How to Avoid Paying Interest on Credit Cards

Contents

If you’re carrying a balance on your credit card, you’re probably paying interest on it. But there are a few things you can do to avoid paying interest, like paying your balance in full each month or transferring it to a 0% APR card. Learn more about how to avoid paying interest on your credit cards.

Checkout this video:

Understanding Interest

When you use a credit card, you are borrowing money from the credit card issuer. The issuer then charges you interest on the money you borrowed, as well as any fees associated with the transaction.

What is interest?

Interest is the fee you pay for borrowing money.

The interest rate is the percentage of the total loan that you pay in interest fees. For example, if you borrowed $1,000 at an interest rate of 10%, you would pay $100 in interest.

Interest is calculated based on the amount of money you borrowed, the interest rate, and how often interest is charged (for example, monthly or yearly).

How is interest calculated?

Interest on credit cards is calculated based on your average daily balance. Your average daily balance is calculated by adding each day’s balance and dividing it by the number of days in the billing cycle.

Here is an example: You have a credit card with a $1,000 credit limit and a 20% APR. You make a $500 purchase on Day 1 and don’t make any more purchases or payments during the month.

On Day 30, the card issuer will calculate your average daily balance like this:

$500 + $500 + $500 + … + $500 = $15,000 ÷ 30 days = $500

Your average daily balance is $500.

The card issuer will then multiply your average daily balance by the monthly periodic rate to come up with the amount of interest you will owe for the month. In this case, 20% divided by 12 months equals 1.67%.

$500 × 1.67% = $8.35

You will owe $8.35 in interest for that month.

Avoiding Interest

Paying interest on your credit cards is one of the most avoidable fees. Here are some tips on how you can avoid paying interest on your credit cards. You can either pay your balance in full every month, or you can make sure that you never exceed your credit limit. You can also transfer your balance to a 0% APR credit card.

Pay your balance in full and on time

The best way to avoid paying interest on your credit card is to pay your balance in full and on time every month. This may seem like a no-brainer, but it’s important to remember that even if you only have a $50 balance, if you don’t pay it off in full, you’ll be charged interest on that balance from the day the bill arrives until the day you pay it off. And, if you don’t pay it off within the grace period (usually 21 days from the date the bill is due), you could be charged a late fee as well.

So, to avoid paying interest and late fees, make sure you pay your credit card bill in full and on time every month. And, if you can’t do that, at least try to pay more than the minimum payment due so that you reduce your balance and lower the amount of interest you’ll have to pay.

Know your grace period

Your credit card’s grace period is the time between the end of your billing cycle and when interest charges begin to accrue on your balance. If you pay your balance in full and on time each month, you can avoid paying interest on your purchases.

Depending on your credit card issuer, your grace period may be 21 to 25 days. You can find out when your grace period ends by reading the terms and conditions of your credit card agreement or by contacting your credit card issuer.

To avoid paying interest, you must pay your balance in full before the end of the grace period. If you don’t, interest will be charged on any unpaid balance from the date of purchase.

Some credit card issuers may offer a promotional interest-free period on new purchases. If you take advantage of this offer, be sure to pay off the purchase before the promotional period ends to avoid paying interest.

Use a low-interest credit card

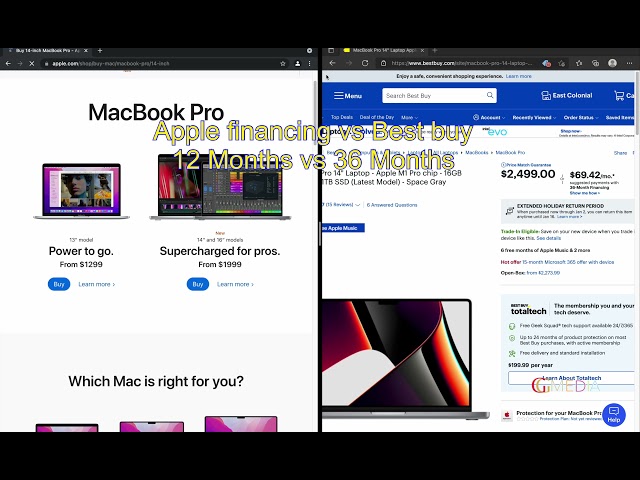

If you have a credit card with a high annual percentage rate (APR), you’re probably paying too much in interest. But there are ways to avoid paying interest on your credit card balance. One way is to transfer your balance to a low-interest credit card. Many credit card companies offer 0% APR promotional rates on balance transfers for a certain period of time, usually 12 to 18 months. And some even offer longer terms.

Another way to avoid paying interest is to take advantage of your card’s grace period. Most credit cards give you a 21-day grace period from the date of your last billing statement before they start charging interest on new purchases. So, if you pay off your entire balance each month, you won’t be charged any interest. That’s why it’s important to know when your billing cycle ends and to make sure you pay off your balance before that date.

If you can’t avoid paying interest on your credit card balance, there are still some things you can do to minimize the amount of interest you pay. One way is to make sure you always make at least the minimum payment on time. This will help reduce the amount of late fees and penalties you have to pay. Another way is to try to pay more than the minimum payment each month, if possible. The more you pay, the less interest you’ll have to pay over time.

Conclusion

The best way to avoid paying interest on your credit cards is to pay your balance in full and on time every month. If you can’t do that, then you should try to pay as much as possible so that you minimize the amount of interest you’re charged. You can also look for cards with 0% intro APR periods or other promotional rates that can help you save money on interest.