How Much Does a Late Payment Affect Your Credit Score?

Contents

If you’re wondering how much a late payment can affect your credit score, you’re not alone. Many people are curious about the impact of late payments on their credit, and for good reason. A late payment can stay on your credit report for up to seven years and can negatively impact your credit score.

Checkout this video:

The Basics of Late Payments

A late payment is when you make a payment after the due date. This can happen with credit cards, loans, and other bills. A late payment can negatively affect your credit score. The amount that your score decreases depends on how late the payment is and how often you make late payments. If you make a late payment, you should try to make your next payment on time to help improve your credit score.

What is a late payment?

A late payment is when you fail to make a payment by the due date. The consequences of a late payment depend on the type of account, the creditor, and your payment history. Generally, the later the payment, the greater the penalty.

Most creditors report late payments to the credit reporting agencies. This information then becomes a part of your credit history and can negatively affect your credit score. A late payment stays on your credit report for seven years from the date it was first reported late.

Late payments can have a number of consequences, including:

-A late fee: Most creditors charge a late fee if you don’t pay your bill by the due date. The fee is usually a percentage of your outstanding balance, up to a maximum amount. For example, your creditor may charge you 5% of your outstanding balance, up to a maximum of $15, if you’re more than 30 days late making a payment.

-Higher interest rates: If you have a variable interest rate on your account, your creditor may increase your interest rate if you make a late payment. For example, if your annual percentage rate (APR) is 14%, your creditor may increase it to 18% if you’re 60 days late making a payment. Higher interest rates will continue to apply until you bring your account current. In addition, some creditors may impose a “default interest rate” on your account if you make a late payment. This default rate may be much higher than your regular APR—25% or more—and can apply indefinitely until you bring your account current and request that the default rate be removed.

-Loss of promotional offers: If you’re participating in a promotional offer—such as zero percent financing on purchases made withyour credit card—you may lose this offer if you make even onelate payment. For example, if you’re six months into an 18-month 0% financing offer andyou make onelate payment,you may have to pay finance charges at the regular APRfrom that point forward on any remaining balance owed underthe promotional offer. In addition, ifyou’re supposedto receive rewards—such as cash back or points towardairline tickets—for usingyour card duringthe promotional period,you may not receive these rewardsifyou make alatepayment duringthe promotional period becauseyou didn’t satisfythe terms ofthe offer

How long does a late payment stay on your credit report?

Generally, late payments can stay on your credit reports for up to seven years. However, the good news is that as time goes by, late payments have less of an impact on your credit score. If you have a history of late payments, you can take steps to improve your payment history and raise your credit score.

How late payments affect your credit score

Late payments can have a major impact on your credit score. Depending on the severity of the late payment, it can cause your score to drop by 100 points or more.

Most creditors report late payments to the credit bureaus after 30 days, so if you make a payment even one day late, it could show up on your credit report and damage your score. If you’re more than 30 days late, you’re likely to see even more drastic effects on your score.

The impact of a late payment on your credit score will depend on a few factors, including how late the payment is, how much is owed, and whether you have a history of making late payments. The good news is that as time goes by, the impact of a late payment will lessen. After about two years, most late payments will no longer have any impact on your credit score.

If you’re struggling to make ends meet and are worried about making a late payment, there are a few things you can do to try to avoid the negative consequences. You can contact your creditor and ask for an extension or negotiate a new payment plan. You can also try to get help from a nonprofit credit counseling agency. Whatever you do, don’t just stop making payments altogether, as this will only make matters worse.

The Impact of Late Payments

Your payment history is one of the most important factors in your credit score—making up 35% of your FICO® Score☉ . A late payment can negatively affect your credit score and remain on your credit report for up to seven years, even if you eventually catch up on the missed payment.

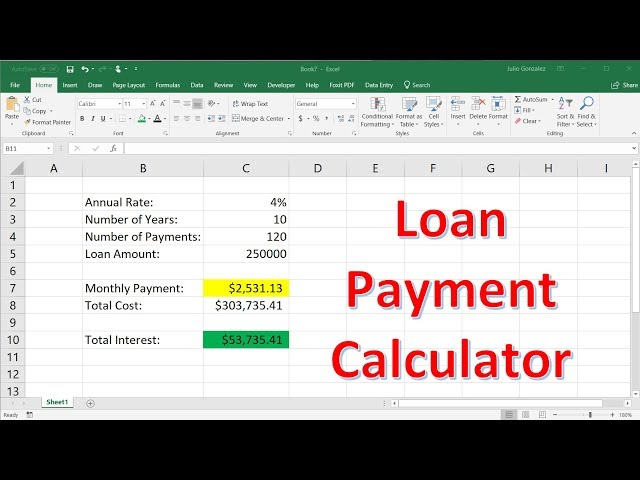

How late payments can impact your ability to get a loan

Late payments can have a significant impact on your ability to get a loan. Lenders often view late payments as a sign of financial difficulties, and this can make it difficult to get approved for a loan. In some cases, late payments can even lead to higher interest rates and fees.

If you have late payments on your credit report, it’s important to take steps to improve your credit rating. You can do this by making all of your payments on time, paying down your debts, and maintaining a good credit history. Taking these steps will help you get approved for a loan in the future.

How late payments can impact your interest rates

Late payments can have a lasting impact on your credit score and may even result in higher interest rates.

