How a Loan Works: A Simple Explanation

Contents

You’ve probably heard the term “loan” before, but how do loans actually work? Here’s a simple explanation of how loans can help you finance a big purchase.

Loan Works: A Simple Explanation’ style=”display:none”>Checkout this video:

Introduction

When you take out a loan, you are borrowing money from a lender and agreeing to repay that money, plus interest, over a set period of time. There are many different types of loans available, but they all work in essentially the same way. In this article, we’ll provide a simple overview of how loans work so that you can better understand your options before you make any decisions.

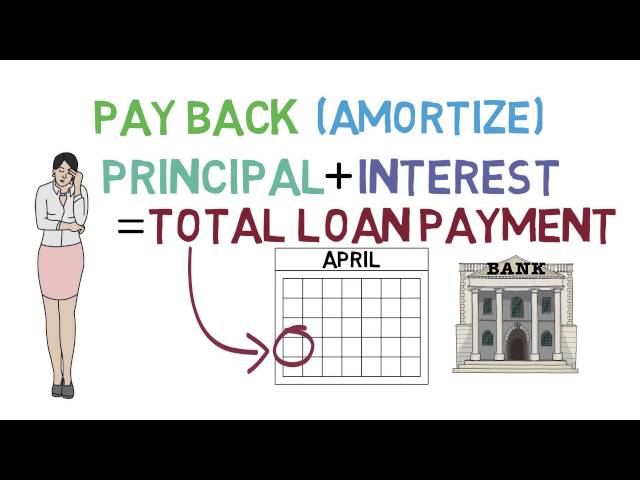

Essentially, all loans can be boiled down to three key components:

-The amount of money being borrowed (the principal)

-The interest rate charged on the loan

-The term of the loan (the length of time you have to repay the loan)

These three factors will determine the monthly payment amount on your loan. The principal is the amount of money being borrowed, and the interest rate is the percentage of that principal that you’ll need to pay back to the lender in addition to repayment of the principal itself. The term is the length of time over which you’ll make those payments. For example, if you borrow $500 at an annual interest rate of 10% and have a one-year term, your monthly payments will be $50 (principal + interest), and you’ll owe $550 in total when the loan is paid off. If you extend your term to two years, your monthly payments will decrease to $25 but your total repayment amount will increase to $600.

It’s important to remember that, while extending your loan term may lower your monthly payments, it will also result in paying more overall due to accruing more interest over time. In general, it’s best to try and repay your loan as quickly as possible in order to save on interest charges.

Now that we’ve covered the basics of how loans work, let’s take a look at some specific types of loans that you might encounter.

What is a loan?

Most people will need to take out a loan at some point in their lives – whether it’s for a car, a home, or tuition. But how do loans work? This simple guide will explain the basics of how loans work, so you can make informed decisions about taking one out.

A loan is simply an amount of money that is borrowed and then repaid over time, usually with interest. Most loans are made by financial institutions such as banks or credit unions, but they can also be made by individuals or businesses.

The terms of a loan will vary depending on the lender and the borrower, but they will typically involve the following:

-The amount of money being borrowed (the principal)

-The interest rate charged on the loan

-The length of time over which the loan will be repaid (the term)

-Any fees associated with taking out or repaying the loan

The loan process

If you’re considering taking out a loan, it’s important to understand how loans work. A loan is a type of debt that you can take on from a financial institution. In order to get a loan, you’ll need to fill out an application and go through a credit check. If you’re approved for the loan, you’ll then need to make monthly payments until the loan is paid off.

Applying for a loan

When you’re ready to apply for a loan, you’ll need to gather some financial documentation. This will usually include your tax returns from the past two years, your most recent pay stubs, and any other asset or debt information. Once you have all of your documentation in order, you can begin the loan application process.

The first step is to choose a lender. There are many different types of lenders, including banks, credit unions, and online lenders. Each type of lender has its own lending requirements, so it’s important to choose one that you feel confident you can qualify with.

Once you’ve chosen a lender, you can begin the actual loan application process. This will involve filling out a loan application form and providing the required documentation. The lender will then use this information to determine whether or not you qualify for the loan. If you do qualify, they will provide you with a loan offer, which will include the terms and conditions of the loan.

Once you receive a loan offer, you can decide whether or not to accept it. If you do decide to accept it, you will need to sign a loan contract and provide any additional information that may be required by the lender. Once everything is finalized, the lender will disburse the funds to you and your loan will be complete!

Loan approval

The first step in the loan process is loan approval. This is when the lender reviews your financial information and decides whether or not to approve your loan. The lender will also determine the interest rate and terms of your loan at this time.

After you are approved for a loan, you will need to sign a loan agreement. This is a legally binding document that outlines the terms of your loan. Make sure you understand all of the terms before you agree to them.

