How Long Does a Bankruptcy Stay on Your Credit?

Contents

How long does a bankruptcy stay on your credit? Depending on the type of bankruptcy, it can stay on your credit report for up to 10 years. That said, it won’t have the same negative impact after a few years. Here’s what you need to know.

Checkout this video:

Overview

Bankruptcy can stay on your credit report for up to 10 years, and it will make it difficult to get approved for new credit products. However, there are steps you can take to improve your credit score after bankruptcy. In this article, we’ll discuss how long a bankruptcy stays on your credit report and how you can rebuild your credit after filing for bankruptcy.

What is bankruptcy?

Bankruptcy is a legal process that provides debt relief for individuals and businesses unable to repay their creditors. When you file for bankruptcy, an automatic stay goes into effect that stops most collection activity, including wage garnishment, foreclosure, and repossession.

There are several types of bankruptcies that are available to individuals and businesses, but the most common ones are Chapter 7 and Chapter 13 bankruptcies.

Chapter 7 bankruptcy is also known as liquidation bankruptcy because it involves the sale of your non-exempt assets to pay off your creditors. Once your assets are sold and your debts are paid off, you will be discharged from your remaining debts.

Chapter 13 bankruptcy is also known as reorganization bankruptcy because it allows you to repay your debts over a three- to five-year period. During this time, you will make monthly payments to a Chapter 13 trustee who will then distribute the funds to your creditors. At the end of your repayment period, any remaining dischargeable debt will be wiped out.

How long does a bankruptcy stay on your credit?

A bankruptcy can stay on your credit report for up to 10 years, making it harder to get approved for loans and credit cards. But there are steps you can take to improve your credit score and rebuild your credit history.

The Different Types of Bankruptcy

There are several different types of bankruptcy that a person can file, each with its own set of pros and cons. The most common types of bankruptcy are Chapter 7 and Chapter 13. Chapter 7 bankruptcy is also known as liquidation bankruptcy. It is the most common type of bankruptcy filed in the United States.

Chapter 7 bankruptcy

Chapter 7 bankruptcy is sometimes called a “straight” bankruptcy or a “liquidation” bankruptcy. A trustee is appointed to take charge of your property and sell any assets that are not exempt from seizure under federal or state law. The proceeds from the sale of these assets are used to pay your creditors. Once your creditors have been paid, you are discharged from most of your debts.

Most people who file for Chapter 7 bankruptcy are individuals, but businesses can also file.

You may hear people refer to Chapter 7 as a “fresh start” bankruptcy because after the discharge, you no longer have to repay most of your unsecured debts.

Chapter 13 bankruptcy

Chapter 13 bankruptcy is also known as a wage earner’s plan. It enables individuals with a regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years. If the debtor’s current monthly income is less than the applicable state median, the plan will be for three years unless the court approves a longer period “for cause.” (1 U.S.C. Section 109(e).) If the debtor’s current monthly income is greater than the applicable state median, the plan generally must be for five years. During this time frame, creditors are prohibited from starting or continuing collection efforts.

Chapter 13 bankruptcy may be used by individuals, married couples, corporations, and partnerships. Section 109 of the Bankruptcy Code (11 U.S.C.) lists seven types of entities that may not file under Chapter 13: insurance companies, railroads, banks and savings associations (as defined in section 3(a) of the Federal Deposit Insurance Act), credit unions (as defined in section 101 of the Federal Credit Union Act), public utilities as defined in section 109(b)(2), and farmers’ cooperative organizations described in section 521(b)(1).

The Impact of Bankruptcy on Your Credit

Bankruptcy can stay on your credit report for up to 10 years, and it will have a negative impact on your credit score for years to come. If you’re considering filing for bankruptcy, you should understand the long-term effects it can have on your credit. In this article, we’ll discuss the impact of bankruptcy on your credit score and credit report.

How long does a bankruptcy stay on your credit report?

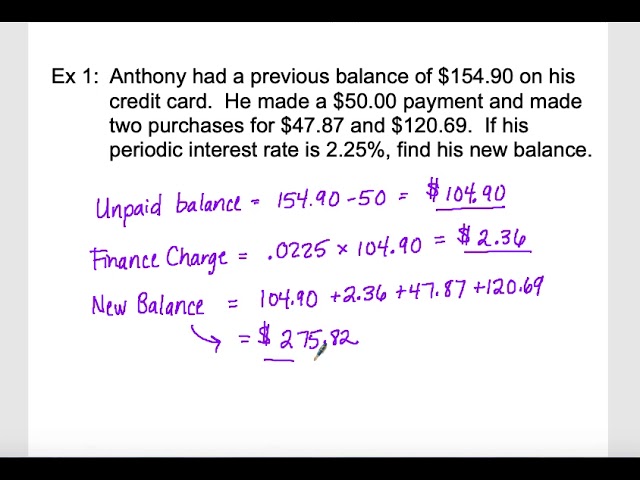

One of the huge impacts of bankruptcy is the hit it takes to your credit score. A single bankruptcy can cause your score to drop 100 points or more. And, that negative mark will stay on your report for up to 10 years, making it difficult to get approved for new credit products.

