How Long After Loan Approval Before Closing?

Contents

How long after loan approval before closing? This is a question many home buyers have during the home buying process. We’re here to help give you a general idea of what to expect.

Checkout this video:

Mortgage Process

Applying for a loan

Your loan application will likely go through several rounds of review, both by computer software and by human underwriters, before it’s finally approved (or not).

The first thing most lenders do when you apply for a mortgage is to check your credit reports from the three main credit bureaus — Equifax, Experian and TransUnion. They’ll also look at your score from each bureau, which is a numerical representation of the information in your credit report. A high score means you have a good credit history and are likely to make payments on time; a low score means you have a history of late or missed payments, or you have too much debt relative to your income.

After reviewing your credit reports and scores, the lender will then look at other factors — such as employment history, income and debts — to determine whether you qualify for a loan and how much of a risk you may be. If everything looks good so far, the next step is usually to have the loan processed by an automated underwriting system.

Mortgage loan approval

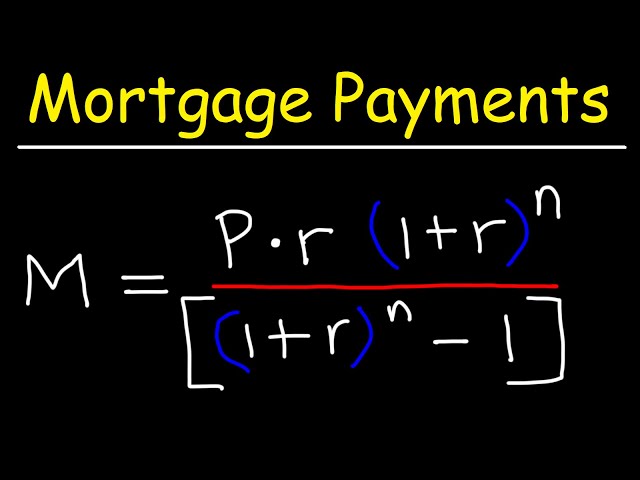

Mortgage loan approval is a process in which the lender evaluates the borrower’s ability to repay the loan. The borrower’s ability to repay the loan is typically determined by their credit history, employment history, and income. Lenders will also consider the value of the property that is being purchased and any outstanding debts that the borrower may have. Mortgage loan approval is necessary in order to get a mortgage loan.

The mortgage loan approval process can take anywhere from a few days to a few weeks. Once the lender has all of the information that they need, they will typically give the borrower a preliminary decision within a few days. The final decision on the loan may take longer, depending on the complexity of the loan and the lender’s own internal process.

Mortgage loan closing

The mortgage loan closing process varies from one lender to the next, but there are certain common steps that must be followed by all lenders. The closing is the final step in the process of obtaining a mortgage loan. It can take anywhere from a few days to a few weeks to complete.

The first step in the closing process is for the lender to provide the borrower with a Good Faith Estimate (GFE). This document lists all of the fees and charges that are associated with the loan, as well as the interest rate and monthly payment. The borrower should review this document carefully to make sure that they understand all of the fees and charges.

Next, the borrower will need to sign a loan application and other paperwork agreeing to the terms of the loan. This includes a Promissory Note, which is a legal document stating that the borrower agrees to repay the loan according to the terms laid out in the note. Once all of the paperwork has been signed, it will be sent to the lender for final approval.

Once approved, a date will be set for closing. On this date, all parties involved in the transaction will meet at a mutually agreed upon location to sign final documents and exchange funds. The borrower will usually need to bring a cashier’s check or wire transfer for their down payment and closing costs on this date.

After all of the paperwork has been signed and all funds have been exchanged, ownership of the property will be transferred from seller to buyer. The borrower will now be responsible for making monthly payments on their new mortgage loan.

Factors That Affect the Timeline

Once you have a firm offer from the lender, the next step is to schedule the closing date. But exactly how long does it take to close on a house? The answer depends on a number of factors, from the type of loan you’re using to the time of year you’re buying. In this article, we’ll go over the different factors that can affect the timeline of your loan approval and closing.

The type of loan

The type of loan you choose will play a role in how long it takes to close. For example, a conventional loan will take anywhere from a few weeks to a few months, while an FHA loan can take up to 60 days. The type of loan you choose will also affect the interest rate you pay and the size of your down payment.

