How Does Paying Off The Balance Monthly Help A Credit Card User Avoid Finance Charges

Contents

- What are finance charges?

- How can you avoid finance charges?

- How does paying off your balance monthly help?

- What are the benefits of paying off your balance monthly?

- How does paying off your balance monthly improve your credit score?

- What are some tips for paying off your balance monthly?

- How can you make paying off your balance monthly easier?

- What should you do if you can’t pay off your balance monthly?

- What are the consequences of not paying off your balance monthly?

- How can you avoid finance charges in the future?

Paying off your credit card balance in full each month is one of the best ways to avoid finance charges. When you pay the full balance, you are essentially paying off the entire amount of interest that has accrued. This means that you will save money in the long run, and avoid paying any unnecessary fees.

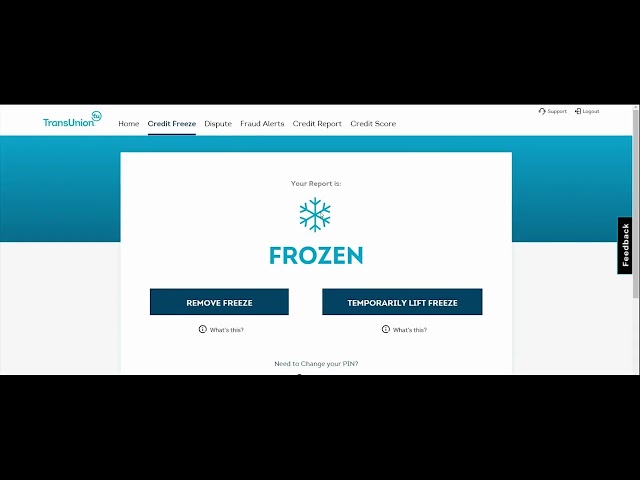

Checkout this video:

What are finance charges?

Finance charges are the fees charged by a credit card company for borrowing money. The finance charge is calculated using your APR (annual percentage rate) and the balance you carry on your credit card. The larger your balance, the more you will owe in finance charges. Credit card companies typically assess finance charges daily, and they are added to your balance at the end of each billing cycle.

Paying off your balance in full each month avoids finance charges because you are not borrowing money from the credit card company. If you carry a balance, you will be charged interest on that balance, which is represented by the APR. The higher your APR, the more you will pay in finance charges if you carry a balance on your credit card.

Paying off your balance monthly also allows you to avoid late payment fees, which can add up quickly. Late payments can also damage your credit score, making it more difficult to get approved for loans and lines of credit in the future.

If you are struggling to pay off your credit card balance each month, there are a few things you can do to avoid finance charges. First, try to pay more than the minimum payment each month. This will reduce the amount of interest you accrue and help you pay down your debt faster. You can also ask for a lower APR from your credit card company or look for a new card with a lower interest rate. Finally, make sure you make all of your payments on time each month to avoid late payment fees and damage to your credit score.

How can you avoid finance charges?

Paying off your credit card balance in full every month can help you avoid finance charges. When you only make the minimum payment, you may be charged interest on your remaining balance. Paying off your balance in full every month can help you avoid these fees and keep your account in good standing.

How does paying off your balance monthly help?

If you are like most people, you probably carry a balance on your credit card from month to month. And, if you are like most people, you probably dread getting your monthly statement and seeing how much interest you have accrued. But did you know that by simply paying off your balance each month, you can avoid paying any interest whatsoever? Here’s how it works.

Credit card companies make their money by charging interest on the balances that their customers carry. The amount of interest charged varies depending on the credit card issuer, but it is typically somewhere between 10% and 20%. So, if you have a balance of $1,000 on your credit card and are being charged 15% interest, that means you will owe the credit card company $150 in interest for that month.

Now let’s say that instead of carrying a balance of $1,000, you pay off the entire balance each month. In this case, you will not be charged any interest because there is no balance to charge interest on. This is why it is so important to pay off your credit card balance in full each month if you want to avoid paying interest.

