How to Find Out How Much You Owe in Student Loans

Contents

If you’re wondering how to find out how much you owe in student loans, you’ve come to the right place. We’ll show you everything you need to know.

Checkout this video:

Introduction

If you have federal student loans, you can log in to your account on the National Student Loan Data System (NSLDS) to find out how much you owe. This site will also list all of your federal student loans and other financial aid. If you have private student loans, contact your loan servicer to find out how much you owe. You can also use a student loan calculator to estimate your monthly payments and total loan cost.

How to Find Out How Much You Owe in Student Loans

If you’re not sure how much you owe in student loans, there are a few ways to find out. You can check your credit report, contact your loan servicer, or look at your repayment history. If you’re not sure where to start, we can help.

How to find your loan servicer

The first step in finding out how much you owe in student loans is to identify your loan servicer. Your loan servicer is the company that handles the billing and other services on your federal student loan.

To find your loan servicer, you can:

-Log in to “My Federal Student Aid.”

-Look under the heading “Loan Servicer” for your servicer’s contact information.

-Check your credit report. You can get a free copy of your credit report through AnnualCreditReport.com. Your servicer should be listed on your credit report.

If you can’t find your loan servicer’s contact information, call the Federal Student Aid Information Center at 1-800-4-FED-AID (1-800-433-3243). TTY users can call 1-800-730-8913.

How to find your loan balance

The first step in finding out how much you owe in student loans is to know who your loan servicer is. Your loan servicer is the company that handles the billing and other services on your federal student loan.

To find out who your loan servicer is, you can:

-Log in to “My Federal Student Aid”. Use this site to view all of the federal loans you have received and the loan servicers for those loans.

-Contact your school. Ask your school’s financial aid office which company services your federal student loans.

-Look on previous billing statements. Your loan servicer sends you a monthly bill, called a “loan statement,” that lists the amount you owe.

-Check your credit report. You can get one free copy of your credit report from each of the three nationwide credit reporting companies every 12 months at AnnualCreditReport.com, or by calling 1-877-322-8228. Reviewing your credit report will also help you identify loans that may not be yours.

If you have trouble finding information about your loan, contact the Federal Student Aid Information Center at 1-800-4-FEDAID (1-800-433-3243). TTY users can call 1-800-730–8913

How to find your interest rate

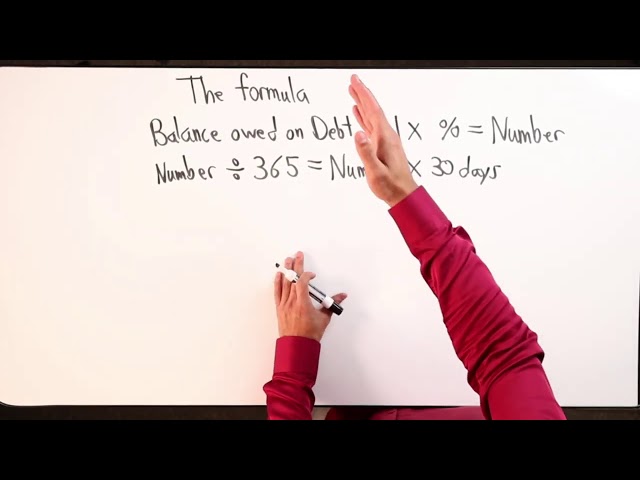

Once you know how much you owe in student loans, you can start thinking about repayment. To calculate your mortgage interest rate, you’ll need to know your loan balance and the interest rate on your loan.

Your loan balance is the amount of money you still owe on your loan. You can find your loan balance on your monthly statement or by logging into your account on your lender’s website.

The interest rate on your loan is the amount of interest charged by your lender, and it’s expressed as a percentage of your loan balance. For example, if you have a $10,000 loan with a 5% interest rate, that means you’ll be charged $500 in interest over the life of the loan.

Conclusion

If you’re like most people, you probably have some student loans. In fact, the average person who graduated from college in 2016 had about $37,172 in student loan debt, according to a report from Experian. If you’re not sure how much you owe or who your lender is, there are a few ways you can find out.

The first place to start is your credit report. You’re entitled to one free credit report per year from each of the three major credit reporting agencies: Equifax, Experian and TransUnion. You can get your reports by visiting AnnualCreditReport.com or by calling 1-877-322-8228. Once you have your reports, look for any accounts that say “student loan” or “education loan.” If you see an account that you don’t recognize, it could be that you have an unpaid student loan from a previous school that you attended.

If you can’t find any mention of your student loans on your credit reports, your next step is to contact the Department of Education’s Federal Student Aid office at 1-800-4-FED-AID (1-800-433-3243). They should be able to tell you how much money you borrowed and who your lender is. You can also visit the National Student Loan Data System’s website at NSLDS.ed.gov to get information on your federal student loans.

For private student loans, things are a little trickier. There’s no central database of private student loan information like there is for federal loans. That means you’ll need to do some detective work to track down your lender (or lenders). Start by checking your credit reports for any mention of private student loans. If that doesn’t turn up anything, try contacting any schools that you attended while borrowing money for college. They may have information on who your lenders were. You can also try contacting the company that handles billing for your current student loans (if applicable) as they may be able to provide some leads.

Once you’ve located your lender (or lenders), give them a call and ask for information about your outstanding balance and repayment options. If you’re having trouble finding out how much money you owe or who your lender is, don’t hesitate to reach out to a professional for help