How to Get a Bank Business Loan

Contents

You may be wondering how to get a bank business loan. The process can be a bit complicated, but we’ve got you covered. Here’s what you need to know.

Checkout this video:

Research the best type of loan for your business

Getting a bank business loan is one of the most common ways to finance your small business. But before you start the process of applying for a loan, it’s important to do your research and understand the different types of loans available.

The first step is to figure out which type of loan is best for your business. There are many different types of loans, and each has its own set of pros and cons. The most important thing is to find a loan that fits your specific needs.

One common type of loan for small businesses is an SBA (Small Business Administration) loan. These loans are backed by the government, which means they come with certain benefits, such as lower interest rates and longer repayment terms. However, SBA loans can be difficult to qualify for, so make sure you do your research before you apply.

Another option is a business line of credit. This type of loan gives you access to a set amount of funds that you can use as needed. Line of credit loans can be helpful if you need to finance short-term expenses or if you need flexibility in how you use the funds.

You should also consider working with a local bank or credit union. These lenders may offer more personalized service and better terms than larger banks. And they may be more willing to work with businesses in their community.

Once you’ve decided which type of loan is best for your business, it’s time to start the application process. The first step is to gather all the required documents, such as financial statements, tax returns, and a business plan. You’ll also need to provide personal financial information for all owners and guarantors on the loan.

Once you have all the required documents, you can begin filling out the application form. This form will ask for basic information about your business, such as your business name, address, and contact information. You’ll also need to provide detailed information about your finances, including your revenue and expenses.

After you’ve completed the application form, it’s time to submit it to the lender for review. The lender will want to see that you have a solid plan for how you’ll use the funds from the loan and that you have the ability to repay the loan on time. They may also request additional documentation or information during this process. If everything looks good, then you should receive approval for your loan within a few weeks time

Find the right lender

The first step to getting a bank business loan is finding the right lender. There are many options available, and it’s important to compare rates and terms before you choose one. You’ll also want to make sure that the lender you choose is willing to work with you to get the best possible terms for your loan.

You can use an online lending marketplace like Lendio to compare rates and terms from a variety of lenders, all in one place. This can save you a lot of time and hassle, and it’s a great way to make sure you’re getting the best possible deal on your loan.

Once you’ve found the right lender, it’s time to start working on your loan application.

Get your financial documents in order

One of the first steps in applying for a bank business loan is to get your financial documents in order. The lender will want to see your business’s financial history, including tax returns, balance sheets and profit and loss statements. Be sure to have these documents ready when you meet with the lender.

The next step is to figure out how much money you need to borrow. This will help you determine which type of loan is right for your business. Once you know how much you need, you can start shopping around for lenders. Be sure to compare interest rates and terms before choosing a lender.

Once you’ve found a lender, it’s time to fill out a loan application. The application will ask for information about your business, including its history, financial situation and the amount of money you need to borrow. The lender will use this information to decide whether or not to approve your loan.

If your loan is approved, the lender will give you the money you need and set up a repayment schedule. Be sure to make your payments on time and in full to avoid defaulting on your loan.

Apply for the loan

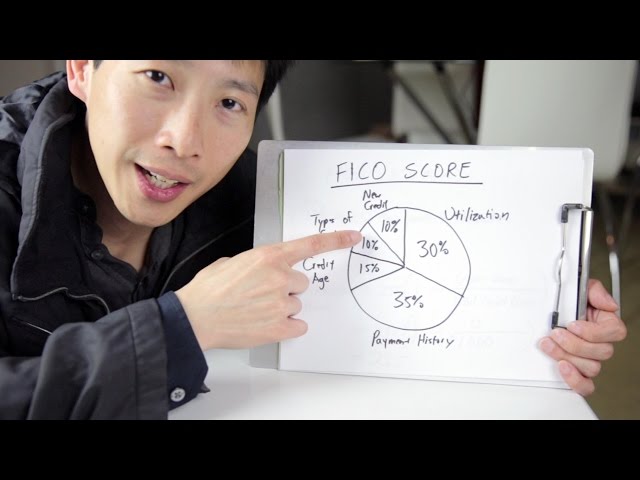

To apply for a bank business loan, you’ll need to put together a loan package that includes financial projections for your business and information about your personal finances. You’ll also need to have good credit and a strong relationship with the bank. The process can take several weeks, so you’ll need to plan ahead.

Negotiate the loan terms

You have a few options when it comes to negotiating the terms of your bank business loan. The first is to negotiate with the bank that you have chosen to work with. The second is to go through a third-party broker. And the third is to use a business loan marketplace like Biz2Credit.

If you choose to negotiate with the bank on your own, it’s important to understand what terms you should be aiming for. Here are a few things to keep in mind:

-The interest rate: This is probably the most important thing to negotiate. The lower the interest rate, the less you will have to pay back in total.

-The repayment term: This is the length of time that you have to repay the loan. The longer the repayment term, the lower your monthly payments will be. But keep in mind that you will pay more interest over the life of the loan if you choose a longer repayment term.

-The collateral: This is something that you put up as security for the loan. It can be things like real estate or equipment. The more collateral you have, the easier it will be to get a bank business loan. But keep in mind that if you default on the loan, you could lose your collateral.

Once you’ve negotiated the terms of your bank business loan, it’s important to get everything in writing before you sign anything. This way, there will be no misunderstanding about what you’ve agreed to.