How to Calculate a Simple Interest Loan

Contents

How to Calculate a Simple Interest Loan. This tutorial provides a step-by-step guide on how to calculate a simple interest loan using Excel.

Checkout this video:

Introduction

Simple interest is a quick and easy way to calculate the interest charge on a loan. It’s not the most accurate method, but it is the simplest. You can use the simple interest method to calculate the interest charge on a loan using the following steps:

1. Determine the principal amount of the loan. This is the original amount of money borrowed.

2. Determine the annual interest rate. This is the percentage of interest charged per year on the loan.

3. Determine the number of years for which the loan is being borrowed.

4. Calculate the simple interest using this formula: Interest = Principal x Annual Interest Rate x Number of Years

For example, if you borrow $1,000 at a 5% annual interest rate for two years, your simple interest would be $50:

Interest = $1,000 x .05 x 2 = $50

With a little practice, you’ll be able to quickly calculate simple interest without using a calculator

What is a Simple Interest Loan?

A simple interest loan is a loan in which the interest is not compounded. Simple interest is calculated only on the principal amount of the loan. The principal is the amount of money borrowed, and the interest is the additional fee charged by the lender for borrowing that money.

How to Calculate a Simple Interest Loan

Simple interest is money you can borrow from a bank or other financial institution, and it is also the interest you pay on certain types of investments. To calculate a simple interest loan, you need to know the loan’s principal, the interest rate, and the length of time you will be making payments. You also need to know whether the interest is calculated daily, monthly, or annually.

The Formula

The formula for calculating a simple interest loan is:

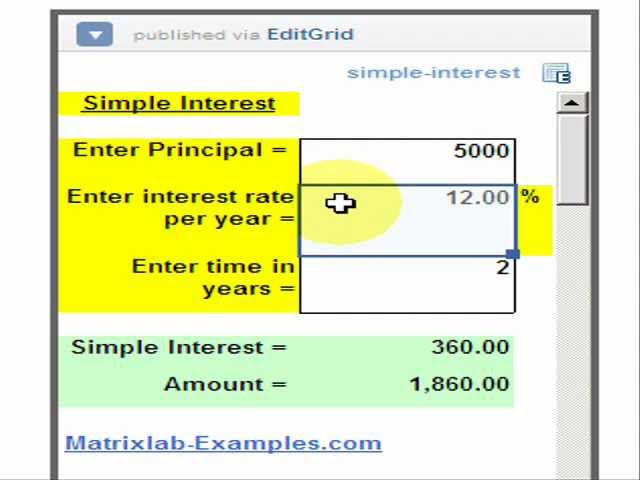

I = P x R x T

where:

I = the interest payment

P = the principal (the amount you borrow)

R = the interest rate (expressed as a decimal)

T = the term of the loan (the number of payments you’ll make)

An Example

To calculate a simple interest loan, you need to know the loan’s principal amount, the interest rate charged per period and the length of the loan (the term). You also need to know the number of periods that have elapsed since you borrowed the money.

Assuming that all these factors are known, you can calculate the outstanding balance of a simple interest loan at any point in time using the following formula:

Outstanding Balance = Principal × (1 + Interest Rate × Elapsed Time)

For example, let’s say you take out a $1,000 loan with a 10% annual interest rate and a two-year term. Let’s further assume that two years have elapsed since you took out the loan. In this case, your outstanding balance would be calculated as follows:

Outstanding Balance = $1,000 × (1 + 0.10 × 2) = $1,000 × 1.20 = $1,200

Conclusion

To calculate a simple interest loan, you need to know the loan amount, the interest rate, and the length of time you will be making payments. You also need to know whether you will be making payments on a monthly or yearly basis. Once you have these pieces of information, you can use an online calculator or do the math yourself.

To calculate the interest yourself, start by multiplying the loan amount by the interest rate. This will give you the total amount of interest you will owe on the loan. Then, divide this number by the number of payments you will make. This will give you your monthly interest payment.