Of course, this is easier said than done for many people. If you find yourself carrying a balance from month to month, there are a few things you can do to try to pay it off:

– Make sure you are making more than the minimum payment each month. The minimum payment is usually just the interest plus 1% of the principal (the original amount borrowed), so if you only make the minimum payment each month, it will take forever to pay off your debt.

– Try to make extra payments whenever possible. Even an extra $50 or $100 per month can make a big difference in how quickly you pay off your debt.

– See if you can get a lower interest rate. If your credit score has improved since you first got your credit card, call your issuer and see if they will lower your rate. A lower rate will mean less money spent on interest each month, which means more money going towards paying off the principal.

What are the benefits of paying off your balance monthly?

There are several benefits to paying off your balance monthly. First, it allows you to avoid finance charges. Second, it keeps your credit score high. Third, it helps you build good credit history. And fourth, it saves you money in the long run.

How does paying off your balance monthly improve your credit score?

Your credit score is important. It is used by financial institutions to determine your creditworthiness and ability to repay debt. A high credit score means you’re a low-risk borrower, which could lead to a lower interest rate on a loan. A low credit score could lead to a higher interest rate and could mean you won’t be approved for a loan at all.

One of the things that influences your credit score is your credit utilization ratio, which is the amount of debt you have relative to your credit limit. If you carry a balance on your credit card from month to month, your credit utilization ratio will be higher than if you pay off your balance in full every month.

Your payment history is also a factor in your credit score. by making timely payments, you demonstrate to creditors that you’re a responsible borrower who can be trusted to repay debt. Missing payments can damage your credit score and make it difficult to get approved for loans in the future.

Paying off your balance in full every month will help you avoid finance charges, save money on interest, and improve your credit score.

What are some tips for paying off your balance monthly?

Paying off your balance in full each month is the best way to avoid finance charges. If you carry a balance from one month to the next, you will be charged interest on that balance. The interest rate on credit cards is generally much higher than the interest rates on other types of loans, so it’s important to try to pay off your balance each month.

There are a few things you can do to help make sure you pay off your balance each month:

– Make sure you know what your credit limit is and keep track of your spending so that you don’t go over that limit.

– If you can, set up automatic payments from your checking account to your credit card account so that you never miss a payment.

– Make a budget and stick to it! Decide how much you can realistically afford to spend each month and don’t let yourself go over that amount.

How can you make paying off your balance monthly easier?

Paying off your balance monthly is the best way to avoid finance charges. Here are a few tips on how you can make paying off your balance easier:

– Pay more than the minimum payment each month. This will help reduce the amount of interest you pay over the life of the debt.

– Make sure you pay your bill on time each month. This will help avoid late fees and keep your interest rate from going up.

– Try to avoid using your credit card for cash advances, as these typically have a higher interest rate than purchases.

– If you’re having trouble making payments, contact your credit card company to see if they can work with you on a payment plan.

What should you do if you can’t pay off your balance monthly?

If you can’t pay off your balance monthly, you should contact your credit card company to work out a payment plan. You may also want to consider transferring your balance to a credit card with a lower interest rate.

What are the consequences of not paying off your balance monthly?

When you carry a balance on your credit card from month to month, you are charged interest on that balance. The amount of interest you are charged depends on your interest rate, which is determined by your credit card issuer. Finance charges can add up quickly, so it’s important to understand how they work and how to avoid them.

If you don’t pay off your balance in full every month, you will be charged interest on the outstanding balance. The interest rate on your credit card will determine how much you will be charged in finance charges. The higher your interest rate, the more you will be charged in finance charges. For example, if you have a credit card with an annual percentage rate (APR) of 18%, and you carry a balance of $100 for one month, you will be charged $1.50 in finance charges ($100 x 0.18 = $1.50).

Paying off your balance in full every month is the best way to avoid finance charges. If you can’t pay off your entire balance, try to pay as much as possible to reduce the amount of interest you will be charged. You may also want to consider transferring your balance to a credit card with a lower APR to save money on finance charges.

How can you avoid finance charges in the future?

Paying off your credit card balance in full and on time each month is the best way to avoid finance charges. If you can’t pay the full balance, try to pay as much as possible to reduce the amount of interest you’ll accrue. You may also want to consider transferring your balance to a card with a lower interest rate to save on finance charges in the future.