How to Apply for a Best Buy Credit Card

Contents

Best Buy offers a store credit card with a number of benefits and perks. If you’re a regular Best Buy shopper, you may be wondering how to apply for a Best Buy credit card. Here’s a quick guide on how to do it.

Checkout this video:

Introduction

Best Buy offers two credit card options: the My Best Buy Credit Card and the My Best Buy Visa Card. Both cards can be used in-store and online at BestBuy.com, and cardholders can enjoy exclusive financing offers, rewards and more. Read on to learn how to apply for a Best Buy credit card that best suits your needs.

What is the Best Buy Credit Card?

The Best Buy Credit Card is a store card that can only be used at Best Buy locations. It offers cardholders 5% back in rewards on qualifying purchases, as well as special financing options on certain items. Applying for the card is easy and can be done online, in-store, or over the phone.

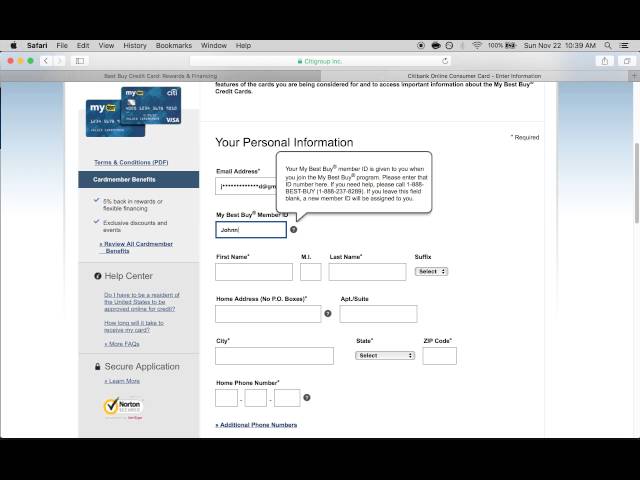

To apply for the Best Buy Credit Card online, you will need to provide your personal information, contact information, and financial information. You will also need to create an account with Best Buy. Once your account has been created, you can begin the application process.

In-store applications can be completed at any Best Buy location. To apply, you will need to provide your personal information and contact information. A customer service representative will then run a credit check and verify your identity. If you are approved for the card, you will receive it on the spot.

Applying for the Best Buy Credit Card over the phone is similar to applying online. You will need to provide your personal information and contact information. A customer service representative will then run a credit check and verify your identity. If you are approved for the card, you will receive it in the mail within 7-10 business days.

Applying for the Best Buy Credit Card

Applying for the Best Buy Credit Card is easy. Simply fill out an application online or at any Best Buy store. You will need to provide some personal information, such as your name, address, phone number, and date of birth. You will also need to provide your Social Security number. Once you have completed the application, you will receive a decision within minutes.

What to do if you are not Approved for the Best Buy Credit Card

If you are not approved for the Best Buy credit card, you can still shop at Best Buy with another form of payment. You may want to consider a Best Buy store card instead. Store cards are not credit cards, but they can still help you save money on your purchases.

Conclusion

Before you apply for a Best Buy credit card, make sure you understand the terms and conditions associated with the card. It’s important to know the interest rate, annual fee, and other associated costs before you make a decision. Once you’ve decided that a Best Buy credit card is right for you, the process is simple. Just fill out an application form and provide some basic information about yourself and your financial history.