How to Get a $20,000 Loan

Contents

It can be difficult to qualify for a traditional bank loan if you have bad credit. However, there are a few options available to you if you’re in need of a loan for $20,000. In this blog post, we’ll explore a few of those options and provide some tips on how to get approved.

Checkout this video:

Introduction

If you’re looking for a loan of $20,000 or more, there are a few things you’ll need to do to increase your chances of being approved. Here’s what you need to know about how to get a $20,000 loan.

1. Know what you need the loan for. Lenders will want to know what you plan to use the money for and may require that you provide proof of your plans.

2. Have a good credit score. You’ll need a credit score of at least 680 to qualify for most loans of this size. If your credit score is lower, you may still be able to qualify for a loan but you’ll likely pay a higher interest rate.

3. Be employed and have a steady income. Lenders will want to see that you have steady employment and income so they can be confident that you’ll be able to repay the loan. If you’re self-employed, you may still be able to qualify but you may need to provide additional documentation such as tax returns or financial statements.

4. Have collateral. Having collateral (something of value that can be used as security for the loan) will improve your chances of qualifying for a loan and may help you get a lower interest rate. Common types of collateral include property, vehicles, and investments.

5. Shop around and compare rates from multiple lenders. Getting multiple quotes from different lenders is the best way to ensure that you’re getting the best interest rate possible on your loan

How to Get a $20,000 Loan

You can apply for a $20,000 loan by going to your local bank or by applying for a personal loan online. The process is relatively simple and there are a few things you need to do in order to qualify. First, you will need to have a good credit score. Second, you will need to have a steady income. Finally, you will need to fill out an application.

Find the Right Lender

There are a few things to consider when you’re looking for a lender for a $20,000 loan. First, you’ll want to make sure the lender is reputable and has a good track record. You can check with the Better Business Bureau to see if there have been any complaints filed against the lender.

Next, you’ll want to compare interest rates and fees from multiple lenders. Be sure to compare apples to apples when you’re doing this, because some lenders may charge higher fees or have higher interest rates for loans of this size.

Finally, make sure you understand all the terms and conditions of the loan before you sign anything. This includes understanding the repayment schedule, late payment fees, and any other charges that may apply. Once you’ve found a loan that meets your needs, be sure to read the fine print carefully before signing on the dotted line.

Compare Loan Offers

Now that you know what kind of loan you need, it’s time to start shopping around for the best deal. The best place to start is by using an online loan search engine, like Credible. This kind of search engine allows you to compare multiple loan offers from a variety of lenders in one place.

When comparing loans, make sure to look at the following factors:

-Loan amount: This is the amount of money you want to borrow.

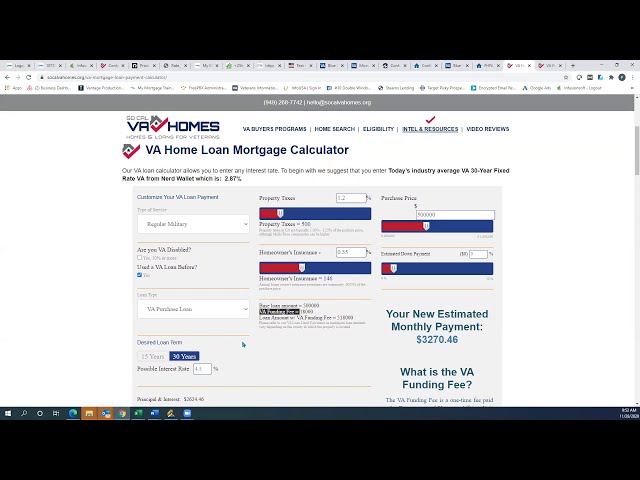

-Interest rate: This is the rate at which interest will accrue on your loan, and it will affect your monthly payment amount.

-Loan term: This is the length of time you have to repay your loan. Loan terms can range from a few months to a few years.

-Annual percentage rate (APR): This is the total cost of borrowing money, including interest and fees. APR can be used to compare different loans against each other.

Once you’ve found a loan that looks good, it’s time to apply.

Check Your Credit Score

Your credit score is one of the most important factors in determining whether or not you will be approved for a loan. Lenders will use your credit score to determine your creditworthiness, and the higher your score, the more likely you are to be approved for a loan. If you have a low credit score, you may still be able to get a loan by applying with a cosigner who has good credit.

Read the Fine Print

Be sure to carefully read the terms and conditions of any loan you are considering before signing on the dotted line. Some loans may seem like a great deal at first glance, but upon closer inspection, you may find that the loan comes with exorbitant fees or an unmanageable interest rate. If you’re not sure what you’re signing up for, ask a friend or family member to take a look at the loan agreement with you. It’s always better to be safe than sorry when it comes to taking out a loan.

Conclusion

The best way to get a $20,000 loan is to shop around and compare rates from multiple lenders. Be sure to check your credit score and history before applying, as this will give you an idea of your chances of approval. Once you’ve found a lender that you’re comfortable with, fill out an application and provide any required documentation. If approved, you should receive your loan funds within a few days.