While the bankruptcy itself will eventually fall off your report, the negative effects of it will linger for years. That’s why it’s so important to take steps to rebuild your credit after a bankruptcy. Here are a few tips:

-Get a secured credit card: This is a credit card that is backed by a deposit you make into a savings account. The limit on the card is usually equal to the amount you have in savings, so there’s no risk of overspending.

-Become an authorized user on someone else’s credit card: This means you can use another person’s credit card but aren’t responsible for making payments on it. You can usually become an authorized user by contacting the credit card issuer and asking them to add you to the account.

-Take out a small loan from a financial institution: This can help show lenders that you’re capable of repaying debt. Just make sure you make your payments on time and in full each month.

Rebuilding your credit after bankruptcy takes time and effort, but it is possible to get your score back up into good territory.

How long does a bankruptcy stay on your credit score?

While the exact impact of bankruptcy on your credit score will depend on your individual circumstances, in general, you can expect your score to take a hit if you file for bankruptcy. Filing for bankruptcy is a major negative mark on your credit report, and it can stay on your report for up to 10 years. This means that it will be harder for you to get approved for new loans and lines of credit during that time.

That said, declaring bankruptcy is not the end of the world. If you have a strong history of responsible credit use before you file, you can begin to rebuild your credit score relatively quickly after your bankruptcy is discharged. And, if you take steps to manage your finances carefully after filing, you can eventually get your score back into good shape.

How to Rebuild Your Credit After Bankruptcy

Get a secured credit card

A secured credit card is an account with a credit limit that is backed by a deposit you make with the issuer. For example, if you open a secured card with a $200 credit limit, you may be required to deposit $200 (or more) with the issuer. Your credit limit will equal the amount of your deposit, and your account will appear on your credit reports as a secured credit card.

You can use a secured card just like any other credit card, which means making purchases and paying off your balance in full each month. As you use the account responsibly and make on-time payments, you may find that issuers will offer to upgrade you to an unsecured credit card. Or, after some time, you may feel confident enough to close the account and receive your deposit back.

Just remember that even though a secured credit card can help rebuild your credit, it’s still important to use it responsibly. That means only charging what you can afford to pay off each month and making your payments on time — both of which will help improve your credit scores over time.

Get a cosigner

If your bankruptcy was recently discharged, you may not have established enough credit history to qualify for a loan on your own. In this case, you may need to get a cosigner for your loan. A cosigner is someone who agrees to pay back the loan if you default.

In order to get a cosigner, you will need to find someone with good credit who is willing to help you. This can be a friend, family member, or even a business associate. Once you have found someone, they will need to fill out an application and sign the loan documents with you.

After you have found a cosigner and applied for the loan, make sure that you make all of your payments on time. If you default on the loan, it will negatively impact both your credit score and your cosigner’s credit score.

Becoming an authorized user can help you rebuild your credit after bankruptcy. This involves being added as an authorized user on someone else’s credit card account. You don’t need to actually use the card to improve your credit score, but you will benefit from the credit history of the account holder.

Keep in mind that becoming an authorized user is a big responsibility. If the account holder doesn’t make their payments on time, or if they max out their credit limit, it will reflect poorly on your credit score. So be sure to choose someone whose financial habits you trust.

FAQs

A bankruptcy will stay on your credit report for up to 10 years, and it will make it very difficult to get new credit. You will likely have to pay higher interest rates and have a higher deposit when you do get new credit. If you are thinking about filing for bankruptcy, you should speak with an attorney to see if it is the right choice for you.

How can I get a mortgage if I have a bankruptcy on my credit?

It’s not impossible to get a mortgage with a bankruptcy on your credit, but it may be more difficult. You may have to wait longer after the bankruptcy is discharged (typically two to four years), and you may need to provide a larger down payment. You may also be required to get private mortgage insurance.

How can I buy a car if I have a bankruptcy on my credit?

If you have a bankruptcy on your credit, you may still be able to finance a car. However, it will most likely have a higher interest rate because you will be considered a high-risk borrower. You may also have to make a larger down payment than someone with good credit.

How can I get a loan if I have a bankruptcy on my credit?

There are a few ways to get a loan after a bankruptcy. You can:

-Apply for a secured loan, which uses collateral such as your home or car to guarantee the loan

-Work with a cosigner who has good credit and can help you qualify for the loan

-Get a personal loan from a lender that specializes in loans for people with bad credit

Depending on the type of bankruptcy you have, it will stay on your credit report for seven to 10 years. During that time, it will be difficult to get approved for new loans or credit cards. After the bankruptcy is over, start rebuilding your credit by paying all of your bills on time and keeping your balances low.