How Much Does Student Loan Debt Affect Your Credit Score?

Contents

If you’re considering taking out student loans, you might be wondering how much debt you can realistically afford. And once you start borrowing, you might be curious about how your loan payments will affect your credit score. Here’s what you need to know.

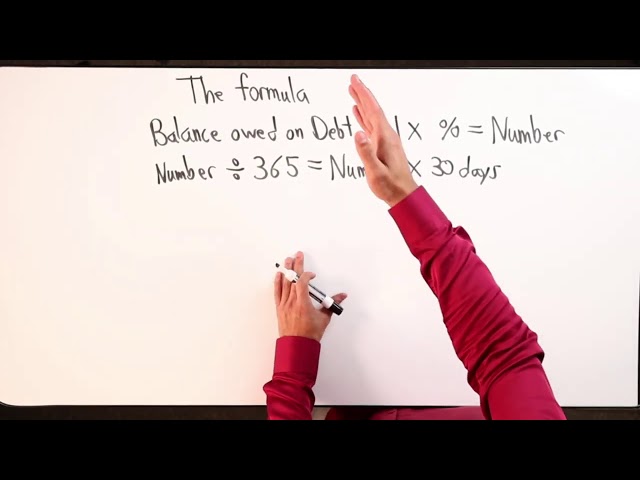

Checkout this video:

The Relationship Between Student Loans and Credit Scores

Your credit score is one of the most important factors in your financial life. It’s used to determine whether you’re eligible for loans, credit cards, and mortgages. It can also affect your insurance rates and your ability to rent an apartment. So, it’s no surprise that people are interested in how their student loan debt will affect their credit score.

How Student Loan Debt Affects Your Credit Score

Student loan debt can have a major impact on your credit score, both in the short term and the long term. In the short term, taking on a large amount of debt can cause your score to drop, as your credit utilization ratio increases. In the long term, if you miss payments or default on your loans, your score will suffer even more.

The good news is that there are things you can do to mitigate the impact of student loan debt on your credit score. First, try to keep your credit utilization ratio below 30%. This means that if you have a total credit limit of $10,000, you should try to keep your balance below $3,000. Second, make sure you make all of your student loan payments on time. If you can do these two things, you should be able to keep your credit score from suffering too much damage from your student loans.

The Different Types of Student Loans

There are two types of student loans: federal and private.

Federal student loans are made by the government and they have fixed interest rates. The most common type of federal student loan is the Stafford Loan.

Private student loans are made by banks, credit unions, and other financial institutions. Private student loans usually have variable interest rates.

The interest rate on a private student loan is determined by the market, your credit score, and the length of the loan. The best way to get a low interest rate on a private student loan is to have a good credit score.

A cosigner may be able to help you get a lower interest rate on a private student loan. A cosigner is someone who agrees to pay back the loan if you can’t.

The Impact of Student Loan Debt on Your Credit Score

The Effect of Student Loan Debt on Your Credit Score

Student loan debt can have a major impact on your credit score, both good and bad. If you’re able to keep up with your payments, it can actually help improve your score. But if you fall behind, it can quickly drag your score down.

Your payment history is the biggest factor in your credit score, so missing even a few payments can have a major impact. If you’re having trouble making your payments, there are some options available to help you get back on track.

If you’re looking to buy a house or car, or even just get a new credit card, having a high credit score is important. So if you’re carrying student loan debt, it’s important to understand how it could impact your score.

The Impact of Student Loan Debt on Your Credit History

The size of your student loan debt will have a direct impact on your credit history. If you have a lot of debt, it will take longer to pay off your loans and this will negatively impact your credit score. On the other hand, if you have a smaller loan amount, you will be able to pay it off more quickly and this will have a positive impact on your credit score. In general, the bigger your student loan debt, the greater the impact on your credit history.

The Impact of Student Loan Debt on Your Credit Utilization

It’s no secret that student loan debt can have a major impact on your finances. But did you know that it can also affect your credit score?

Your credit score is a key factor in determining whether you’re able to get loans and credit cards, and how much interest you’ll pay. So it’s important to understand how your student loan debt could impact your score.

There are two main ways that student loan debt can affect your credit score: through your “credit utilization” and by causing you to miss payments.

Credit utilization is a key factor in your credit score. It’s the percentage of your available credit that you’re using at any given time. So if you have $5,000 in available credit and you’re using $1,000 of it, your credit utilization is 20%.

Ideally, you want to keep your credit utilization below 30%. That’s because lenders see high levels of utilization as a sign that you might be struggling to manage your debt. And the lower your credit score is, the more difficult it will be to get loans and lines of credit with favorable terms.

Student loan debt can also cause you to miss payments, which will damage your credit score. If you miss a payment on any type of loan, it will be reported to the major credit bureaus (Experian, Equifax, and TransUnion). And missed payments can stay on your report for up to seven years.

So if you’re struggling to make your student loan payments, it’s important to take action before it starts impacting your credit score. There are a number of options available to help make repaying your student loans easier. You can contact your lender to discuss changing the terms of your loan, or look into consolidation or refinancing options.

If you’re already facing financial difficulties, there are programs available that can help you get back on track. The Department of Education’s Income-Based Repayment Plan allows borrowers to make monthly payments based on their income and family size. And if you’re struggling even more, the deferment or forbearance options might be right for you. These programs allow borrowers to temporarily postpone or reduce their monthly payments if they’re experiencing financial hardship.

How to Manage Your Student Loan Debt

The first thing you need to know is that your student loan debt does not have to be a death sentence for your credit score. In fact, with a little bit of planning and some effort, you can make your student loan debt work for your credit score, instead of against it.

Tips for Managing Your Student Loan Debt

Student loan debt can be a heavy burden, but there are ways to manage it effectively. Here are a few tips:

-Create a budget: Determine how much you can realistically afford to pay each month, and make sure your loan payments fit into that budget.

-Pay off your loans with the highest interest rates first: This will save you money in the long run.

-Consider consolidating your loans: This can lower your monthly payments and make it easier to keep track of multiple loans.

-Make extra payments when you can: Any additional money you can put towards your loans will save you money in interest and help you pay off your debt sooner.

How to Consolidate Your Student Loans

If you’re struggling to make your monthly student loan payments, consolidation may be a good option for you. Student loan consolidation entails combining your multiple student loans into a single loan with a single monthly payment. This can make budgeting and managing your debt easier, and may also help you qualify for a lower interest rate.

There are two main types of student loan consolidation: federal and private. Federal consolidation is only available through the Department of Education’s Direct Loan program. Private consolidation is available through banks, credit unions, and other lenders.

When you consolidate your loans, you’ll be given a new interest rate that is the weighted average of your previous rates, rounded up to the nearest one-eighth of 1%. So if you had two loans with rates of 5.5% and 6%, your new rate would be 5.625%.

If you have private loans, you may be able to get a lower interest rate by refinancing them. Refinancing involves taking out a new loan with a lower interest rate to pay off your existing loans. You’ll need to have good credit to qualify for the best rates.

How to Refinance Your Student Loans

Refinancing your student loans can save you money if you can find a loan with a lower interest rate than your current loan. If you have private loans, you may be able to get a lower rate by applying for a refinanced loan with a new private lender. If you have federal loans, you can’t refinance through a private lender, but you may be able to get a Direct Consolidation Loan through the federal government. You may also be able to lower your monthly payments by extending the term of your loan, although this will result in paying more in interest over the life of the loan.