How to Get Something Off Your Credit Report

Contents

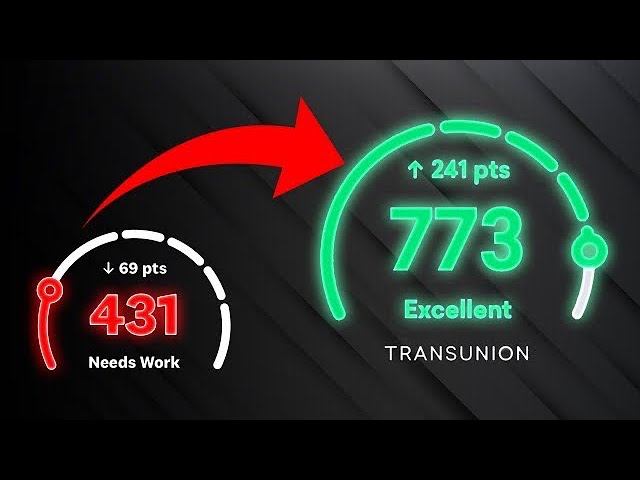

You may have seen ads for credit repair services that promise to help you get negative items off your credit reports.

But do these services really work? Are they worth the money?

In this blog post, we’ll explore these questions and give you the information you need to make an informed decision about credit repair.

Checkout this video:

The credit reporting process

You can get something off your credit report by contacting the credit bureau and dispute the error. You will need to provide documentation to support your claim. The credit bureau will investigate the dispute and remove the error if they find that it is inaccurate.

How credit reporting works

The credit reporting process is important to understand because it is the foundation that your credit score is based on. A credit report is a record of your credit history that includes information about each time you have applied for and used credit. Credit reporting agencies, also called credit bureaus, collect this information and use it to create a credit report.

Lenders then use your credit report and score to help them decide whether or not to give you a loan and at what interest rate. landlords, Employers, and utility companies may also use your credit report to decide whether or not to give you services.

It’s important to know that you have the right to get a free copy of your credit report from each of the three major credit bureaus every 12 months. You can request your reports all at once or space them out throughout the year. You can also get your reports more often if you’re working on repairing your credit.

The different types of credit reports

There are four major types of credit reports:

-TransUnion

-Experian

-Equifax

-Innovis

These reports are maintained by the three main credit bureaus and are used to determine your creditworthiness. Each report contains information on your credit history, such as your payment history, outstanding balances, and any derogatory items that may be affecting your score.

How to get something off your credit report

There are a few ways to get something off your credit report. You can dispute the item with the credit bureau, you can negotiate with the creditor, or you can wait it out.

How to dispute an error on your credit report

If you find an error on your credit report, you can dispute it. This means that you’re asking the credit bureau to investigate and fix the error.

You can do this by writing a letter to the credit bureau. In your letter, you should include:

-Your name, address, and phone number

-A copy of your credit report with the error circled

-An explanation of why you believe the information is wrong

-Documents that support your claims (for example, a copy of a bill that shows the correct account information)

You should send this letter by certified mail so that you have proof that it was sent and received. The credit bureau has 30 days to investigate and fix the error.

How to remove a late payment from your credit report

If you have a late payment on your credit report, you’re not alone. According to a report from Experian, one of the major credit bureaus, 26.8% of Americans had at least one late payment on their credit report in 2019

There are a few things you can do to try to remove a late payment from your credit report.

First, you can contact the creditor and ask them to remove the late payment. This is called a goodwill adjustment.

You can also send a dispute letter to the credit bureau asking them to remove the late payment.

If you haveProof that the late payment is inaccurate, you can also send a copy of this proof to the credit bureau.

Finally, you can try to negotiate with the creditor to have the late payment removed in exchange for making future payments on time.

How to remove a collections account from your credit report

There are a few ways to remove a collections account from your credit report. The first is to negotiate with the collection agency and have them agree to delete the collections account from your credit report in exchange for payment. This is called a pay for delete agreement.

The second way to remove a collections account from your credit report is to wait it out. Collections accounts will remain on your credit report for 7 years from the date of the original delinquency. After that, the collections account will be automatically removed from your credit report.

The third way to remove a collections account from your credit report is to dispute it. If you dispute the debt with the collection agency, they will have 30 days to respond with proof that the debt is valid. If they cannot provide proof that the debt is valid, then the collections account will be removed from your credit report.

The impact of removing something from your credit report

How removing an error can improve your credit score

An error on your credit report can have a negative impact on your credit score, but removing it can help improve your score.

When you remove an error from your credit report, your credit score will likely improve. This is because errors can lowered your credit score and by removing them, your score will no longer be lowered.

If you have an error on your credit report, you should contact the company that made the error and ask them to remove it. You should also contact the three major credit reporting agencies (Equifax, Experian, and TransUnion) and ask them to remove the error from your report.

Errors on your credit report can be damaging to your credit score, but you can improve your score by removing them. If you have an error on your credit report, you should contact the company that made the error and ask them to remove it as well as the three major credit reporting agencies.

How removing a late payment can improve your credit score

If you have a late payment on your credit report, you might be wondering how to get it removed. While you can’t remove a late payment directly from your report, there are a few things you can do to help improve your credit score and eventually have the late payment removed from your credit history.

Late payments can stay on your credit report for up to seven years, and each late payment will have a negative effect on your credit score. The best way to improve your credit score is by making all of your payments on time, but if you do have a late payment, there are a few things you can do to help improve your score.

One thing you can do is contact the creditor and ask them to remove the late payment from your account. This is called a “goodwill adjustment.” If the creditor agrees to remove the late payment, it will be removed from your credit report and your score will improve.

Another option is to negotiate with the creditor to have the late payment removed in exchange for bringing your account current. This is called a “pay for delete” agreement. Keep in mind that this won’t work if you’re already behind on payments or if the creditor doesn’t agree to the arrangement.

If you have a late payment on your credit report, there are a few things you can do to try to improve your credit score. You can contact the creditor and ask for a goodwill adjustment or try to negotiate a pay for delete agreement.

How removing a collections account can improve your credit score

If you have a collections account on your credit report, it could be having a negative impact on your credit score. While the account itself will remain on your report for seven years, removing it could still give your score a boost.

When you have a collections account, it means that you have failed to pay a bill and the lender has turned the debt over to a collection agency. This is a serious mark on your credit history and can stay on your report for up to seven years.

However, just because the collections account will remain on your report for seven years does not mean that it will have the same negative impact on your score for the entire seven years. In fact, as time goes on, the impact of the collections account will lessen.

One of the biggest factors in credit scoring is how recently you have missed a payment. So, even though the collections account will remain on your report for seven years, its impact will lessen over time. After five years, the collections account will have much less of an impact on your credit score than it did when it was first reported.

Additionally, as you take steps to improve your credit (by paying down debts and making all future payments on time), the impact of the collections account will diminish further. So, even though removing a collections account from your credit report isn’t easy, it can still be beneficial to do so if you’re trying to improve your credit score.