It’s important to make all of your payments on time, but if you do happen to miss one, it’s important to take steps to correct the situation as soon as possible.

How late payments can impact your credit score?

Late payments will stay on your credit report for seven years. However, the effect of late payments on your credit score will lessen over time. After two years, late payments will have less of an impact on your credit score.

How late payments can impact your interest rates?

If you’re carrying a balance on your credit cards, late payments can also lead to higher interest rates. That’s because when you make a late payment, your credit card issuer may raise your APR (annual percentage rate).

How late payments can impact your credit limit

One of the most important factors in your credit score is your payment history. Your payment history includes all of your past and present payments, as well as any late payments. Any late payments on your account will be reported to the credit bureaus, and will stay on your report for seven years.

late payments can have a significant impact on your credit score. If you have one or two late payments, you may not see a big drop in your score. But if you have several late payments, or if your late payments are recent, you can expect to see a significant drop in your score. Depending on how low your score is to begin with, a few late payments could even put you in danger of having your account closed by the credit card company.

If you’re worried about the impact of late payments on your credit score, there are a few things you can do to minimize the damage. First, try to make all of your payments on time from now on. Second, if you have any overdue bills, make sure to pay them off as soon as possible. Third, sending a goodwill letter to the company that reports the late payment to the credit bureau can sometimes help remove the negative mark from your report. Finally, if you’re still having trouble keeping up with your payments, consider talking to a financial advisor about ways to better manage your finances.

How to Avoid Late Payments

Most people know that paying their bills on time is important to maintaining a good credit score. However, many don’t realize just how much of an effect a late payment can have. A late payment can drop your credit score by as much as 100 points, which can take months or even years to recover from.

Set up automatic payments

The best way to avoid late payments is to set up automatic payments. This way, you will never have to worry about remembering to make a payment or accidentally forgetting. You can set up automatic payments with most creditors, and you can often choose how much you want to pay and when you want it to be withdrawn from your account.

Create a budget

A budget is really nothing more than telling your money where to go. This simple act will help you avoid wasteful spending and ensure that your bills are paid on time. When creating a budget, be sure to include a buffer for unexpected expenses. This will help you avoid the penalties and fees associated with late payments.

Stay organized

Paying your bills on time is one of the most important factors in your credit score—accounting for about 35% of your score—so it’s crucial that you make all your payments before their due dates.

But if you’re like most people, you probably have a lot of different bills to keep track of, and it can be easy to miss a payment here and there. Luckily, there are a few things you can do to make sure you never miss another payment:

First, get organized. Make a list of all the bills you have to pay, and when they’re due. This can be as simple as keeping a running list in your wallet, or setting up a spreadsheet on your computer.

Second, set up reminders. Whether it’s a monthly email reminder or a weekly text message, make sure you have some way of reminding yourself when each bill is due.

Third, set up autopay. Many companies will let you automatically withdraw the amount of each bill from your bank account every month, so you don’t even have to think about it. Just be sure to keep enough money in your account to cover all your bills!

Finally, if you do happen to miss a payment, don’t panic. One late payment won’t ruin your credit score—but it will ding it for a few points. To minimize the damage, try to catch up on the bill as soon as possible, and be sure to pay all your bills on time from then on.

What to Do if You Have a Late Payment

A late payment can negatively affect your credit score and may stay on your credit report for up to seven years. If you have a late payment, you should contact the creditor as soon as possible and try to arrange a payment plan. You can also dispute the late payment if you feel it is inaccurate.

Talk to your creditor

If you have a late payment on your credit report, it’s important to take steps to make sure that your account is up to date and that you avoid additional late payments.

Your first step should be to contact your creditor and explain the situation. Many creditors are willing to work with you to make sure that your account is brought up to date. You may be able to negotiate a payment plan or a deferral of your payments.

If you’re not able to reach an agreement with your creditor, you can try contacting a credit counseling service. A credit counselor can help you develop a plan to get your debt under control and may be able to negotiate with your creditors on your behalf.

In some cases, a late payment can be removed from your credit report if you can show that it was caused by extenuating circumstances. If you believe that a late payment on your credit report is inaccurate, you can file a dispute with the credit bureau.

Create a plan to pay off your debt

If you have a late payment on your credit report, it’s important to take steps to remove the negative mark. A late payment can stay on your report for up to seven years and can negatively impact your credit score.

The first step is to contact the creditor and explain the situation. Many times, the creditor will be willing to work with you to create a plan to pay off the debt. If you are unable to come to an agreement with the creditor, you can also try negotiating with a credit repair company.

Once you have a plan in place, make sure you make all of your payments on time. You should also continue to use credit responsibly by paying your bills in full and on time every month. By following these steps, you can improve your credit score and get back on track financially.

Dispute the late payment

If you have a late payment on your credit report, you may be able to get it removed by disputing it with the credit bureau. A late payment will stay on your credit report for seven years from the date it was reported, so it’s important to dispute it as soon as possible.

To dispute a late payment, you will need to send a letter to the credit bureau that is reporting the late payment. In the letter, you should explain why you believe the late payment is inaccurate. You should also include any documentation that you have that supports your case.

The credit bureau will then investigate your claim and determine whether or not the late payment should be removed from your credit report. If they find that the late payment is accurate, they will send you a notification of their decision and the late payment will remain on your credit report.