How Banks Charge Interest on Loans

Contents

How do banks charge interest on loans? The answer may surprise you.

Checkout this video:

How Interest Works

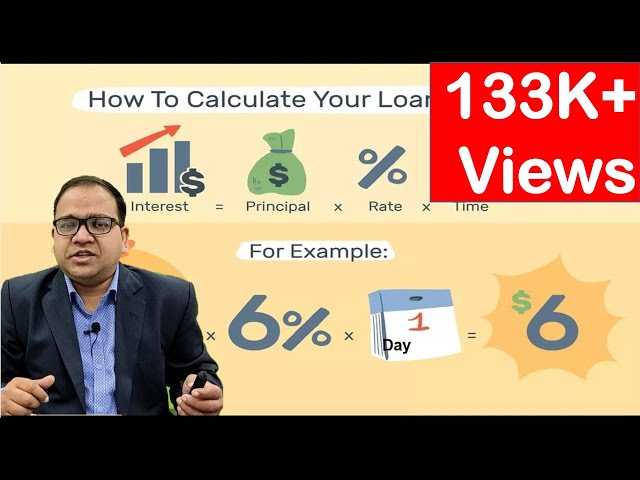

Interest is the price of money, and it is calculated as a percentage of the principal, which is the amount of money borrowed. For example, if you take out a loan for $100 at an annual interest rate of 5%, you will owe the lender $105 at the end of the year. The $5 that you owe is the interest on the loan.

How Interest Is Charged

Interest is usually charged as a percentage of the loan amount, calculated per year (an annual rate). Loan terms often run for several years, so the amount of interest you pay can be substantial.

Interest rates tend to be higher on loans that are easy to get (like credit card debt) and lower on loans that are more difficult to get (like a mortgage). The loan’s interest rate also depends on your credit score—the higher your score, the lower your rate usually is.

How Interest Is Calculated

When you take out a loan, the bank doesn’t just hand you the cash and say “See ya in a few years!” They expect to be paid back, plus interest. But how is that interest calculated?

The answer depends on two factors: the type of interest rate you’re paying, and the method your bank uses to calculate interest. Let’s start with the types of interest rates.

There are two main types of interest rates: fixed and variable. A fixed interest rate means that the rate will stay the same for the life of the loan. A variable interest rate means that the rate can change over time. Variable rates are often tied to an index, such as the prime rate.

The prime rate is a base rate that banks charge their best customers. It’s also what other lenders use to set their rates. When the prime rate goes up, so do variable rates.

Now let’s look at how banks calculate interest on loans. The two most common methods are simple interest and compound interest.

With simple interest, you only pay interest on the principal (the amount you borrowed). For example, let’s say you take out a loan for $1,000 at a 5% simple interest rate. After one year, you would owe $50 in interest ($1,000 x 0.05 = $50).

With compound interest, you pay interest on both the principal and any accumulated interest from previous periods. So, using the same example above, let’s say that instead of simple interest, your loan has compound interest calculated monthly. After one year, you would owe $52.50 inInterest ($1,000 x 0.05 = $50 + $2.50 in accumulated Interest). Compound Interest is more common because it results in a higher overall return for lenders!

Types of Interest

Banks typically charge interest on loans in one of three ways: simple interest, precomputed interest, or compound interest. Simple interest is charged as a percentage of the principal balance and is paid at the end of the loan term. Precomputed interest is charged as a percentage of the principal balance and is paid at regular intervals throughout the loan term. Compound interest is charged as a percentage of the principal balance and is paid at regular intervals throughout the loan term.

Simple Interest

Simple interest is theInterest that is charged on theprincipal of a loan,and it is notaffected by anyprevious paymentsor outstandingbalance. This typeof interest isused for short-termand long-term loans,and it usually hasa lower interestrate thancompoundinterest.

Compound Interest

With compound interest, interest is calculated not only on the original principal but also on the accumulated past interest. That means that the longer you leave your money in the account, the greater the earnings.

With simple interest, by contrast, interest accrues only on the principal. That makes compound interest more powerful than simple interest over time.

Here’s an example to illustrate: Suppose you deposit $1,000 in a savings account that pays 5% interest, compounded annually. After one year, you would earn $50 in interest ($1,000 x 0.05 = $50). In year two, you would earn 5% of not just the original $1,000 principal but also of the first year’s $50 in interest, for a total of $52.50 in interest for that second year ($1,050 x 0.05 = $52.50). And so it goes: In year three you would earn 5% of $1,102.50 and so on.

As this example shows, each subsequent year’s earnings are greater than the last because they are based on a larger balance — your original deposit plus all the accumulated past interest. The effect is that your money grows at an ever-accelerating rate.

Fixed Interest

With a fixed interest rate, your repayments will stay the same for the life of the loan, even if interest rates rise. You’ll have certainty about your repayments and you’ll know exactly how much you need to budget for.

Variable Interest

With a variable interest rate, your interest rate can go up or down over the life of your loan. Your monthly repayments will usually stay the same, even when the interest rate changes.

With a variable interest rate loan, you take on more risk because your repayments could go up if interest rates rise. But you could also save money if rates fall.

How Banks Charge Interest on Loans

Interest is the cost of using someone else’s money. When you borrow money from a bank, they charge you interest. The amount of interest you pay depends on how much money you borrow, the term of the loan, and the interest rate. The interest rate is the percentage of the loan that the bank charges you for borrowing the money.

The Interest Rate

In order to loan money, banks charge interest. The Annual Percentage Rate (APR) is the amount of interest that the bank charges on a loan, expressed as a percentage of the loan amount. The APR includes the interest rate and any other fees that may be charged by the bank, such as points or loan origination fees.

What’s important to understand about APRs is that they are almost always higher than the stated interest rate on a loan. That’s because in addition to the stated rate, APRs also include fees that may be charged by the lender. These fees can add up, and they’re not always easy to spot when you’re shopping for a loan.

Here’s an example: let’s say you’re considering two different loans, one with an APR of 6% and one with an APR of 10%. At first glance, it might seem like the 6% loan is a better deal because it has a lower interest rate. But if the 6% APR includes points and origination fees that total $1,000, then your actual interest cost for the loan will be much higher than 6%. In this case, the 10% APR loan would actually be cheaper overall.

When you’re shopping for a loan, it’s important to look at more than just the interest rate. Be sure to ask about any fees that may be charged and compare APRs before you make a decision.

The Loan Term

The length of the loan term is the number of years the loan is scheduled to be paid over. The most common loan terms are 15 years and 30 years. Some loans may have 10-year, 20-year, or 40-year terms, but these aren’t as common.

The longer the loan term, the lower your monthly payment will be because you’ll spread out your loan balance over a longer period of time. But keep in mind that with a longer loan term you’ll also pay more in interest overall because you’re borrowing the money for a longer period of time.

The Loan Amount

The loan amount is the total amount of money you borrow from the bank. The interest rate is the percentage of the loan amount that you pay back to the bank in addition to the original loan amount. The term of the loan is the length of time you have to pay back the loan, and the payments are usually made on a monthly basis.

Conclusion

In conclusion, it’s important to remember that all banks are different and charge interest in different ways. Be sure to ask about how your bank charges interest on loans before you take one out.