What is a Consumer Credit Report?

Contents

A consumer credit report is a record of an individual’s credit history. It includes information about credit accounts, loans, and any bankruptcies or foreclosures.

Checkout this video:

Introduction

A consumer credit report is a record of your credit history. It includes information about your borrowing and repayment habits, as well as any bankruptcies, foreclosures, or other financial difficulties you may have had.

Lenders use this information to determine whether you’re a good candidate for a loan, and if so, what interest rate they should offer you. Insurance companies may also use your credit report to help set your premiums.

You’re entitled to a free copy of your credit report from each of the three major credit reporting agencies once every 12 months. You can request yours at AnnualCreditReport.com.

What is a Consumer Credit Report?

A consumer credit report is a report that includes information on where you live, how you pay your bills, and whether you have been sued or arrested, or have filed for bankruptcy. Lenders use this information to decide whether to give you credit, how much interest to charge you, and whether to require a co-signer.

You have the right to get a free copy of your consumer credit report from each of the three national credit reporting agencies every 12 months. To get your free annual report, visit www.annualcreditreport.com or call 1-877-322-8228. You will need to provide your name, address, social security number, and date of birth to verify your identity.

How to Get a Free Credit Report

You’re entitled to a free credit report if a company takes “adverse action” against you, like denying your application for credit, insurance, or employment. You have to ask for your report within 60 days of receiving notice of the action. The notice includes the name, address, and phone number of the consumer reporting company. You’re also entitled to one free report a year if you’re unemployed and plan to look for a job within 60 days; if you’re on welfare; or if your report is inaccurate because of fraud, including identity theft.

Otherwise, a consumer reporting company may charge you up to $12.00 for another copy of your report within a 12-month period.

There are three different major credit reporting agencies — the Experian credit bureau, TransUnion® and Equifax® — that maintain a record of your credit history known as your credit report. Your FICO® Score is based on information in your credit report at the time it is requested.

How to Read a Credit Report

Most people know that a credit report is important, but few actually understand what it is. A credit report is a snapshot of your financial history, and it is one of the most important factors in determining whether or not you will be approved for a loan. Here is a guide to help you understand how to read a credit report.

A credit report is made up of four sections: personal information, accounts, inquiries, and public records.

The personal information section includes your name, address, Social Security number, and date of birth. This section also includes any aliases or previous addresses that you have used.

The accounts section lists all of the loans or lines of credit that you have ever had. It includes the date of the loan, the type of loan, the balance, the monthly payment amount, and the status of the account (open or closed).

The inquiries section lists all of the companies that have requested your credit report in the past two years. Inquiries stay on your credit report for two years and can be divided into two categories: hard inquiries and soft inquiries. Hard inquiries are made when you apply for a loan or line of credit and are used to determine your eligibility. Soft inquiries are made when companies check your credit for non-lending purposes such as job applications or background checks. Inquiries have a small impact on your credit score and are only penalized if there are multiple inquiries within a short period of time.

The public records section lists any negative information about you that has been reported to the credit bureau, such as bankruptcies, foreclosures, or tax liens. This information can stay on your credit report for up to seven years and can have a significant impact on your ability to get new lines of credit.

When you are looking at your credit report, you should check all three sections carefully to make sure that all of the information is accurate. If you see anything that looks incorrect, you should dispute it with the appropriate bureau.

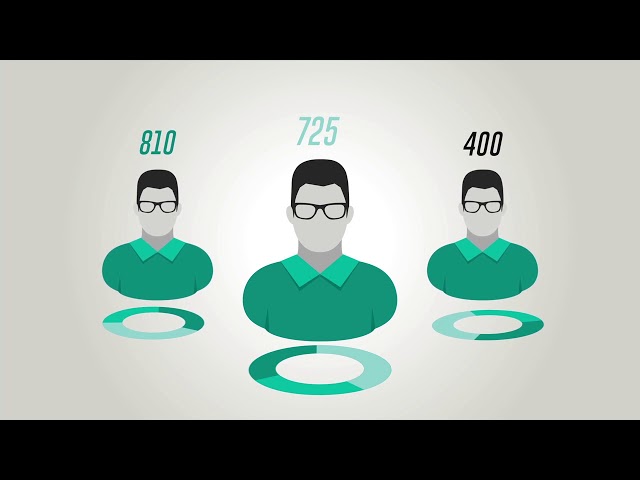

What is a Credit Score?

A credit score is a number that reflects the information in your credit report at a given point in time. Lenders use your credit score to help them decide whether or not to give you a loan, and if so, how much interest to charge you. The higher your score, the lower the risk you pose to a lender, and the better your chances of getting approved for a loan with favorable terms.

How to Improve Your Credit Score

There are a number of things you can do to improve your credit score. Some methods are more effective than others, and some will take longer to see results. Here are a few of the best ways to improve your credit score:

Pay Your Bills on Time: Payment history is one of the most important factors in your credit score. If you always pay your bills on time, you will see a gradual improvement in your score over time.

Reduce Your Debt: Another important factor in your credit score is the amount of debt you have relative to your credit limit. If you can reduce your debt, you will see an immediate improvement in your credit score.

Keep Your Credit Utilization Low: Credit utilization is the amount of debt you have relative to your available credit. It’s a good idea to keep your utilization below 30%, but the lower it is, the better it is for your score.

Correct Any Errors on Your Credit Report: If there are any errors on your credit report, they could be dragging down your score. You can request a free copy of your credit report from each of the three major credit bureaus once per year, and dispute any errors you find.

Conclusion

Your credit report is an important tool that lenders use to determine your creditworthiness. It is important to understand what is included in your report and how it is used in order to make the best financial decisions for your future.