The type of property

The type of property you’re buying also influences the timeline. A single-family home is usually a easier to finance than a multifamily property, so it may close more quickly. On the other hand, a commercial property or land purchase requires specialized underwriting and may take longer to finance.

The borrower’s credit score

One important factor that affects the timeline of a loan approval is the borrower’s credit score. Lenders will typically pull the borrower’s credit score during the pre-approval process and then again right before closing. A low credit score could prolong the approval process because the lender may need to take time to review the borrower’s credit history in more detail. On the other hand, a high credit score may speed up the process because it signals to the lender that the borrower is a low-risk candidate.

Other factors that can affect how long it takes to get approved for a loan include:

-The type of loan being applied for

-The property being purchased (e.g., a home vs. an investment property)

-The down payment amount

-The lender’s internal processes

The Mortgage Loan Closing Process

The loan closing is the final step in the mortgage loan process. After the loan agreement is signed, the loan closing typically happens within 30 days. The loan closing is when the home buyer officially becomes the home owner. The closing process includes a few important steps, such as signing the mortgage loan paperwork and paying any closing costs.

The loan application

The loan application is the first step in the mortgage loan closing process. The loan application is a contract between the borrower and the lender. This contract will set forth the terms of the loan, including the interest rate, the term of the loan, and any other important information. The loan application will also set forth the borrower’s financial information, including income, debts, and assets.

The loan application is followed by a period of time called “loan processing.” Loan processing is when the lender reviews the loan application and verifies all of the information that was provided by the borrower. The lender will also order a credit report and an appraisal during this time.

Once loan processing is complete, the lender will make a decision on whether or not to approve the loan. If the loan is approved, the closing process can begin. If the loan is not approved, the borrower will be notified and given a chance to fix any issues that were found during processing.

The closing process can take anywhere from a few days to a few weeks. During this time, both parties will sign documents and complete any final steps necessary to fund the loan. Once everything is complete, both parties will receive copies of all signed documents and the funds will be transferred tothe borrower.

The loan approval process

The loan approval process is the set of steps that lenders take to determine whether a borrower meets their requirements for a loan. These steps can vary from lender to lender, but they typically include obtaining a credit report, verifying employment and income, and assessing the borrower’s debt-to-income ratio.

Once a lender has approved a borrower for a loan, the loan closing process can begin. The closing is the final step in the mortgage process, and it can take place anywhere from two weeks to two months after the loan has been approved. The length of time it takes to close a loan depends on a number of factors, including the type of loan, the lender’s processes and procedures, and the parties involved in the transaction.

For example, closing on a mortgage loan usually takes longer than closing on a car loan because there are more steps involved in getting a mortgage approved and closed. Additionally, loans that are sold on the secondary market (such as Fannie Mae and Freddie Mac loans) typically take longer to close than loans that are held by the lender (such as portfolio loans).

The parties involved in the transaction can also affect how long it takes to close a loan. For example, if the borrower is working with a real estate agent who is not familiar with the lending process, it may take longer to close the loan than if the borrower were working with an experienced agent. Similarly, if there is an issue with the property that is being financed (such as title issues), it may take longer to resolve those issues and close the loan.

In general, most loans will take anywhere from 30 days to 45 days to close. However, there are some loans that can close in as little as 14 days, and there are some that can take 60 days or more. The best way to find out how long your particular loan will take to close is to ask your lender.

The loan closing process

The loan closing process is when your loan becomes final and you get the keys to your new home. The process can take anywhere from a few weeks to a few months, depending on various factors such as the type of loan you’re using, the lender you’re working with, and more.

Here’s a general overview of what you can expect during the loan closing process:

You (the buyer) and the seller will sign a contract stating that you agree to purchase the home for a certain price.

The escrow company will then open escrow, which is when they begin collecting all the money and paperwork needed to close on the home. This includes things like inspections, appraisals, title searches, and more.

Once everything is in order, you (the buyer) will sign loan documents at the title company or escrow office. The seller will also sign some documents and hand over the keys to the home.

At this point, the deal is officially closed and you are now the proud owner of a new home!