What Credit Bureau Does Navy Federal Use?

Contents

Navy Federal Credit Union uses all three major credit bureaus – Experian, Equifax, and TransUnion – to help them make lending decisions. So if you’re wondering “What credit bureau does Navy Federal use?”, the answer is all of them!

Checkout this video:

What is a Credit Bureau?

A credit bureau is a financial institution that collects credit information about individuals and companies in order to generate credit reports. Credit bureaus use this information to help lenders assess the creditworthiness of potential borrowers.

There are three major credit bureaus in the United States: Experian, Equifax, and TransUnion. Navy Federal Credit Union uses all three of these bureaus in order to get a complete picture of an applicant’s credit history.

When you apply for a loan with Navy Federal, the credit union will pull your credit report from one or more of the above-mentioned bureaus. They will then use this information to help them make a decision about your loan application.

If you have any questions about your credit report or what credit bureau Navy Federal uses, feel free to contact the credit union directly.

Navy Federal Credit Union is the world’s largest credit union with over 8 million members, $91 billion in assets, 323 branches, and a workforce of over 17,000 employees. Navy Federal is headquartered in Vienna, Virginia and has branches located throughout the United States.

Navy Federal Credit Union uses all three credit bureaus – TransUnion, Equifax, and Experian – to help make lending decisions. This is good news for members, as it gives you a better chance of being approved for a loan.

Experian

Navy Federal uses Experian as its primary credit bureau, but it also considers your credit reports from the other two bureaus, TransUnion and Equifax. This is called a tri-merge credit report. Your score from each bureau is averaged to come up with your final score.

Equifax

Navy Federal Credit Union uses Equifax for credit reporting. This means that if you have an account with Navy Federal, any activity on that account will be reported to Equifax. This is important to know because your credit score is based on the information in your credit report.

TransUnion

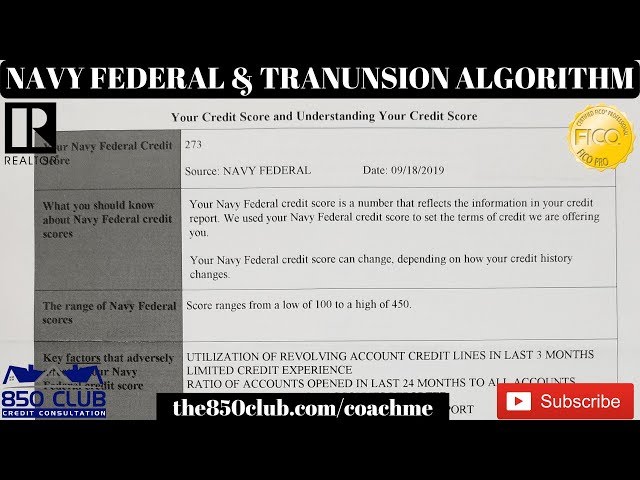

Navy Federal Credit Union uses TransUnion for credit reporting. TransUnion is one of the three major credit bureaus.

How to Get Your Free Credit Report

If you have applied for a loan or credit card with Navy Federal Credit Union and been denied, you might be wondering why. One potential reason could be your credit score. Luckily, you can get a free copy of your credit report from each of the three major credit bureaus — Experian, Equifax and TransUnion — once a year.

To get your free Experian report, go to www.experian.com/fcr and enter your name, address, Social Security number and date of birth. For your free Equifax report, go to www.equifax.com/fcn and enter the same information. To get your free TransUnion report, go to www.transunion.com/crm and enter your personal information plus an additional piece of information about yourself, such as your driver’s license number or the last four digits of your Social Security number.

Once you have your credit reports in hand, take a close look at them to see if there are any errors that could be dragging down your score. If you find any incorrect information, dispute it with the credit bureau using their online tools. Once the error is corrected, your score should go up!

How to Dispute an Error on Your Credit Report

If you find an error on your credit report, you can dispute it with the credit bureau. The credit bureau will then investigate and remove the error if they find that it is indeed inaccurate.

How to Improve Your Credit Score

Navy Federal Credit Union uses TransUnion to pull your credit report and score when you apply for a loan or credit card. That’s why, if you’re hoping to get approved for a Navy Federal loan or credit card, it’s important to check your TransUnion credit report and score beforehand so you know where you stand.

There are a few things you can do to improve your TransUnion credit score, including:

-Checking your credit report for errors and dispute any that you find

-Paying all of your bills on time

-Keeping your credit balances low

-Only applying for new credit when necessary

By following these steps, you can help improve your chances of getting approved for a Navy Federal loan or credit card.