How Much Can I Get for My Car Title Loan?

How much can I get for my car title loan? We offer you a competitive quote based on the value of your car.

Checkout this video:

How Title Loans Work

A title loan is a loan where you use your car’s title as collateral. This means that if you can’t repay the loan, the lender can take your car. Title loans are a type of secured loan, which means there’s less risk for the lender because they have your car as collateral.

What is a car title loan?

A car title loan is a loan where you use your car as collateral. The lender will give you a loan based on the value of your car, and you will keep your car while making payments on the loan. If you cannot make the payments, the lender can repossess your car.

How do car title loans work?

A car title loan is a loan you get using your car as collateral. You keep your car and drive it, but the lender has the title to the car as insurance that you will repay the loan. If you fail to make payments, the lender can repossess your vehicle and sell it to repay the loan.

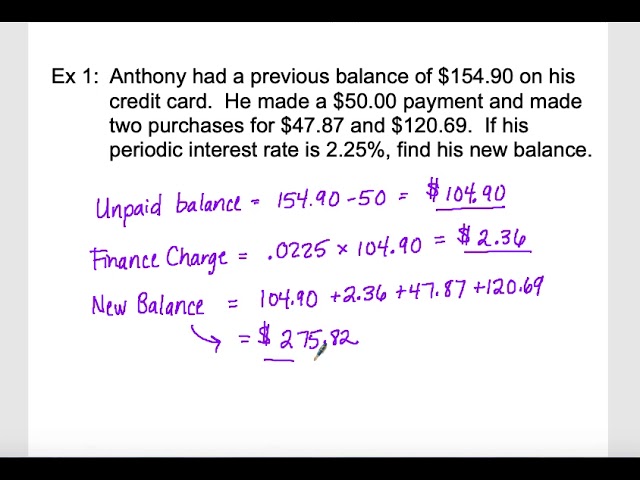

Car title loans are a solution for people who need cash but don’t want to sell their car or take out a traditional loan with a bank. Title loans are typically small loans, ranging from $100 to $5,500, with high interest rates—sometimes up to 300% APR. The amount of money you can borrow depends on the value of your vehicle and your ability to repay the loan.

When you take out a car title loan, you’re giving the lender permission to put a lien on your vehicle’s title. A lien is a legal claim on your property that allows the lender to repossess it if you default on your payments. Once you have repaid the loan in full, the lender will remove the lien from your title.

Car title loans are short-term loans, which means they are due in full within 30 days or sooner. Some lenders may give you up to one year to repay the loan, but typically not for amounts over $2,500. Many lenders also require that you make payments every week or every two weeks instead of once a month.

If you can’t repay the loan in full within the timeline specified in your loan agreement, you may be able to roll over or renew the loan by paying only the finance charge again and extending the repayment period. But this will likely add more fees and interest costs to an already expensive loan, so it’s not recommended unless it’s absolutely necessary.

How much can I get for a car title loan?

The amount of money you can get for a car title loan depends on the value of your car. The lenders we work with will loan you 25% to 50% of your car’s value. So, if your car is worth $10,000 you could get $2,500 to $5,000. If your car is worth less, you could get less money.

How to Get a Title Loan

A title loan is a special type of loan that uses your car title as collateral. This means that if you default on the loan, the lender can seize your car. Title loans are usually high-interest loans, which means you could end up paying a lot of money in interest if you take out a loan and don’t pay it back on time.

Find a lender

The first step to getting a car title loan is finding a lender. You can do this by searching online or in your local Yellow Pages. Once you find a few potential lenders, be sure to research each one thoroughly. Read online reviews, check with the Better Business Bureau, and contact each lender to ask questions. It’s also important to make sure the lender you choose is licensed to operate in your state.

Get a loan estimate

The first step is finding out how much your vehicle is worth and how much you could qualify to borrow. You can do this by talking to a loan specialist or using an online loan calculator. Be sure to take into account the Kelley Blue Book value of your car, as well as any money you still owe on it. You should also factor in the interest rate and any fees associated with getting a title loan.

