How Much Down Payment Do You Need for a Conventional Loan?

Contents

If you’re looking to get a conventional loan, you’ll need to put down a significant down payment. Here’s what you need to know about how much you’ll need to save.

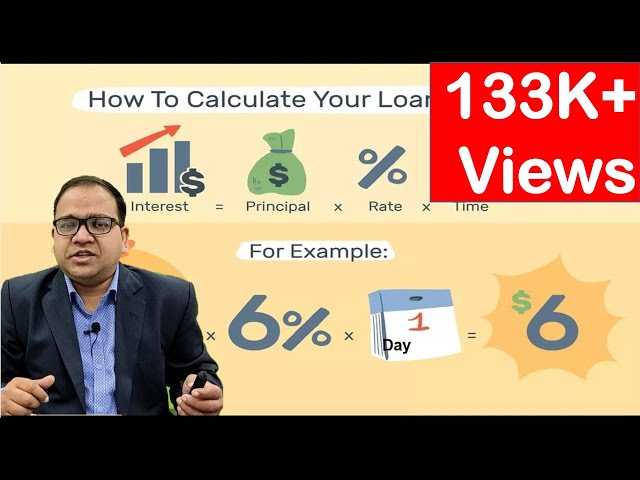

Checkout this video:

How Much Down Payment Do You Need for a Conventional Loan?

A conventional loan is a type of mortgage that is not backed by the government, such as an FHA or VA loan. Conventional loans are available through many lenders, including banks, credit unions, and online lenders. Down payments on a conventional loan can be as low as 3%, but you will need at least 5% for a down payment on an investment property.

How Much Down Payment Do You Need for a FHA Loan?

For many conventional loans, you’ll need a down payment that is 20 percent of the value of the home. If you’re getting an FHA loan, your down payment will be 3.5 percent. You can still get a conventional loan if your down payment is less than 20 percent, but you’ll have to get private mortgage insurance (PMI).

How Much Down Payment Do You Need for a VA Loan?

The VA loan is a great benefit for active duty military members and veterans. It allows them to purchase a home with no down payment and no private mortgage insurance (PMI). However, there are still some costs associated with the loan, including theVA funding fee.

The VA funding fee is a one-time fee that’s charged when you get a VA loan. The fee is used to help cover the costs of the VA loan program. The fee varies depending on factors like your down payment amount, whether you’re a first-time homebuyer, and whether you have a service-connected disability.

For most borrowers, the VA funding fee is 2.15% of the loan amount. If you make a down payment of at least 5%, you can choose to have the VA funding fee added to your loan balance or paid in cash at closing.

How Much Down Payment Do You Need for a USDA Loan?

You can get a USDA loan with as little as 0% down payment. However, you will need to pay for mortgage insurance, which will add to your monthly payments.

How Much Down Payment Do You Need for a Jumbo Loan?

Jumbo loans are mortgages that are more expensive than traditional loans, making them more difficult to qualify for. In most cases, you’ll need a down payment of at least 20% of the loan amount in order to get approved.