How to Apply for an SBA Loan

Contents

The process for applying for an SBA loan is long and detailed. But, if you have a small business and you need a loan, it’s worth it to go through the process. Here’s a step-by-step guide on how to apply for an SBA loan.

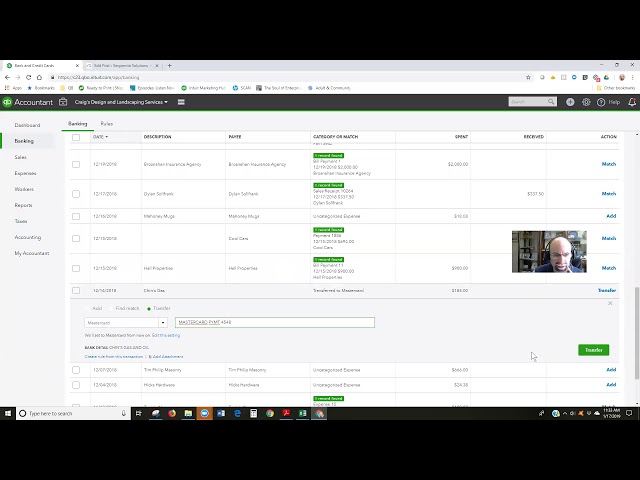

Checkout this video:

SBA Loan Basics

The Small Business Administration (SBA) is a U.S. government agency that provides support to small businesses and entrepreneurs. One way the SBA supports small businesses is through its loan programs. SBA loans are federally-guaranteed loans made by participating lenders (such as banks, credit unions, and development companies) that are backed by the SBA.

What is an SBA loan?

An SBA loan is a loan made by a bank, credit union, or other financial institution that is partially guaranteed by the Small Business Administration (SBA). The SBA is a U.S. federal government agency that promotes small business ownership by providing financing and other assistance.

The SBA does not lend money directly to small businesses. Instead, it guarantees a portion of loans made by participating lenders, such as banks and credit unions. This guarantee protects the lender from loss if the borrower defaults on the loan.

SBA-guaranteed loans are typically used for startup or expansion capital, equipment purchases, working capital, or real estate purchases. Loan terms and conditions are set by the lender, not the SBA.

The SBA does not charge a guarantee fee for 7(a) loans of $150,000 or less. For loans above $150,000, the guarantee fee is 3 percent of the portion of the loan over $150,000.

What are the eligibility requirements for an SBA loan?

The U.S. Small Business Administration (SBA) offers several loan programs to help small businesses get the financing they need to start or grow their businesses. In order to be eligible for an SBA loan, your business must:

-Be for-profit

-Be based in the United States

-Have a good credit history

-Be unable to get financing from other sources

Applying for an SBA Loan

The SBA loan program is a great way to get funding for your business. However, there are a few things you need to know before you apply. In this article, we will cover the basics of applying for an SBA loan.

How to apply for an SBA loan

Applying for an SBA loan is a multi-step process that involves completing and submitting several forms and documents. The first step is to fill out the SBA loan application, which is available online or through your local SBA district office.

Next, you’ll need to provide financial documents such as tax returns, bank statements, and loan repayment history. The SBA will also require a business plan, personal financial statement, and collateral. Once you have all of the required documentation, you can submit your application to the SBA for review.

Loan applications can take several weeks to process, so it’s important to be patient and remain in communication with your lender during this time. If your application is approved, you’ll be notified of the loan amount, interest rate, and repayment terms. Once you accept the loan offer, you’ll sign a promissory note and begin making payments according to the agreed-upon schedule.

What documentation do you need to apply for an SBA loan?

To apply for an SBA loan, you’ll need to fill out the SBA 7(a) loan application and provide the following documentation:

-Personal financial statement

-Tax returns for the past three years

-Details about your collateral

-A business plan

-Your resume

-Bank statements for the past three months

SBA Loan Types

There are many different types of SBA loans, each with their own set of qualifications and requirements. The most common type of SBA loan is the 7(a) loan, which can be used for a variety of purposes, including starting a business, expanding a business, or purchasing equipment or real estate.

7(a) Loan

The 7(a) loan program is the SBA’s primary program for helping startup and existing small businesses obtain financing. The 7(a) loan program covers a wide range of financing needs, such as working capital, expansion, equipment purchases, and inventory.

