How Often Can You Apply for Credit Cards?

Contents

How often can you apply for credit cards?

The answer may depend on the issuer, but there are some general guidelines you can follow.

Checkout this video:

Applying for Credit Cards

Applying for credit cards can be a great way to improve your credit score and get access to more credit. However, you need to be careful about how often you apply for credit cards. Applying for too many credit cards can actually hurt your credit score. So, how often can you apply for credit cards?

Applying for too many credit cards at once

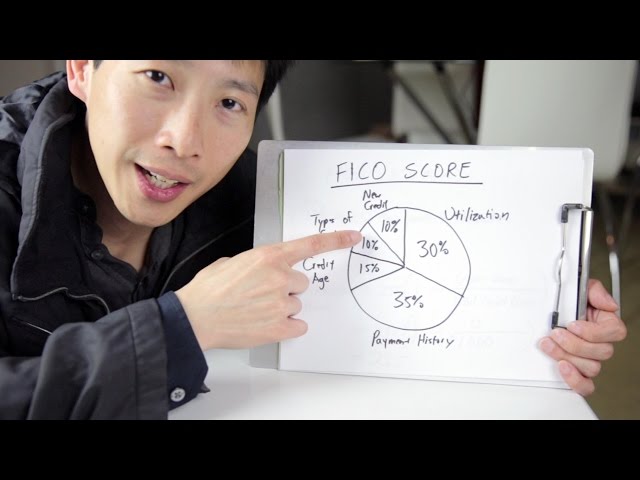

Applying for too many credit cards at once can negatively impact your credit score. Each time you apply for a credit card, the issuer will do a hard pull on your credit report. This hard inquiry can lower your credit score by a few points. If you apply for several cards in a short period of time, it can add up and have a significant impact on your score.

It’s best to space out your credit card applications so that you only have one or two hard inquiries on your report at any given time. This will minimize the damage to your score and give you the best chance of getting approved for the cards you want.

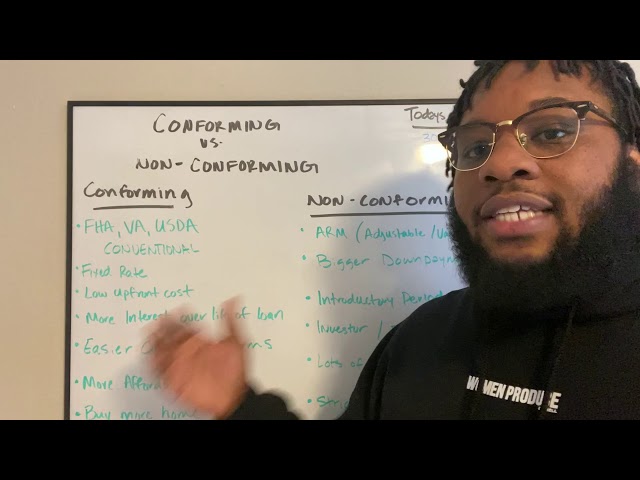

Applying for credit cards with the same bank

It’s generally a good idea to diversify your credit card portfolio by having cards from different issuers. This way, you’re not as vulnerable if one bank makes a change that you don’t like, such as removing a perk or increasing an annual fee.

That said, there are some advantages to getting multiple cards from the same issuer. First, it can be easier to earn rewards because you can combine points across cards. For example, if you have two cards from the same airline, you can pool your points to book a flight sooner.

Another advantage is that you may be able to get a higher credit limit by having multiple cards with the same issuer. This could come in handy if you have a large purchase to make or want to avoid hitting your credit limit on one card and incurring fees.

If you’re considering applying for multiple credit cards with the same bank, here are a few things to keep in mind:

Inquiries for multiple cards may count as one: If you apply for several cards from the same issuer within a short period of time, those inquiries may only count as one on your credit report. So if you’re worried about how multiple inquiries will affect your score, know that they may not have as much of an impact as you think.

You may not qualify for all offers: Just because you’re approved for one credit card with an issuer doesn’t mean you’ll automatically qualify for other offers. Each card has its own set of criteria, so make sure you meet the requirements before applying.

Your spending patterns will be monitored: When you have multiple credit cards with the same issuer, that issuer will have a better idea of how you spend money. If they see that you’re consistently making large purchases or carrying a balance on one card, they may lower your credit limit or close your account altogether. So it’s important to use your cards responsibly regardless of how manyyou have.

