What Credit Bureau Does Capital One Use?

Contents

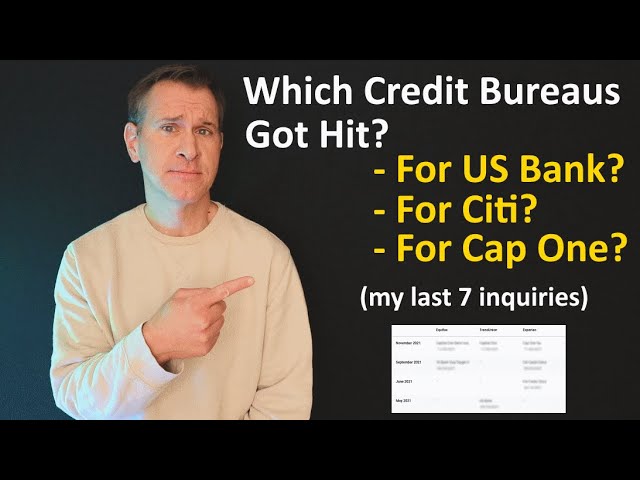

Capital One uses TransUnion and Equifax to pull credit reports. This is why you may see different scores from Capital One than from other lenders.

Checkout this video:

Capital One and the Three Credit Bureaus

Capital One and Experian

Capital One uses Experian as its primary credit bureau, but it also pulls information from Equifax and TransUnion. This is typical for most lenders.

When you apply for a Capital One credit card, the company will do a hard pull of your Experian credit report. Capital One will also likely pull your Equifax and TransUnion reports to get a complete picture of your credit history.

If you have strong credit, you may be approved for a Capital One card with a good interest rate and generous credit limit. If you have fair or poor credit, you may still be approved for a Capital One card, but it will probably have a higher interest rate and lower credit limit.

Capital One and Equifax

Capital One uses Equifax as its primary credit bureau, but it also uses Experian and TransUnion to a lesser extent. If you have good or excellent credit, you should have no problem getting approved for a Capital One credit card. However, if your credit is on the lower end, you may only be approved for a secured card with a deposit.

Capital One and TransUnion

Capital One uses TransUnion for all applications as of 2019. If you have a Capital One account, you can get your free credit report from Transunion by logging into your online account and going to the “manage my credit” section. If you don’t have an account with Capital One, you can still get your TransUnion report for free by going to their website.

How Credit Bureaus Affect Your Credit Score

Credit bureaus are responsible for recording and maintaining information about your credit history. This information is used to calculate your credit score, which is a key factor in determining your creditworthiness. Capital One uses the credit bureau Experian to help assess credit risk and make lending decisions.

Experian Boost

Experian Boost is a free service that allows you to immediately add positive payment history from utilities, phone bills and streaming services to your Experian credit report. This history can help boost your credit score, making it easier to qualify for loans and get lower interest rates.

To sign up for Experian Boost, you’ll need to provide some information about your current financial situation, including your monthly housing payment and any recurring debts you have. You’ll also need to provide access to your bank account so Experian can verify your payment history. Once you’ve signed up, Experian Boost will update your credit report with your positive payment history within days, giving you a boost to your credit score that could help you save money on future loan applications.

Equifax Credit Score

Your Equifax credit score is a numerical representation of your creditworthiness, and it’s one factor that lenders may consider when you’re applying for a loan or credit card.

Credit scores are calculated based on the information in your credit report, and they can range from 300 to 850. A higher score means you’re more likely to qualify for a loan with favorable terms, while a lower score could signal that you’re a higher-risk borrower.

The information in your Equifax credit report is compiled from your credit applications and other financial data sources. It includes details about your payment history, outstanding debt, and other factors that could affect your ability to repay a loan.

Your Equifax credit score is just one part of your overall credit picture, so it’s important to review your complete credit report periodically to check for errors or signs of identity theft. You can get a free copy of your Equifaxcredit report once every 12 months from AnnualCreditReport.com.

TransUnion Credit Score

Most people are familiar with the three major credit bureaus: Experian, Equifax, and TransUnion. These organizations collect information about your credit history and use it to generate your credit score. But what many people don’t realize is that there are actually dozens of other credit bureaus out there.