The maximum loan amount for a 7(a) loan is $5 million. Interest rates on 7(a) loans are generally lower than rates on other types of loans, and the terms can be up to 10 years for working capital and 25 years for fixed assets.

504 Loan

The 504 loan provides long-term, fixed-rate financing to acquire fixed assets for expansion or modernization. A 504 loan can be used to finance the total project cost, which can include the purchase price of the business property, renovations, equipment, and other related business expenses such as attorney and accountant fees.

Microloan

The SBA Microloan program provides small loans, ranging from $500 to $50,000, to small business owners and entrepreneurs. These loans can be used for a variety of purposes, including working capital, inventory or equipment purchases, and business-occupied real estate financing.

To qualify for an SBA Microloan, you must:

-Be owner of a for-profit business

-Operate in the United States or its territories

-Have no outstanding delinquent federal taxes or student loans

-Demonstrate credit availability from other sources

SBA Loan Terms

An SBA loan is a great way to get financing for your small business. But what are the terms of an SBA loan? The Small Business Administration (SBA) is a government agency that provides loans to small businesses. The SBA does not lend the money directly to the small business. Instead, they guarantee a portion of the loan, making it easier for the small business to get financing.

Interest rates

The current maximum interest rate for 7A loans is 6.75%* and 504 loans is 5.75%. The rate for the 7A program is tiered and ranges depending on the size of the loan and the maturity date. For 504 loans, rates are also tiered, with maturities of 10 years or less having a lower rate than loans with maturities greater than 10 years.

Repayment terms

The repayment terms of an SBA loan are generally very favorable to the borrower. repayment terms will be determined by several factors, including the use of proceeds, the type of collateral securing the loan, and the overall risk profile of the loan. In general, however, SBA loans typically have a repayment term of 10-25 years.

SBA Loan Programs

The U.S. Small Business Administration (SBA) offers several loan programs to help small businesses get the financing they need. SBA loan programs include the 7(a) Loan Program, the 504 Loan Program, and the Disaster Assistance Loan Program. In this article, we’ll cover how to apply for an SBA loan.

SBA Express

The SBA Express Loan Program, also known as the “SBA 504” or “Small Business Advantage” program, provides financing for major fixed assets, such as equipment or real estate. This program offers lower down payments and longer terms than traditional bank financing, making it easier for small businesses to afford the costs of expansion.

To be eligible for an SBA Express loan, your business must:

-Be for-profit

-Be based in the U.S. or its possessions

-Have a net worth of less than $ 15 million and average after-tax profits of less than $ 5 million over the past two years

-Use the loan proceeds for fixed asset purchases only (equipment, machinery, furniture, fixtures, leasehold improvements)

-not exceed SBA loan limits

SBA 7(a)

The 7(a) Loan Guaranty Program is the SBA’s primary program for helping start-up and existing small businesses obtain financing. The program makes capital available to small businesses through bank and non-bank lending institutions. SBA guarantees a portion of the loan, enabling the lender to provide financing on more favorable terms.

To be eligible for an SBA 7(a) loan, your business must:

– Be for-profit

– Operate primarily in the U.S. or its possessions

– Be involved in an eligible business activity (see list below)

– Have reasonable investment goals and not excessive profits

Eligible business activities include, but are not limited to:

– Manufacturing

– Wholesale and retail trade

– Service industries

– Minority business activities

– Real estate investments

SBA 504

The 504 program provides small businesses with long-term, fixed-rate financing used to acquire fixed assets for expansion or modernization.

Eligible projects include:

-Purchase of land and buildings

-Construction of new facilities or renovation of existing facilities

-Purchase of long-term machinery and equipment

CAPLines

The SBA’s CAPLines program helps small businesses meet their short-term and cyclical working capital needs. The program has four components:

-Seasonal Line: A short-term loan for businesses with regular peaks and valleys in their sales cycles (e.g., retailers, landscapers, boat dealers).

-Contract Line: A short-term loan to finance the direct costs of performing a contract (e.g., inventory and labor) as well as an interim basis until progress payments are made.

-Builders Line: A short-term loan to finance construction costs (inventory, labor, materials) for builders and contractors building one or more homes or commercial properties.

-Export Line: A working capital line of credit to support the export cycle for businesses engaged in international trade on either a short-term or long-term basis.