Once you have signed the loan agreement, the lender will provide you with the money you have borrowed. You will then be responsible for repaying the loan, with interest, over the term of the loan.

Loan disbursement

Once you’ve signed your loan agreement, the lender will send the money to your school. If you’re attending school less than half-time, the lender can send the money to you.

If you have a Perkins Loan, your school will hold the money in an account and disburse it to you in at least two payments. The first payment is usually made within 30 days after the start of your grace period. The second payment is made no earlier than 60 days and no later than 120 days after the first payment.

For all other types of federal student loans, your school must wait until at least the first day of your grace period before disbursing your loan. Your grace period is a set time after you graduate, leave school or drop below half-time enrollment when you’re not required to make payments on your loan.

Your school will notify you when it has received your loan funds and how those funds will be disbursed (paid out). Keep in mind that if this is your first time receiving a Direct Loan, there might be a delay of a few days between when your school gets the money and when you do.

Types of loans

There are many different types of loans available to people. Some of the most common types of loans are home loans, auto loans, and student loans. Each type of loan has its own set of terms and conditions. In this section, we’ll take a closer look at how each type of loan works.

Personal loans

Personal loans are a type of unsecured loan, which means that the loan doesn’t require any collateral (such as a car or property) to secure the loan. This makes personal loans a higher risk for lenders, which usually results in higher interest rates than other types of loans.

Personal loans can be used for a variety of purposes, including consolidating debt, financing a large purchase, or paying for unexpected expenses.

When considering taking out a personal loan, it’s important to compare offers from multiple lenders to ensure you’re getting the best rate and terms possible. It’s also important to remember that personal loans are a type of debt, which means you’ll need to carefully consider whether taking on more debt is the right decision for you.

Home loans

A home loan is a type of loan that helps you finance the purchase of a house. The house serves as collateral for the loan, which means that if you can’t make your payments, the lender can take possession of the house. Home loans typically have fixed interest rates, which means that the interest rate stays the same for the term of the loan, and they usually have repayment terms of 15 or 30 years.

Auto loans

If you’re planning to finance a new or used vehicle, you’ll likely end up taking out an auto loan. An auto loan is a type of installment loan, which means you borrow a set amount of money and then repay it, usually in monthly payments.

Before you start shopping for a new ride, it’s important to understand how auto loans work. That way, you can choose the right loan for your budget and avoid overspending on your car.

Here’s a quick overview of how auto loans work:

You’ll need to decide how much money you want to borrow. You can do this by looking at the total cost of the car and subtracting any down payment or trade-in value.

Next, you’ll need to find a lender who is willing to give you a loan for that amount. You can do this by shopping around at banks, credit unions, and online lenders.

Once you’ve found a lender, you’ll need to fill out a loan application and provide information about your income, debts, and other financial obligations. The lender will then review your application and decide whether or not to give you the loan.

If you are approved for the loan, you’ll then need to sign a contract which outlines the terms of the loan. This contract will include information such as the interest rate, monthly payment amount, and length of the loan.

Once the contract is signed, the lender will give you the money and you can use it to buy your car. After that, you’ll need to make monthly payments until the loan is paid off in full.

Student loans

There are two main types of student loans: federal student loans and private student loans.

Federal student loans are made by the government and have fixed interest rates, meaning the rate won’t change over the life of the loan. Private student loans are made by banks and other financial institutions, and have variable interest rates, meaning the rate could change over time.

Both types of student loans can be used to pay for tuition and other school-related expenses, such as room and board, books, and fees.

Federal student loans are available to both undergraduate and graduate students, while private student loans are generally only available to creditworthy borrowers who are enrolled in an eligible degree program at an eligible school.

Conclusion

Loans are a part of our lives, whether we’re buying a car or a home, paying for college or taking out a business loan. But how do loans work? In this article, we’ll explain the mechanics of loans so you can better understand how they can help (or hurt) your financial life.

A loan is simply an agreement between two parties to exchange money now with the understanding that the debt will be repaid with interest in the future. The loan agreement usually includes several key terms, such as the amount of money being borrowed, the interest rate charged on that money, and when the debt is to be repaid.

The term “loan” can refer to many different types of debt, from personal loans to mortgages to lines of credit and more. In general, though, all loans share these characteristics:

-You borrow money from a lender and agree to pay it back over time.

-The terms of the loan spell out how much you’ll pay in interest and fees as well as when and how you’ll repay the debt.

-The size of your monthly payment is determined by the term length and interest rate of your loan.

While loans can be helpful in achieving financial goals, it’s important to remember that they are also a form of debt. That means if you’re not careful, you could end up paying more in interest and fees than you originally borrowed. Loans can also put your assets at risk if you’re unable to make your payments on time. So before taking out a loan, be sure you understand all the risks and benefits involved.