So, which credit bureau does Capital One use? The answer is all of them! Capital One pulls information from all of the major credit bureaus when they’re making a decision about your creditworthiness. That’s why it’s so important to make sure that all of your information is accurate across all of the different bureaus.

One way to do this is to check your credit report from each bureau at least once a year. You can get your annual report for free from AnnualCreditReport.com. Another way to keep an eye on your credit is to sign up for a credit monitoring service like Credit Karma. Credit Karma gives you free access to your TransUnion and Equifax credit scores, as well as your report, so you can quickly spot any errors or inaccuracies.

If you find any inaccuracies on your report, you should dispute them with the relevant bureau right away. By law, the bureau has 30 days to investigate your claim and correct any errors. And if they can’t verify the information, they have to remove it from your report altogether!

How to Get Your Free Credit Report

You’re entitled to one free copy of your credit report from each of the three nationwide credit bureaus every 12 months. Order online from annualcreditreport.com, the only authorized website for free credit reports, or call 1-877-322-8228. You will need to provide your name, address, social security number, and date of birth to verify your identity.

AnnualCreditReport.com

AnnualCreditReport.com is the only website authorized by the federal government to provide you with a free credit report. The Fair Credit Reporting Act (FCRA) guarantees you access to your credit report from each of the three nationwide credit reporting agencies — Equifax, Experian and TransUnion — every 12 months. These agencies are also required to provide you with a free report if you’ve been turned down for credit, employment or insurance within the past 60 days.

In addition to your annual free report, you can check your credit reports any time by ordering them from AnnualCreditReport.com or by contacting each of the three credit reporting agencies directly:

Equifax: 1-800-685-1111

Experian: 1-888-397-3742

TransUnion: 1-877-322-8228

CreditKarma.com

You are entitled to one free credit report from each of the three major credit bureaus—Experian, Equifax, and TransUnion—every twelve months. You can request a report from AnnualCreditReport.com, the only website authorized to provide reports from all three bureaus.

If you want to check your credit more often than once a year, you can do so by ordering a report from one or more of the credit bureaus directly. Each bureau has its own website and its own process for ordering a report. Be aware that some websites masquerade as official credit bureau websites but are really just commercial sites that will charge you a fee for a copy of your report.

The FTC has more information on how to get your free credit report.

CreditSesame.com

You can get your free credit report from CreditSesame.com. Just click on the “Get Your Free Credit Report” button and follow the instructions. You’ll need to provide some basic information, including your name, address, date of birth, and Social Security number. Once you’ve provided this information, you’ll be able to access your credit report.

How to Dispute an Error on Your Credit Report

Online

Visit the website of the credit bureau that issued the report in question. You can find links to all major credit bureaus on our website.

Click on the “ file a dispute ” or “ consumer support ” link.

Have your report and supporting documentation ready to upload. This might include a copy of your driver’s license, a voided check, or a bill from the creditor in question.

Enter your dispute online, making sure to include as much detailed information as possible. Be clear and concise in your explanation of the error.

Once you’ve submitted your dispute, the credit bureau has 30 days to investigate and respond back to you with their findings.

By Phone

If you spot an error on your credit report, you’ll want to take steps to correct it as soon as possible. One way to do this is to dispute the error directly with the credit bureau that issued the report.

You can dispute an error on your credit report by phone, but it’s important to know what to expect before you make the call. The credit bureau may require you to provide documentation to support your claim, so it’s a good idea to have this ready before you call. You should also be prepared to give them your contact information and any other relevant details about the error.

It’s important to note that the credit bureau is not obligated to remove the error from your report, but they will investigate your claim and make any necessary corrections. If you are not satisfied with the results of their investigation, you can file a complaint with the Consumer Financial Protection Bureau.

By Mail

You can dispute an error on your credit report by mail.

To do so, you will need to send a written letter to the credit bureau that is reporting the error. Be sure to include your name, address, and any other relevant information, as well as a copy of your credit report with the error highlighted.

In your letter, state clearly that you believe there is an error on your credit report and explain why. You should also request that the bureau investigate the matter and correct the error.

The credit bureau will then have 30 days to investigate your claim and get back to you with their findings. If they find that there was indeed an error on your credit report, they will take steps to correct it.