Loan Closing

During the loan closing process, the loan originator will collect all of the necessary documentation from the borrower in order to complete the loan application. This may include things like pay stubs, tax returns, and bank statements. Once all of the documentation has been collected, the loan originator will then submit it to the underwriter for approval.

The underwriter will review all of the information and make a decision about whether or not to approve the loan. If everything looks good, they will give their approval and the loan will move forward to closing. If there are any issues with the application, the underwriter may request additional information or deny the loan entirely.

Once approved, the borrower will then work with a closing agent to schedule a time and place to sign all of the paperwork and finalize the loan. The closing agent will go over all of the documents with the borrower to make sure they understand everything before signing. Once everything is signed and finalized, the borrower will be given keys to their new home!

FAQs

If you’re a first-time homebuyer or you’ve never applied for an FHA loan before, there may be some things you don’t know about the process. Here are some frequently asked questions that will help you understand the process of how to apply for an FHA loan in Georgia.

How much can I borrow with an FHA loan in Georgia?

The amount you can borrow with an FHA loan in Georgia will depend on a number of factors, including the value of your home, the size of your down payment, and your financial history. However, you can typically expect to borrowing between 3 and 5 percent of your home’s value.

What is the minimum credit score for an FHA loan in Georgia?

The minimum credit score for an FHA loan in Georgia is 580. This is for a conventional loan with 3.5% down payment. For borrowers with lower credit scores, an FHA loan may be the only option for financing.

How much does an FHA loan in Georgia cost?

There are a few costs associated with getting an FHA loan in Georgia. First, you will have to pay a loan origination fee, which can be up to 2% of the loan amount. You will also have to pay for appraisal and inspection fees, as well as any other fees charged by the lender.