How Does the APR Measure the True Cost of a Loan?

Contents

How Does the APR Measure the True Cost of a Loan? – The APR is the true cost of the loan including all fees and interest paid over the life of the loan.

Checkout this video:

What is APR?

Annual Percentage Rate (APR) is the true cost of a loan. It is the total yearly cost of borrowing, including interest, fees, and other charges, expressed as a percentage of the amount borrowed. The APR is the best way to compare different loans because it takes into account all of the costs associated with a loan.

For example, let’s say you want to compare two loans: Loan A has an interest rate of 6% and fees of $100, while Loan B has an interest rate of 10% and fees of $200. If you just looked at the interest rate, you might think that Loan A is the better deal because it has a lower rate. But when you factor in the fees, Loan B actually has a lower APR because it has a smaller total cost.

It’s important to remember that APR is not the same as interest rate. The interest rate is just one component of the APR. Fees can also contribute to a higher APR. So when you’re comparing loans, make sure to look at the APR instead of just the interest rate.

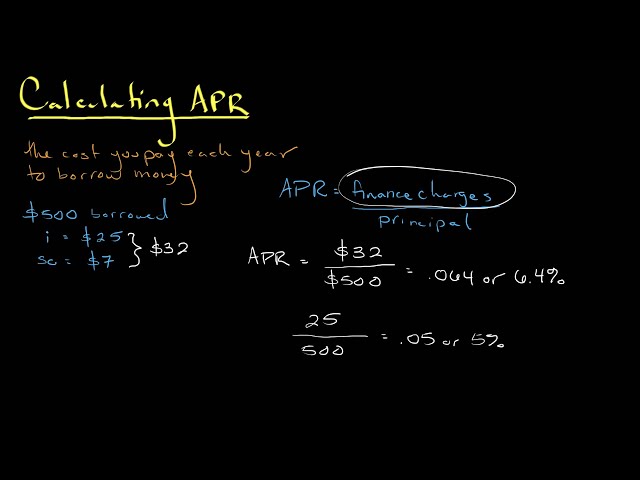

How is APR Calculated?

The APR is more than just the interest rate. It is the true cost of the loan. The APR includes the interest rate, points, fees, and other charges that you pay to get the loan.

The APR is the yearly cost of the loan, expressed as a percentage of the loan amount. It includes the interest rate, points, fees and other charges that you pay to get the loan. The APR is a better way to compare loans because it lets you compare the total cost of the loan.

The interest rate is only part of the picture. The APR includes all of the costs of getting the loan, such as points, fees, and other charges. The APR is a better way to compare loans because it lets you compare the total cost of the loan.

What is the Difference Between APR and Interest Rates?

An annual percentage rate (APR) is a broader measure of the cost to you of borrowing money, also expressed as a percentage rate. In general, the APR reflects not only the interest rate but also any points, mortgage broker fees, and other charges that you pay to get the loan. For that reason, your APR is usually higher than your interest rate.

The lower your APR, the less you pay in total to borrow the money. That makes it an important number when you compare loans. The actual interest rate has5%

How Does APR Affect the Cost of a Loan?

The APR is the true cost of the loan, including all fees and interest, so it allows you to compare different types of loans from different lenders on a level playing field. The lower the APR, the less you will pay in interest and fees over the life of the loan.

Keep in mind that the APR is not always a good indicator of which loan is best for you. Some loans, such as fixed-rate mortgages, have higher interest rates but lower APRs because they have low or no fees. So, if you plan to hold onto a loan for a long time, a loan with a lower APR may be a better choice even if it has a higher interest rate.

How to Shop for a Loan with the Lowest APR

The APR is the best way to compare different loans because it tells you the true cost of the loan. The APR includes the interest rate, points, fees, and other charges that you will pay over the life of the loan, expressed as a percentage of the loan amount. The lower the APR, the less you will pay over the life of the loan.

There are several things to consider when shopping for a loan with the lowest APR:

-Compare loans from multiple lenders. Be sure to compare APRs, not just interest rates.

-Consider the fees associated with each loan. Some loans have origination fees or prepayment penalties that can increase the overall cost of the loan.

-Choose a shorter loan term if possible. This will reduce the amount of interest you pay over the life of the loan.

-Make sure you understand all of the terms and conditions before signing any paperwork.