Once you have a loan estimate, you can start shopping around for lenders. Be sure to compare offers from multiple lenders to get the best deal possible. When you’re ready to apply, most lenders will require that you fill out an online application. They will also need to see some paperwork, such as your car’s title and a copy of your driver’s license. Once you have been approved for a loan, you will typically have to sign a contract and then you will get the money you need.

Apply for the loan

To apply for a car title loan, you’ll need to give your lender the following information:

-The make, model, year and mileage of your vehicle

-Your name and contact information

-Your vehicle’s registration

-Your driver’s license or other form of identification

-Proof of income

Most lenders will also require you to have full coverage insurance on the vehicle you’re using as collateral.

To get an estimate of how much you can borrow, you can use an online loan calculator or contact a local lender.

Get your money

A title loan is a great way to get the money you need without having to go through a traditional lender. Title loans are secured loans that use your car as collateral. This means that if you default on the loan, the lender can repossess your car.

Title loans are generally much smaller than traditional loans, but they can still be a great way to get the money you need. The amount you can borrow will depend on the value of your car and your ability to repay the loan.

Getting a title loan is relatively easy. The first step is finding a lender that offers title loans. There are many online lenders that offer title loans, so you should have no problem finding one that suits your needs.

Once you have found a lender, you will need to fill out an application and provide some basic information about yourself and your car. The lender will then appraise your car and give you a loan offer. If you accept the offer, you will sign a loan agreement and receive the money you need.

Repaying your title loan is just as easy as getting it. You will make regular payments to the lender until the loan is repaid in full. Once the loan is repaid, your car will be released from collateral and you will be free and clear.

If you are in need of quick cash, a title loan may be right for you

What to Do With a Title Loan

So, you’ve decided to take out a car title loan. You’re not alone. In 2019, about 2.5% of all Americans took out a car title loan. But now that you’ve got the loan, what are you supposed to do with it?

Use the money wisely

If you’re considering taking out a car title loan, it’s important to use the money wisely. A title loan is a high-interest loan, which means you could end up paying back significantly more than you borrowed if you’re not careful.

Here are some tips for using a title loan responsibly:

1. Only borrow as much as you need. Don’t take out a loan for more money than you actually need. This will help keep your repayment amount manageable.

2. Create a budget. Before taking out a loan, sit down and create a budget. Determine how much money you need to cover your expenses and make sure your loan payment can fit comfortably into your budget.

3. Make payments on time. It’s important to make all of your payments on time in order to avoid additional fees and damage to your credit score. If you think you might have trouble making a payment, reach out to your lender as soon as possible to see if they can work with you.

4. Pay off the loan as soon as possible. The sooner you pay off the loan, the less interest you’ll accrue and the less money you’ll ultimately have to pay back. Try to make extra payments whenever possible in order to get the loan paid off more quickly.

5 Getting a car title loan is a big decision and it’s important that you use the money wisely. By following these tips, you can help ensure that you’re able to repay the loan without any problems.

Repay the loan

If you are facing financial difficulties and are unable to repay your car title loan, contact your lender immediately. Many lenders offer repayment options, such as extended payment plans, that can help make repaying your loan easier. In some cases, you may be able to renegotiate the terms of your loan to lower your monthly payments.

If you are unable to repay your car title loan, the lender may choose to repossess your vehicle. This means that the lender will take back ownership of your vehicle and sell it in order to recoup the money you owe on the loan. If your vehicle is sold for less than what you owe on the loan, you may be responsible for paying the difference.

If you are facing financial difficulties, there are a number of other options available to you besides taking out a car title loan. You may want to consider speaking with a credit counselor or financial advisor to discuss your options and find a solution that is best for you.

Avoid defaulting on the loan

If you are thinking about taking out a car title loan, you need to be aware of the risks involved. One of the biggest dangers is defaulting on the loan. This can lead to your car being repossessed and you could end up damaging your credit score.

Before taking out a car title loan, you need to make sure that you can afford the repayments. You should also think about whether you really need the money and whether there is another way to raise the funds. If you are struggling to make ends meet, it is unlikely that a car title loan is the best solution.

If you do decide to take out a car title loan, you should shop around for the best deal. Make sure that you understand all of the terms and conditions before signing any agreement. And always make sure that you can afford the repayments before taking out the loan.