What is a Cash Advance Credit Line?

Contents

A cash advance credit line is a type of loan that allows you to borrow money against your credit limit. This can be a helpful way to get emergency cash, but it’s important to understand the terms and conditions of your loan before you apply.

Checkout this video:

What is a cash advance credit line?

A cash advance credit line is a type of short-term loan that can give you quick access to cash when you need it. Unlike a traditional loan, a cash advance credit line is not based on your credit history or income. Instead, it is based on your credit card limit.

If you have a good credit history and income, you may be able to get a cash advance credit line with a lower interest rate than a traditional loan. However, if you have bad credit or no income, you may be charged a higher interest rate.

A cash advance credit line can be used for any purpose, including emergency expenses, travel, and home repairs. However, it is important to remember that a cash advance credit line is not free money. You will need to repay the loan plus interest and fees.

How does a cash advance credit line work?

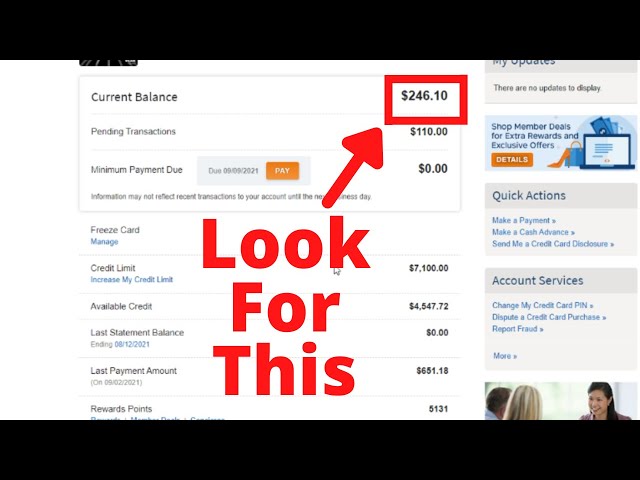

A cash advance credit line is an arrangement between a financial institution and a customer that allows the customer to withdraw cash up to a certain limit. The limit is usually set at a percentage of the customer’s total credit line. For example, if a customer has a credit line of $1000 and a cash advance limit of 10%, the customer can withdraw up to $100 in cash.

There are two types of cash advance credit lines: secured and unsecured. A secured cash advance credit line is backed by collateral, such as a savings account or a piece of property. An unsecured cash advance credit line is not backed by collateral and is therefore riskier for the financial institution.

Customers can typically use their cash advance credit lines by writing checks or using debit cards at ATMs. Some financial institutions may also allow customers to make purchases with their credit lines, but this is less common.

Interest rates on cash advances are typically higher than those on regular credit lines because they are considered to be high-risk loans. Financial institutions may also charge fees for using cash advance credit lines, such as annual fees, transaction fees, and balance transfer fees.

What are the benefits of a cash advance credit line?

A cash advance credit line is a type of credit that allows you to withdraw cash up to a certain limit. This limit is typically a percentage of your credit limit. Cash advances usually come with higher interest rates than purchases or balance transfers, so it’s important to understand the terms of your cash advance before taking one out.

There are several benefits of cash advances, including:

-Convenient access to cash: With a cash advance, you can get the cash you need quickly and easily. This can be helpful in emergency situations or when you need to make a large purchase.

-No need for collateral: With a cash advance, you don’t need to put up any collateral, such as your home or car. This makes it a much less risky form of borrowing than other types of loans.

-Flexible repayment terms: With a cash advance, you can typically choose how long you have to repay the loan. This can be helpful if you need time to save up for the repayment amount.

What are the drawbacks of a cash advance credit line?

There are a few potential drawbacks to using a cash advance credit line. First, the fees and interest rates associated with cash advances are generally much higher than for regular credit card purchases. This can make it expensive to use a cash advance credit line, so you’ll want to be sure you can afford the fees before using this type of credit.

Another potential drawback is that cash advance credit lines can reduce your overall credit limit. This can be a problem if you have a high balance on your credit card and need to maintain a low debt-to-credit ratio to keep your score high. Finally, some creditors may view frequent use of a cash advance credit line as a sign that you’re in financial distress, which could lead to reduced access to credit in the future.

How can I get a cash advance credit line?

A cash advance credit line is an amount of money that a bank or lending institution will lend to a customer based on the value of the customer’s assets. The credit line can be used by the customer to withdraw cash, make purchases, or pay bills. In order to qualify for a cash advance credit line, the customer must have a certain amount of equity in their asset portfolio.