What is a Conforming Fixed Loan?

Contents

A conforming loan is a mortgage that is equal to or less than the dollar amount limit set by the Federal Housing Finance Agency (FHFA).

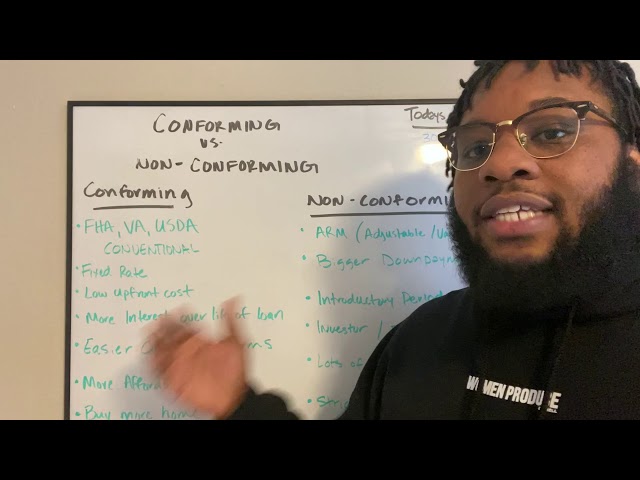

Checkout this video:

Introduction

A conforming fixed loan is a mortgage loan that conforms to the guidelines set forth by the Federal National Mortgage Association (FNMA, or Fannie Mae) and the Federal Home Loan Mortgage Corporation (FHLMC, or Freddie Mac). These two government-sponsored enterprises purchase most of the home loans originated in the United States. A conforming fixed loan meets certain criteria set by Fannie Mae and Freddie Mac and therefore may be sold to either or both of these organizations.

What is a Conforming Fixed Loan?

A conforming fixed loan is a mortgage in which the monthly payments will stay the same throughout the life of the loan, and the loan amount falls within the guidelines set by Freddie Mac and Fannie Mae. These two government-sponsored enterprises purchase loans that conform to their guidelines in order to securitize them and sell them to investors. A conforming loan is one that meets or “conforms” to these guidelines. The main guidelines for these loans are as follows:

-Loan amount: Freddie Mac and Fannie Mae only purchase loans that are below a certain amount, which varies by county. In most counties, this limit is $453,100 for a single-family home.

-Loan type: Both Freddie Mac and Fannie Mae only purchase certain types of loans, such as conventional fixed-rate mortgages and adjustable-rate mortgages.

-Occupancy: The property must be owner-occupied, meaning that it cannot be investment property or a second home.

-Debt-to-income ratio: Your monthly debt payments (including your mortgage payment) cannot exceed a certain percentage of your gross monthly income. For Freddie Mac loans, this limit is 45%; for Fannie Mae loans, it’s 50%.

If your loan meets all of these criteria, it is considered a conforming loan and can be securitized by Freddie Mac or Fannie Mae. If it doesn’t meet one or more of these criteria, then it is considered a non-conforming loan and cannot be securitized. Non-conforming loans typically have higher interest rates than conforming loans because they are more risky for lenders.

The Benefits of a Conforming Fixed Loan

A conforming fixed loan is a mortgage for which the interest rate will stay the same over the life of the loan. This type of mortgage is typically available for terms of 15 or 30 years, but in some cases, 40-year terms are also available. The main advantage of a conforming fixed loan is that the interest rate will not change over the life of the loan, so your monthly payments will always be predictable.

Another advantage of a conforming fixed loan is that they are typically available with lower interest rates than other types of loans, such as adjustable-rate mortgages (ARMs). This can save you a significant amount of money over the life of the loan. In addition, because your payments will always be the same, you can budget more easily and have greater peace of mind knowing that your payment will never increase.

If you are considering a conforming fixed loan, be sure to compare offers from multiple lenders to get the best interest rate possible.

How to Qualify for a Conforming Fixed Loan

A conforming fixed loan is a mortgage loan that meets the standards set by the Federal National Mortgage Association (FNMA or Fannie Mae) and the Federal Home Loan Mortgage Corporation (FHLMC or Freddie Mac).

In order to qualify for a conforming fixed loan, you must have a credit score of at least 620 and a debt-to-income ratio of no more than 50%. You will also need to provide documentation of your income and assets, as well as an appraisal of the property you plan to purchase.

Conclusion

A conforming loan is a mortgage loan that meets all the requirements to be eligible for purchase by investors such as Fannie Mae and Freddie Mac. Conforming loans follow the guidelines set by these two government-sponsored enterprises and therefore must meet certain criteria, such as credit score, loan amount, and type of property. For example, a typical conforming loan would have a credit score requirement of at least 620 and a maximum loan amount of $5 million.