How is the Interest Rate on a Payday Loan Calculated?

Contents

If you’re considering taking out a payday loan, you’re probably wondering how the interest rate is calculated. Here’s a quick overview of how payday loan interest rates work.

Checkout this video:

How Payday Loans Work

A payday loan is a type of short-term borrowing where a lender will extend high interest credit based on a borrower’s income and credit profile. A payday loan’s principal is typically a portion of a borrower’s next paycheck. These loans charge high interest rates for short-term immediate credit. How is the interest rate on a payday loan calculated?

The Basics of Payday Loans

A payday loan is a type of short-term borrowing where a lender will extend high interest credit based on a borrower’s income and credit profile. A payday loan’s principal is typically a portion of a borrower’s next paycheck. These loans charge high interest rates for short-term immediate credit. These loans are also called cash advance loans or check loans.

How do payday loans work?

If someone needs money quickly to cover an unexpected expense, they may look to take out a payday loan. For example, let’s say you need to pay for emergency car repairs. You don’t have the money right now, but you know your next paycheck is coming in two weeks. You can go to a payday lender and write a post-dated check for the amount you need plus the lender’s fees. The lender gives you the cash now and cashes your check when it’s due.

What are the dangers of taking out a payday loan?

Most people understand that payday loans are expensive. They come with high fees, and if you can’t pay back the loan when it comes due, you might take out another one to cover the first — incurring even more fees. This can quickly lead to a dangerous cycle of debt that is hard to break free from.

How the Interest Rate is Calculated

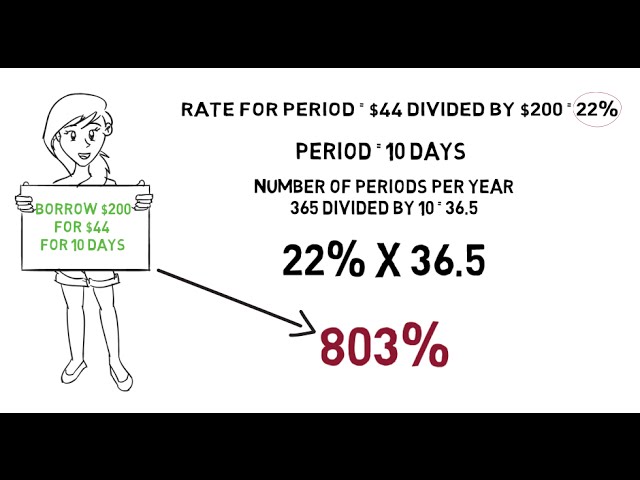

The interest rate on a payday loan is calculated with a simple formula: the finance charge divided by the amount of the loan.

For example, if you borrow $100 for two weeks and the finance charge is $15, your APR would be 15% (($15/2)/$100). This would be considered a very high APR, which is why payday loans are not recommended for long-term use.

How to Get the Best Interest Rate on a Payday Loan

Payday loans are one of the most expensive types of borrowing, with rates that can exceed 1,000%. If you’re considering taking out a payday loan, it’s important to understand how the interest is calculated so that you can be sure you’re getting the best rate possible.

Shop Around

When you need money fast, it’s important to shop around for the best deal on a payday loan. You don’t want to get stuck with a high interest rate that will add to your financial stress.

The first step is to compare rates from different lenders. You can do this by going online and checking various lenders’ websites. Make sure to look at the annual percentage rate (APR), which is the cost of borrowing money over the course of a year, including interest and fees.

The second step is to compare the fees charged by different lenders. Most payday lenders charge a flat fee, which means you’ll pay the same amount regardless of how much money you borrow. But some lenders charge a variable fee, which means the amount you pay will depend on how much money you borrow.

The third step is to compare the repayment terms offered by different lenders. Some payday loans have to be repaid in full when you get your next paycheck, while others allow you to make partial payments over time. There are also some lenders who offer extended repayment terms, which can give you more time to repay your loan without incurring additional fees.

Once you’ve compared rates, fees, and repayment terms from different lenders, you can choose the lender that offers the best deal on a payday loan.

Compare APRs

Annual Percentage Rates, or APRs, are the main way that payday lenders set the cost of borrowing. Most states have laws that put a maximum limit on the APR that a lender can charge. The federal Truth in Lending Act gives borrowers the right to know the APR of their loan before they sign for it.

Unfortunately, many lenders don’t follow these rules. They may not tell you the APR until after you’ve signed for the loan. Or they may give you an incomplete or misleading picture of the costs. Compare APRs to get the best deal. Remember, the lower the APR, the less you’ll pay in interest and fees over time.

Consider the Total Cost of the Loan

When you take out a payday loan, you might think that the interest rate is all you need to consider. However, the total cost of the loan is actually more important. This is because the interest rate is only part of what you will pay for the loan.

The other part is the fees. Payday lenders typically charge a flat fee per loan, plus a percentage of the amount borrowed. For example, if you borrow $100 and the lender charges a $15 fee, your total cost would be $115.

To get the best deal on a payday loan, you need to compare the total cost of the loan, not just the interest rate.

How to Avoid Paying Too Much in Interest on a Payday Loan

Payday loans can be a great way to get fast cash when you need it, but they can also be very expensive if you don’t carefully manage the loan. The interest rate on a payday loan is calculated based on the amount you borrow, the length of time you need to borrow the money, and the fees associated with the loan. Let’s take a closer look at how payday loan interest is calculated so you can avoid paying too much.

Read the Fine Print

Payday loans can be very expensive. Loan amounts generally range from $50 to $1,000, depending on state laws. Fees also depend on state laws, but the structure tends to be similar: A fee for every $100 borrowed, plus a one-time finance charge. For example, a typical two-week payday loan with a $15 per $100 fee equates to an annual percentage rate (APR) of almost 400%, according to the CFPB. (Here’s a primer on how interest rates work.)

To avoid paying too much in interest on a payday loan, it’s important to read the fine print and understand the terms and conditions of your loan agreement. Payday loans typically have higher interest rates and shorter repayment terms than other types of loans, such as personal loans or lines of credit. And although state laws regulate maximum loan amounts, lenders may still try to charge excessive fees or require collateral.

In general, it’s best to avoid payday loans if at all possible. If you absolutely need a short-term loan, be sure to shop around for the best terms and be sure you can afford the repayments.

Avoid Renewing the Loan

One way to avoid paying too much interest on a payday loan is to avoid renewing the loan. Payday loans typically have a term of two weeks, and if you cannot afford to repay the loan in full at the end of that term, you may be tempted to renew the loan. This will extend the term of the loan and increase the amount of interest you will have to pay.

Pay off the Loan as Quickly as Possible

The interest rate on a payday loan is calculated using a variety of factors, including the amount you borrow, the length of time you keep the loan, and the fees you pay. In general, the longer you keep the loan, the more interest you will have to pay. Payday lenders typically charge a flat fee for every $100 borrowed, plus a fee for every additional $100 borrowed after that. For example, if you borrow $200 for two weeks, you may have to pay a fee of $30 plus interest.