How Much Can I Borrow for a Home Loan?

Contents

How much can I borrow for a home loan? This is a question many first time home buyers ask. This blog post will give you some insight into how lenders determine how much you can borrow for a home loan.

Checkout this video:

How Lenders Determine How Much You Can Borrow

When you apply for a home loan, the lender will look at a variety of factors to determine how much money to lend you. They’ll consider your income, your debts, and your credit history, as well as the type of loan you’re applying for and the value of the home you’re buying. In this article, we’ll take a closer look at how lenders determine how much you can borrow for a home loan.

Your Income

The classic way lenders determine how much you can borrow for a home loan is by using what’s called the “28/36 rule.” This means that your total monthly housing costs (which include your mortgage payment, property taxes, and insurance) should not exceed 28% of your gross monthly income. Additionally, your overall debt (which includes your mortgage, car payments, student loans, and credit card payments) should not exceed 36% of your gross monthly income. These two ratios are known as your “front-end ratio” and your “back-end ratio.”

For example, let’s say you make $4,000 per month. That means your maximum housing costs should be $1,120 per month (28% x $4,000), and your maximum overall debt should be $1,440 per month (36% x $4,000).

Of course, this is just a general rule of thumb. There are other factors that will affect how much you can borrow for a home loan, such as your credit score, employment history, and savings.

Your Employment History

Employment history is one of the primary factors that lenders look at when determining how much money to lend you for a home loan. Lenders want to see that you have a steady income and a good employment history. They will also look at your credit history to see if you have any late payments or other red flags.

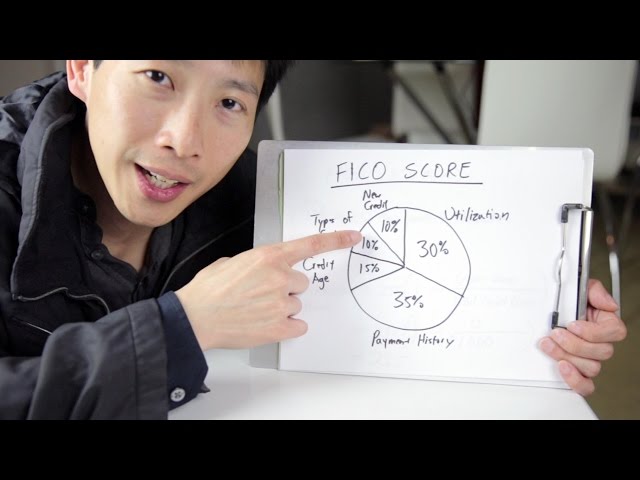

Your Credit Score

Your credit score is one of the primary factors that lenders look at when determining how much you can borrow for a home loan. Your credit score is a number that ranges from 300 to 850 and represents your creditworthiness. A higher credit score means you’re a lower-risk borrower, which could qualify you for a lower interest rate on your loan.

The Value of the Home You’re Purchasing

One of the most important factors in how much home you can afford is the value of the home you’re purchasing. The lender will order an appraisal of the property to determine its value, and loan amount will be based on a percentage of that value – typically up to 80%.

For example, let’s say you’re purchasing a home for $200,000. The lender may lend you up to 80% of that amount, or $160,000. But keep in mind that the appraised value may come in lower than the purchase price, and if it does you’ll need to make up the difference with a larger down payment.

How to Increase How Much You Can Borrow

You can increase how much you can borrow for a home loan by taking on a cosigner, increasing your income, or improving your credit score. A cosigner with a good credit score can help you qualify for a loan that you might not have been able to get on your own. If you can increase your income, that will also give you a better chance of being approved for a loan. Another way to increase your borrowing power is to improve your credit score.

Save for a Larger Down Payment

One of the best ways to increase your borrowing power is to save for a larger down payment. A larger down payment means you can buy a more expensive home or put less money down on a less expensive home. The size of your down payment will also affect your interest rate and monthly payments.

Saving for a larger down payment can be difficult, especially if you’re already struggling to make ends meet. One way to save is to create a budget and make sure you are spending less than you earn. You can also set up a automatic savings plan so that money is transferred from your checking account to your savings account each month.

If you have debt, paying it off can also increase your borrowing power. This is because lenders often consider your debt-to-income ratio when determining how much money you can borrow. Paying off debt can lower this ratio and make you a more attractive borrower.

If you’re unsure how much money you can borrow for a home loan, speak to a lender or financial advisor. They will be able to help you understand your options and make an informed decision about how much money you should borrow.

Improve Your Credit Score

There are a few things you can do to improve your credit score before you apply for a home loan, which may help you qualify for a higher loan amount:

Pay down your debts: Lenders like to see low levels of debt, so paying down your balances can improve your credit score.

Pay your bills on time: Payment history is one of the biggest factors in calculating your credit score, so make sure you’re always paying on time.

Correct any errors on your credit report: If there are any errors or negative items on your credit report, make sure to dispute them with the credit bureau.

Find a Lender Who’s Willing to Work with You

It can be difficult to find a lender who’s willing to work with you if you have bad credit. But there are some lenders out there who are willing to work with you if you have a low credit score. There are also some government programs that can help you get a loan with bad credit.

Here are some tips for finding a lender who’s willing to work with you:

-Look for lenders who specialize in loans for people with bad credit. These lenders are more likely to be willing to work with you.

-Look for government programs that can help you get a loan with bad credit. These programs are designed to help people with bad credit get loans.

-Talk to your local Housing Authority or HUD office. They may be able to help you find a lender who’s willing to work with you.

-Talk to a housing counselor. A housing counselor can help you understand your options and find a lender who’s willing to work with you.