How Do Credit Card Interest Rates Work?

Contents

How do credit card interest rates work? Find out how credit card interest is calculated and what factors determine your interest rate.

Checkout this video:

Understanding Interest Rates

Interest rates are the cost of borrowing money. The higher the interest rate, the more it will cost you to borrow money. However, there are a few things to keep in mind when it comes to interest rates. For example, the interest rate is only one part of the equation. The other part is the Annual Percentage Rate (APR).

What is APR?

Annual Percentage Rate (APR) is the yearly rate of interest that is charged on an outstanding credit card balance. This rate is calculated by taking into account the individual’s interest rate, any fees that may have been charged by the credit card issuer, and compounding this rate over the course of a year. In other words, APR is the total cost of borrowing money from a credit card issuer, expressed as a percentage of the total amount borrowed.

APR is important to understand because it can have a significant impact on the total amount of interest that is paid on a credit card balance over time. For example, if a credit card has an APR of 20%, and a customer only pays the minimum required payment each month, it would take almost 19 years to pay off the balance in full! In contrast, if that same credit card had an APR of 10%, the same minimum payment would pay off the balance in full in just over 8 years.

There are two types of APR that are commonly used by credit card issuers: promotional and standard. Promotional APR is typically offered to customers as an introductory offer when they first open a credit card account. This low introductory rate can be helpful for customers who plan to carry a balance on their credit card from month-to-month, as it will help them keep their monthly interest payments low. However, it’s important to note that promotional rates will eventually expire, and revert back to the standard APR. For this reason, it’s important for customers to understand both types of APR before opening a new credit card account.

What is a daily periodic rate?

The daily periodic rate (DPR) is the rate used to calculate the interest charge on your credit card account. It’s a fraction of the APR that’s applied to your balance each day.

You can calculate your DPR by dividing your APR by 365 (the number of days in a year). For example, if your APR is 15%, your DPR would be 0.04109%.

To calculate the interest charge for a given day, you would multiply your DPR by the outstanding balance on that day. So, if you had a balance of $1,000 and a DPR of 0.04109%, you would be charged $4.11 in interest for that day ($1,000 x 0.04109% = $4.11).

How is interest calculated on credit cards?

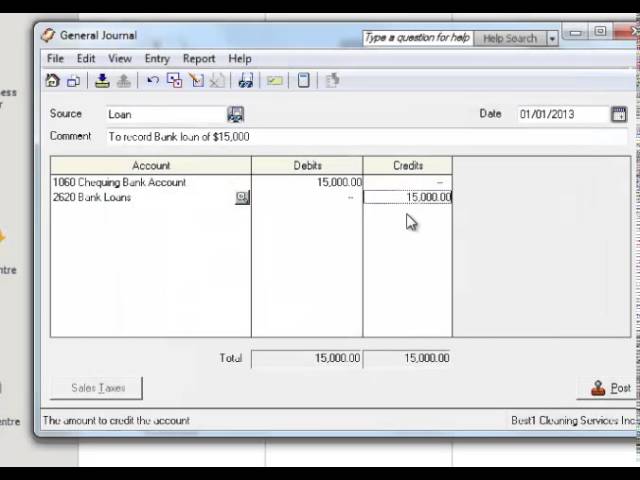

Credit card companies make money by charging interest on the money you borrow from them. They use what’s called the “average daily balance” method to calculate the interest charge on your monthly credit card statement.

To get your average daily balance, they start with the balance on your statement date. They add any new charges and subtract any payments or credits you made during that billing cycle. They divide that total by the number of days in the billing cycle. That gives them your average daily balance.

Then they multiply your average daily balance by the monthly periodic rate. The periodic rate is your annual percentage rate (APR) divided by 12. For example, if your APR is 15%, your periodic rate would be 1.25%.

Last, they multiply the periodic rate by the number of days in that billing cycle. So, if you had a $1,000 balance and paid $50 during a 30-day billing cycle, here’s how their calculation would look:

$1,000 x 1.25% periodic rate x 30 days in billing cycle = $37.50 in interest charges for that month

Factors That Determine Interest Rates

The first thing to understand is that credit card issuers make money by charging interest on the money you borrow. So, the higher the interest rate, the more money they make. Of course, they also have to account for the possibility that you may not repay your debt, so they build that into the interest rate as well. There are a few different factors that determine the interest rate you’ll pay.

