How to Apply for a Business Credit Card

Contents

If you’re a small business owner, you know that having a business credit card can be a big help in managing your finances and growing your business. But how do you go about applying for a business credit card?

In this blog post, we’ll walk you through the process of applying for a business credit card, from choosing the right card for your business to filling out the application. We’ll also give you some tips on how to improve your chances of getting approved.

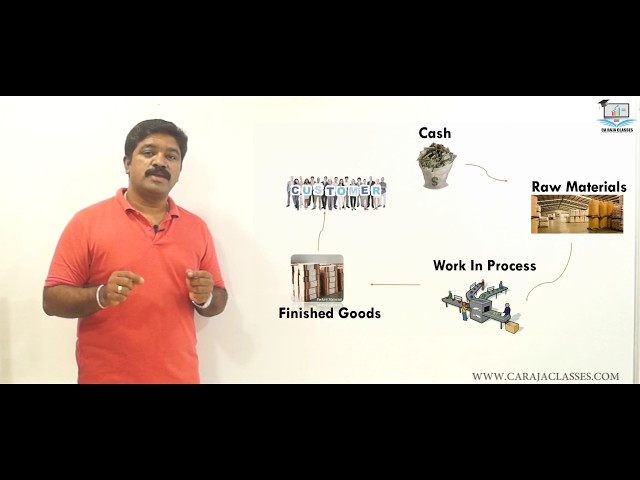

Checkout this video:

Research the best business credit card for your needs

The best business credit card is the one that meets your specific business needs. When researching business credit cards, start by looking at the features and benefits that are most important to you and your business. Then, compare those features and benefits to the offers available to find the best fit for your company.

Here are some features and benefits to consider when researching business credit cards:

-Low interest rates: Look for a card with a low APR (annual percentage rate) so you can save on interest charges when carrying a balance.

-Generous rewards: Some business credit cards offer generous rewards programs, such as cash back or points that can be redeemed for travel or merchandise. If saving money is a priority for your business, look for a card that offers generous rewards.

-No annual fee: Many business credit cards come with an annual fee, which can range from $50 to $500 or more. If avoiding an annual fee is important to you, look for a card that doesn’t have one.

-0% intro APR period: Some business credit cards offer 0% intro APR periods, which can help you save on interest charges when you’re making a large purchase or need to carry a balance for a few months. Just be sure to pay off your balance before the intro period ends, or you’ll be charged interest at the regular APR.

Gather the required information

To apply for a business credit card, you’ll need to provide some basic information about your business, including your tax identification number and annual revenue. You’ll also need to indicate whether you want a personal guarantee on the card. This means that you’ll be personally liable for any debt incurred on the card. Most issuers will also require a personal credit check as part of the application process.

If you’re not sure which card is right for your business, consider using a business credit card comparison tool to see what’s available. You can compare features like rewards programs, interest rates and fees to find the best fit for your needs.

Submit your application

In order to apply for a business credit card, you will need to fill out an application with your basic business information. This will include your business name, address, and contact information. You will also need to provide your Social Security number or taxpayer identification number, as well as your annual revenue and the average amount you spend per month on business expenses. Once you have gathered all of this information, you can begin filling out the online application.

Most business credit card applications will ask for your personal information first. This is so the lender can run a personal credit check on you and get an idea of your creditworthiness. They will also want to see your business information so they can determine if you are a high-risk applicant or not. After you have submitted your application, it is important to wait for a response from the lender before attempting to use your new credit card.

Wait for a decision

Wait for a decision

After you’ve applied for a business credit card, it can take a few days to hear back about your application. In the meantime, there are a few things you can do to prepare for your new card.

If you’re approved, you’ll receive a notice in the mail with information about your credit limit and any other important details. Once you have your card, be sure to activate it and start using it right away. You’ll need to make at least one purchase within the first few months in order to keep your account active.

If you’re not approved, don’t worry. There are plenty of other business credit cards out there, and you can always reapply at a later date. In the meantime, focus on building up your personal credit so that you’ll have a better chance of being approved next time around.

If approved, activate your card and start using it

If you’re approved for a business credit card, you’ll need to activate it before you can start using it. To do so, you’ll typically need to either call the issuer or go online to the account management portal.

After you activate your card, you can start using it for purchases. When making a purchase, you’ll need to provide your credit card number, expiration date and security code. You may also be asked to provide your name and billing address.