Disaster Loans

The U.S. Small Business Administration (SBA) offers disaster assistance in the form of low-interest loans to businesses and homeowners in declared disaster areas. SBA disaster loans can be used to repair or replace real estate, personal property, machinery, equipment, inventory, and business assets that have been damaged or destroyed in a declared disaster.

The SBA has several different loan programs available, each with its own eligibility requirements and terms. The most common type of SBA loan is the 7(a) loan program, which can be used for a variety of purposes including working capital, expansions, equipment purchases, and real estate acquisitions. Other SBA loan programs include the 504 Loan Program for long-term investments in fixed assets like real estate or machinery, and the Microloan Program which provides small loans of up to $50,000 to startup businesses and small businesses with limited access to capital. Find out more about each type of SBA loan program here:

– 7(a) Loan Program: The 7(a) Loan Program is the most common type of SBA loan. 7(a) loans can be used for a variety of purposes including working capital, expansions, equipment purchases, and real estate acquisitions.

– 504 Loan Program: The 504 Loan Program provides long-term financing for investments in fixed assets like real estate or machinery. Loans are typically structured with a down payment of 10% from the borrower, 40% from a private lender, and 50% from the SBA.

– Microloan Program: The Microloan Program provides small loans of up to $50,000 to startup businesses and small businesses with limited access to capital. Loans are made through intermediary lenders who also provide technical assistance to borrowers.

SBA Loan Guarantees

The U.S. Small Business Administration (SBA) does not lend money. Rather, the SBA provides a guarantee to lenders for a portion of the loan. This enables the lender to offer you a better deal, such as a lower interest rate or a longer repayment period, than they otherwise might.

What is an SBA loan guarantee?

The Small Business Administration (SBA) does not lend money directly to small business owners. Rather, the SBA guarantees loans made by approved lenders, such as banks and other financial institutions. This guarantee reduces the risk for lenders and makes it more likely they will approve financing for small businesses. For example, if you default on an SBA-guaranteed loan, the agency will reimburse your lender for a portion of their losses.

The SBA loan guarantee program is designed to help small businesses obtain financing when they might not be able to get a loan on their own. The agency provides a partial guarantee to lenders for certain types of loans, including7(a) and 504 loans, that can be used for working capital, equipment, real estate, or other purposes.

How does an SBA loan guarantee work?

An SBA loan guarantee allows a lender to provide financing to a small business borrower that might not otherwise qualify for a loan. The SBA does not lend money directly to small business owners. Rather, the SBA provides lending partners with a partial guarantee for loans made to small businesses, reducing the risk to the lender and making it more likely that small businesses will receive the financing they need.

The SBA guarantee is not an outright purchase of the loan; rather, it is a promise by the SBA to repay a portion of the loan if the borrower defaults. This guarantee gives lenders confidence to work with small businesses that may be considered higher risk. The SBA guarantees 75% of loans of $150,000 or less and 85% of loans over $150,000.

SBA Loan Forgiveness

Applying for an SBA Loan can be a long and tedious process, but it is worth it in the end. The SBA Loan Forgiveness Program is a great way to get your loan forgiven if you are having trouble making payments. The program is designed to help small businesses that are struggling to make ends meet.

What is SBA loan forgiveness?

The SBA forgives part or all of an SBA disaster loan if the borrower agrees to provide certain services to a low-to-moderate income community for a specified period of time. If you are unable to perform your service obligation, you may be required to repay all or part of the disaster loan that was forgiven.

How does SBA loan forgiveness work?

Typically, an SBA loan must be repaid in full even if your business is unable to succeed. However, the government may offer SBA loan forgiveness in certain situations. For example, if you use an SBA loan to start or expand a business in a designated disaster area, you may be eligible for SBA loan forgiveness.

To apply for SBA loan forgiveness, you must submit a request to the SBA. If your request is approved, the SBA will forgive a portion of your loan. The amount of loan forgiveness will depend on how you use the loan proceeds. For example, if you use the loan proceeds to purchase equipment or inventory, you may be eligible for full loan forgiveness. However, if you use the loan proceeds to cover operating expenses, you may only be eligible for partial loan forgiveness.

The process for applying for SBA loan forgiveness can be complex and time-consuming. Therefore, it’s important to work with an experienced lender who can help guide you through the process.