How Long Credit Inquiries Stay on Your Report

Contents

Credit inquiries stay on your report for two years. But, they only impact your score for the first year. After that, they fall off.

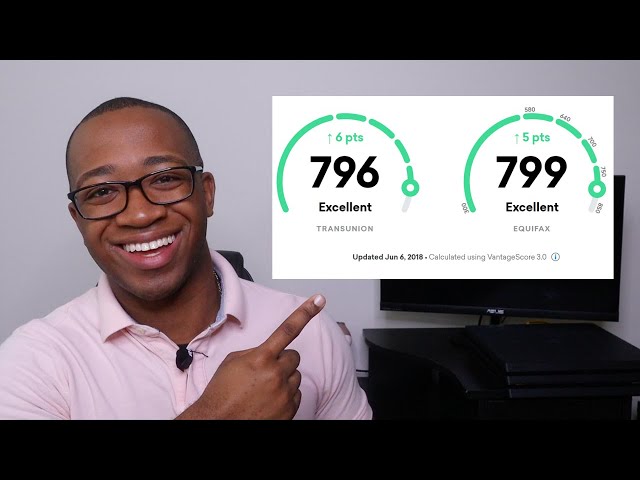

Checkout this video:

How Long Do Inquiries Stay on Your Report?

Inquiries stay on your credit report for two years. However, hard inquiries only affect your credit score for the first year. After that, they’ll have no impact on your credit score.

How Do Inquiries Affect Your Score?

Most credit scoring models will factor in credit inquiries when calculating your score. The impact of inquiries on your score will depend on the scoring model being used, as well as a number of other factors.

In general, inquiries can have a small negative impact on your credit score. For most people, one or two inquiries will not have a significant impact. However, if you have a short credit history or a history of bad credit, inquiries can have a larger impact.

How Long Inquiries Stay On Your Report

Inquiries stay on your report for two years. However, they only affect your score for the first year. After that, they are simply ignored by most scoring models.

There are two types of inquiries: hard and soft. Hard inquiries are generated when you apply for new credit. Soft inquiries are generated when you check your own credit or when companies check your credit for pre-approved offers of credit. Only hard inquiries have an impact on your score.

How Can You Remove Inquiries From Your Report?

If you find an inquiry on your credit report that you don’t recognize, it could be the result of identity theft. In that case, you should file a police report and a fraud alert with the credit bureaus. You can also dispute the inquiry with the credit bureau that issued it.

If the inquiry is legitimate, there are a few things you can do to try to remove it from your report.

First, you can request that the creditor delete the inquiry from your report. This is called a “goodwill adjustment.” Creditors are not required to do this, but some may be willing to remove the inquiry if you have a good history with them and you explain why the inquiry is inaccurate or unjustified.

You can also try to get the inquiry removed by disputing it with the credit bureau that issued it. The credit bureau will then investigate your claim and remove the inquiry if it finds that it is inaccurate or unjustified.

If neither of these methods works, you can also wait for the inquiries to fall off your report naturally after two years.

How To Avoid Inquiries In The First Place

Inquiries are classified as hard if they are for new credit. Hard inquiries have the potential to lower your credit score.

A hard inquiry is generated when you apply for a new line of credit, such as a credit card, car loan, or mortgage. Inquiries are also generated when companies review your credit report for pre-screened offers of credit or insurance.

Inquiries stay on your report for two years and can hurt your score for up to one year. So if you’re going to apply for a lot of new credit in the near future, you may want to avoid doing so right before applying for something major like a mortgage.

You can avoid inquiries in the first place by only applying for new credit when you really need it. You can also opt out of pre-screened offers of credit by calling 1-888-5OPTOUT (1-888-567-8688).