Credit history

Credit history is one of the most important factors in determining the interest rate on a credit card. Credit history is a record of how you have managed your credit in the past. It includes information about whether you have made your payments on time, how much credit you have used, and any derogatory information such as bankruptcies or foreclosures.

Credit card companies use this information to decide whether you are a good risk and to set the interest rate on your card. If you have a good credit history, you will probably qualify for a lower interest rate. If your credit history is poor, you may be charged a higher rate or may not be approved for a card at all.

Other factors that may be considered in setting the interest rate on a credit card include:

-Your income

-Your debts

-The type of card (secured or unsecured)

-The issuing bank

Credit utilization

Credit utilization is probably the most important factor in determining your credit card interest rate. Credit utilization is simply how much of your credit limit you’re using at any given time. The lower your credit utilization, the better. In fact, many experts recommend keeping your credit utilization below 30%.

For example, let’s say you have a credit card with a $5,000 limit and you typically carry a balance of $1,000. Your credit utilization would be 20% ($1,000 divided by $5,000). If you kept that same balance but raised your credit limit to $10,000, your credit utilization would drop to 10% ($1,000 divided by $10,000).

Credit issuers typically use two different methods to calculate your balances for purposes of determining credit utilization:

-The average daily balance method. This method adds each day’s balance during the billing cycle and divides that figure by the number of days in the billing cycle.

-The adjusted balance method. This method subtracts any payments made during the billing cycle from the beginning balance before calculating the average daily balance.

Types of cards

There are numerous types of credit cards available on the market today, each with different features and benefits. However, when it comes to the interest rate you’ll pay on your credit card balance, the type of card you have is just one of many factors that come into play.

Here are some of the things that can affect the interest rate you’ll pay on your credit card:

-The type of card you have: For example, rewards cards tend to have higher interest rates than other types of cards.

-Your credit score: In general, the better your credit score, the lower the interest rate you’ll qualify for.

-The prime rate: The prime rate is a benchmark interest rate used by lending institutions and can serve as a basis for calculating your credit card’s interest rate.

-Promotional rates: Some cards offer promotional rates on purchases or balance transfers for a limited time. Once the promotional period expires, the interest rate will increase.

-Your payment history: If you’ve made late payments or carried a balance on your card in the past, you may be charged a higher interest rate going forward.

In addition to the factors above, there are a few other things to keep in mind when it comes to credit card interest rates. For example, most cards have variable interest rates, which means they can change over time based on the prime rate or other factors. And if you have multiple cards from the same issuer, they may all have different interest rates depending on each card’s individual terms and conditions.

Finally, it’s important to remember that paying your balance in full and on time each month is always the best way to avoid paying interest on your credit card purchases.

How to Avoid Paying Interest on Credit Cards

Interest rates on credit cards can be confusing. After all, how can a creditor charge you interest on money you already paid them? In this article, we’ll explain how credit card interest works and how you can avoid paying it.

Pay your balance in full each month

One way to avoid paying interest on your credit cards is to pay your balance in full each month. This means that you will only be charged for the purchases that you make during the month, and not for any previous balance. If you cannot pay your balance in full each month, you should try to at least make a payment that is larger than the minimum payment due. By doing this, you will reduce your overall balance and the amount of interest that you will be charged.

Use a 0% APR credit card

One way to avoid paying interest on your credit card balance is to use a 0% APR credit card. These cards offer a 0% introductory APR period, which means you won’t be charged interest on your balance for a certain amount of time.

intro APR period, which means you won’t be charged interest on your balance for a certain amount of time. This can be helpful if you need to make a large purchase or want to consolidate debt onto one card. Just be sure to pay off your balance before the intro period ends, or you’ll be stuck paying interest at the regular APR.

Get a personal loan

If you’re carrying a balance on your credit card, you’re probably paying interest. To avoid paying interest, you can take out a personal loan and use it to pay off your credit card balance. Then, you’ll just have to pay off the personal loan. This is a good option if you can get a personal loan with a lower interest rate than your credit card interest rate.