Applying for credit cards with different banks

There’s no definitive answer to how often you can apply for credit cards with different banks, as it can depend on a number of factors. However, if you’re planning on applying for multiple credit cards within a short period of time, it’s important to be aware of the potential impact on your credit score.

When you apply for a credit card, the bank will usually do a “hard pull” of your credit report. This can temporarily lower your credit score by a few points. If you have several hard pulls in a short period of time, it can have a more significant impact on your score.

Additionally, each new credit card account will add to your overall “credit utilization,” which is the amount of credit you’re using relative to the amount of credit you have available. If your credit utilization is too high, it can also negatively impact your score.

For these reasons, it’s generally best to space out your applications for new credit cards, so that you’re not having too many hard pulls or increasing your credit utilization too much at once. If you’re not sure how often you should apply for new cards, it’s a good idea to talk to a financial advisor or credit counselor who can help you create a plan that’s right for you.

Applying for Store Credit Cards

Applying for store credit cards online

When you’re trying to build credit or earn rewards, one strategy is to open several store credit cards. But how often can you apply for credit cards?

The answer depends on the store, but most have a limit of one card per household. That means if you and your spouse both apply for the same card, only one of you will be approved.

There are some exceptions, though. Target, for example, allows each member of a household to have their own Target REDcard. And Barnes & Noble allows each person in a household to have their own Barnes & Noble Mastercard.

If you’re not sure whether a store allows multiple credit cards per household, your best bet is to call the customer service number on the back of the card and ask.

Applying for store credit cards in person

If you’re interested in applying for a store credit card, your best bet is to do so in person. Many stores will offer you a discount on your purchase if you apply for their credit card on the spot. Applying for a store credit card in person also allows you to ask questions about the card and get more information about the rewards and benefits that come with it.

When you apply for a store credit card in person, be sure to bring your driver’s license or other form of identification. The store will likely need this information to run a credit check on you. Be prepared to answer questions about your income, employment history, and debts. You may also be asked to provide your Social Security number.

Applying for Secured Credit Cards

You can apply for multiple secured credit cards at the same time, but it’s important to know how this will affect your credit score. Applying for too many credit cards at once can lower your score, so it’s important to space out your applications. We’ll give you some tips on how to do this.

Applying for a secured credit card online

When you apply for a secured credit card online, you will typically need to provide some personal information such as your name, address and Social Security number. You may also need to provide financial information such as your annual income and monthly housing payment. Once you have submitted your application, the issuer will review your credit history and make a decision about whether or not to approve you for the card.

If you are approved, you will generally need to make a deposit into a savings account with the issuer in order to secure the line of credit. The size of the deposit will usually be equal to your credit limit. For example, if you are approved for a $500 credit limit, you may need to make a $500 deposit. Once your deposit has been made, your secured credit card will be mailed to you and you can begin using it just like any other credit card.

Applying for a secured credit card in person

When applying for a secured credit card in person, you will need to bring along your Social Security number, proof of income, and a government-issued photo ID. You will also need to have your credit reports handy so that you can review them with the credit card issuer.

Applying for a Business Credit Card

You can usually apply for a business credit card once every six months. This is because business credit cards usually have a higher credit limit than personal credit cards. Applying for a business credit card can help you build your business credit history, which can be useful if you ever need to apply for a loan.

Applying for a business credit card online

When you’re ready to apply for a business credit card, the application process is similar to that of a personal credit card. However, there are a few key differences.

For starters, you’ll need to provide your business information instead of your personal information. This includes your business name, address, tax identification number and type of business. You may also be asked to provide your average monthly credit card sales and the names of any business partners or principals.

In addition, most business credit cards require a personal guarantee. This means that you, as the business owner, are personally responsible for repaying any debt incurred on the card. If your business can’t repay the debt, you’ll be on the hook for it yourself.

Finally, keep in mind that some business credit cards require an annual fee. Be sure to read the terms and conditions carefully before you apply so that you know what fees you’ll be responsible for paying.

Applying for a business credit card in person

When you apply for a business credit card in person, you will need to bring along some documentation. This may include your business license, tax ID number, and financial statements. The bank will use this information to determine your creditworthiness and decide whether or not to approve your application.

It’s important to note that you can only apply for a business credit card if you are a business owner. If you are not a business owner, you will not be able to get a business credit card.