How to Apply for the Best Buy Credit Card

Contents

How to Apply for the Best Buy Credit Card & Get the Best Deals – Find out how to apply for the Best Buy credit card and get the best deals on your purchases. Learn about the different types of Best Buy cards and how to use them to get the most out of your shopping experience.

Checkout this video:

Introduction

The Best Buy credit card can save you money on your purchases at Best Buy, both in-store and online. It’s a good idea to familiarize yourself with the different types of cards available and how they work before you apply.

There are two main types of Best Buy credit cards: the Store Card and the Elite Plus Card. The Store Card is a basic card that can only be used at Best Buy. The Elite Plus Card is a more advanced card that can be used anywhere Visa is accepted.

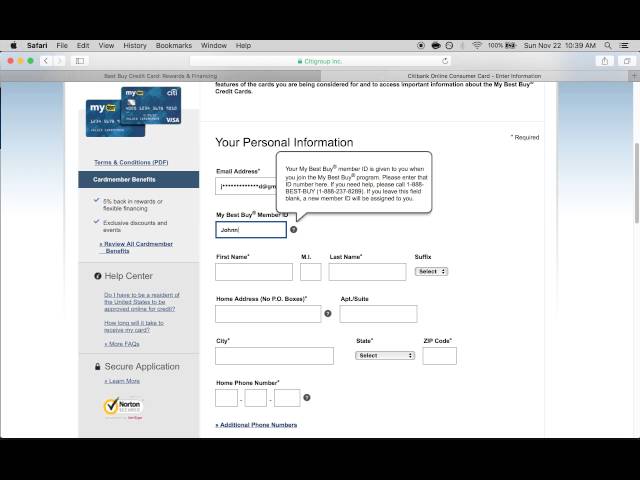

To apply for the Best Buy credit card, you’ll need to provide some basic personal information, such as your name, address, and date of birth. You’ll also need to provide your Social Security number so that Best Buy can run a credit check.

It’s important to note that, like most store cards, the Best Buy credit card comes with a relatively high interest rate. If you carry a balance on your card from month to month, you could end up paying more in interest than you save with the card’s discounts.

What are the requirements for the Best Buy credit card?

In order to qualify for the Best Buy credit card, you must:

-Be a legal resident of the United States

-Be at least 18 years old

-Have a valid Social Security number

-Have a good to excellent credit rating

To apply for the Best Buy credit card, you will need to provide:

-Your full name

-Your date of birth

-Your current address and phone number

-Your email address

-Your annual income

-Your Social Security number

What are the benefits of the Best Buy credit card?

Apart from the obvious benefit of being able to purchase items from Best Buy on credit, the Best Buy credit card offers a number of other advantages. Cardholders earn 2% back in rewards on every purchase made at Best Buy, whether it’s for a big-ticket item or something small like an accessory. These rewards can be used like cash in-store or online at BestBuy.com.

Cardholders also get special financing offers on select purchases. For example, a recent offer gave cardholders 18 months of financing on any single item purchased for $599 or more. These special financing deals can save cardholders a lot of money on major purchases, as long as they pay off the balance within the specified time frame.

Finally, the Best Buy credit card comes with some built-in fraud protection features. For example, if your card is ever lost or stolen, you can call customer service and have your card canceled immediately. You won’t be responsible for any unauthorized charges made to your account, and you can rest easy knowing that your information is safe.

How to apply for the Best Buy credit card?

To apply for the Best Buy credit card, visit the Best Buy website and click on the “Apply Now” link. You will be directed to a page where you will be asked to provide your personal information, contact information, and financial information. Once you have completed the application, click on the “Submit” button and your application will be processed.

Conclusion

Best Buy credit cardholders enjoy a number of perks, including 5% back in rewards on Best Buy purchases, no annual fee, and a 0% APR for 18 months on Best Buy purchases. Applying for the Best Buy credit card is quick and easy, and can be done online, in-store, or over the phone.