How Long Do Credit Checks Take?

Credit checks are an important part of the loan approval process, but they can also be a bit of a mystery. How long do they take? What do lenders look for? We’ve got the answers to all your credit check questions.

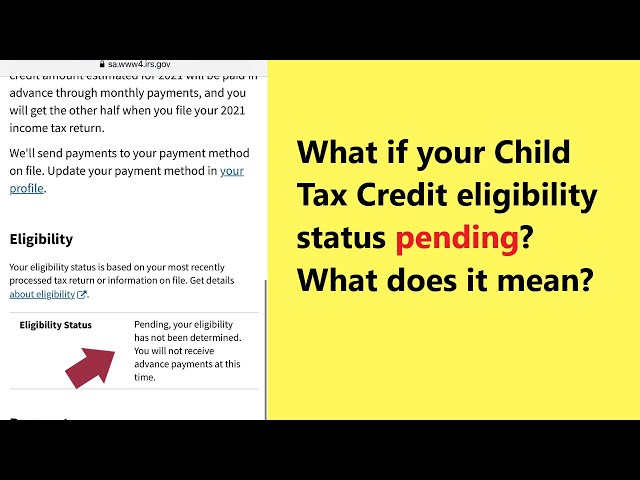

Checkout this video:

Hard Inquiries

A hard inquiry is when a lender checks your credit when you apply for a loan or credit card. This type of inquiry can stay on your credit report for up to two years, but it only counts towards your credit score for the first twelve months. Hard inquiries can have a minor impact on your credit score, but they are generally not a cause for concern.

What is a hard inquiry?

When you apply for credit, the lender will check your credit report. This is called a hard inquiry, and it can temporarily ding your score.

A hard inquiry appears on your credit report when you apply for a new line of credit and is used to help lenders determine whether or not to approve your application.

Hard inquiries stay on your report for two years but only impact your score for the first year.

If you’re shopping around for a loan or credit card, it’s a good idea to do all of your rate shopping within a 14-day period. That way, multiple inquiries will only count as one on your credit report.

How long do hard inquiries stay on your credit report?

Hard inquiries will stay on your credit report for 24 months, but only impact your credit score for the first 12 months. After that, you can take steps to remove hard inquiries from your credit report.

How many hard inquiries is too many?

A hard inquiry is when a lender checks your credit report because you’ve applied for a loan or credit card. Hard inquiries can stay on your credit report for up to two years, but they typically only affect your score for one year. That’s because as time goes on, they matter less and less.

Generally, having more than two hard inquiries in a 12-month period will ding your score. The impact of hard inquiries is usually greatest when you have several in a short period of time. This can happen if you apply for several loans or credit cards in quick succession.

While multiple hard inquiries can hurt your score, they won’t have a long-term impact if you manage your credit responsibly in the months and years after you apply for credit. So, if you need to apply for a loan or credit card, don’t be discouraged by the idea of having a hard inquiry on your report.

Soft Inquiries

What is a soft inquiry?

A soft inquiry is a type of credit check that does not have a negative impact on your credit score. Soft inquiries are generated when you or someone else checks your credit report for non-lending purposes, such as when you check your own report, when an employer checks your report in connection with a job application, or when a business checks your report in connection with a possible business relationship.

How long do soft inquiries stay on your credit report?

A soft inquiry is a type of credit check that does not impact your credit score or show up on your credit report. Soft inquiries can occur when you check your own credit, when a business checks your credit as part of a background check, or when a business checks your credit in order to pre-approve you for a financial product.

Soft inquiries do not have any impact on your credit score and are only visible to you. They will stay on your report for up to two years, but they will only be visible to you and businesses that pull your report.

How many soft inquiries is too many?

As a credit-holder, you have the power to directly impact your credit score. Therefore, it’s in your best interest to understand how different activities – both good and bad – will affect your credit.

One type of activity that you might not give much thought to are soft inquiries. A soft inquiry is when a company checks your credit report for reasons other than extending you new credit – like when you’re applying for a new job or apartment. Because soft inquiries don’t usually result in new debt, they generally have no negative effect on your credit score.

While most people know that hard inquiries can ding their credit score, not as many know that there is such a thing as too many soft inquiries. Having too many soft inquiries in a short period of time can be a red flag for lenders and creditors, signaling that you might be in financial distress. So how many is too many?

As with most things related to credit, there is no hard and fast rule. However, if you have more than six soft inquiries in a six-month period, that could start to look suspicious to creditors. And if you have more than two hard inquiries in the same time frame, that could also negatively impact your score.

Of course, the best way to avoid having too many inquiry hits on your report is to only apply for new credit when you really need it. That way, you can minimize the number of hard inquiries – which can actually lower your score – and focus on building up positive activity elsewhere.

The Bottom Line

How long does it take for a credit check to show up on your report?

Credit checks conducted by lenders usually take less than a week to appear on your credit report. If you’re applying for a mortgage, auto loan, or another type of credit, the lender will likely order a “hard” inquiry, which will show up on your report and may temporarily lower your score.

How can you avoid having too many inquiries on your report?

The number of inquiries on your credit report is just one factor that makes up your credit score, and too many can lead to a lower score. There are a few things you can do to minimize the impact inquiries have on your credit score:

-Shop around for loans within a short period of time. FICO® scoring treats multiple inquiries in a short period of time as a single inquiry if they’re made for the same type of loan.

-Limit the number of inquiries by only applying for new credit when you need it.

-If you’re rate shopping for an auto loan, mortgage or student loan within a 30-day period, the FICO® Score will count all those inquiries as just one inquiry.