What Does a Mortgage Loan Officer Do?

Contents

A mortgage loan officer is a professional who helps potential home buyers obtain financing for their purchase. A mortgage loan officer can work for a bank, credit union, or other lending institution.

Checkout this video:

Introduction

A mortgage loan officer is a professional who helps potential homebuyers obtain financing for their purchase. A loan officer can work for a financial institution or be employed by a mortgage company. In either case, the loan officer’s duties include helping borrowers complete a loan application, gathering financial documentation and educating the borrower about different types of loans that might be available.

The job of a mortgage loan officer can be both challenging and rewarding. It is challenging because it requires a detailed knowledge of the various types of loans available, as well as an understanding of the financial markets. It is also rewarding because it offers the opportunity to assist people in achieving their dreams of homeownership.

The Job of a Mortgage Loan Officer

A mortgage loan officer is a person who works for a bank, credit union, or other financial institution and helps potential homebuyers get loans. The loan officer’s job is to work with potential borrowers to get them approved for a mortgage loan.

Mortgage loan officers typically work with people who are buying homes, but they may also work with people who are refinancing their homes or taking out home equity loans. Loan officers typically work in an office setting, but they may also travel to meet with potential borrowers.

Mortgage loan officers must be licensed by the state in which they work. They must also take continuing education courses to stay up-to-date on the latest changes in the mortgage industry.

The Duties of a Mortgage Loan Officer

A mortgage loan officer is a professional who helps potential home buyers obtain financing to purchase a home. A loan officer typically works for a bank or other financial institution and is responsible for helping customers complete the loan application process and securing the necessary financing.

Loan officers typically work with customers on a one-on-one basis to determine their specific borrowing needs and then help them find the best loan products to meet those needs. They may also be responsible for developing marketing plans to attract new customers, as well as maintaining relationships with existing customers.

In addition to their customer service duties, loan officers must also have a strong understanding of the various types of loans available and the underwriting criteria used by lenders. They must be able to explain loan terms and conditions to customers in plain language and help them compare different loan options. Loan officers must also be able to efficiently manage their time and workload in order to meet deadlines and close loans in a timely manner.

The Skills of a Mortgage Loan Officer

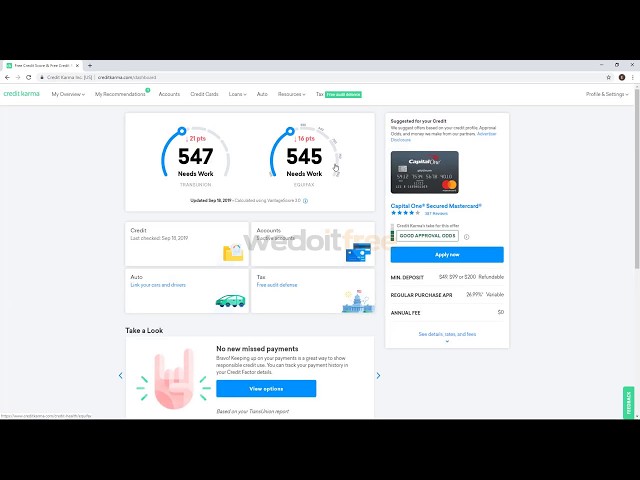

Mortgage loan officers typically need at least a bachelor’s degree in finance, business administration, or a related field. Many have degrees in accounting, economics, or other business-related fields. A mortgage loan officer must be licensed by the Nationwide Mortgage Licensing System & Registry (NMLS). Some states have additional requirements.

Mortgage loan officers must have excellent math skills and be able to calculate interest rates, terms of loans, and payment options. They need to be able to explain these calculations to potential borrowers who may not be familiar with them. Mortgage loan officers need to be good at multitasking so they can handle several applications at once and stay organized. They need to be able to work independently and make decisions without supervision.

The Education and Training of a Mortgage Loan Officer

Most mortgage loan officers need at least a bachelor’s degree and on-the-job training to get started in their career. Many industries value experience over education, but the banking and finance industry is different. In this industry, most employers prefer to hire mortgage loan officers who have a college degree, preferably in finance, economics, or business.

While you’re getting your degree, it’s also important to take courses in mathematics and computers. These courses will give you the skills you need to understand the financial reports that you’ll be working with as a mortgage loan officer.

After you have your degree, you can start working as a mortgage loan officer in a bank or other financial institution. However, many employers prefer to hire candidates who have experience in the banking or finance industry. You may be able to get this experience by working as a teller, customer service representative, or personal banker before you become a mortgage loan officer.

The Salary of a Mortgage Loan Officer

A mortgage loan officer is responsible forOriginating, evaluating and approving mortgage loans. They work with loan applicants to gather necessary paperwork and financial information to make a determination on whether or not to approve a loan. They may also work with borrowers who are having difficulty making their mortgage payments. In some cases, mortgage loan officers may be able to renegotiate the terms of a loan in order to make it more affordable for the borrower.

Mortgage loan officers typically work for banks, credit unions or other financial institutions. They may also work for specialized mortgage companies. The median annual salary for a mortgage loan officer was $63,730 in 2016, according to the U.S. Bureau of Labor Statistics.

The Job Outlook for Mortgage Loan Officers

Mortgage loan officers typically work for commercial banks, credit unions, mortgage companies, and savings and loans associations. Many work for large financial institutions or mortgage banks. A few work for the federal government.

Self-employed loan officers work directly with customers and set their own hours. Some work part time.

Most loan officers are paid a salary and commissions on the loans they originate. They may also receive bonuses based on the number of loans they close. In some cases, loan officers may be eligible for production-based bonuses, profit sharing, and other incentive plans.