How Much Car Loan Can I Afford?

How much car loan can you afford? This is a common question among car buyers. Find out how you can calculate your monthly car loan payments.

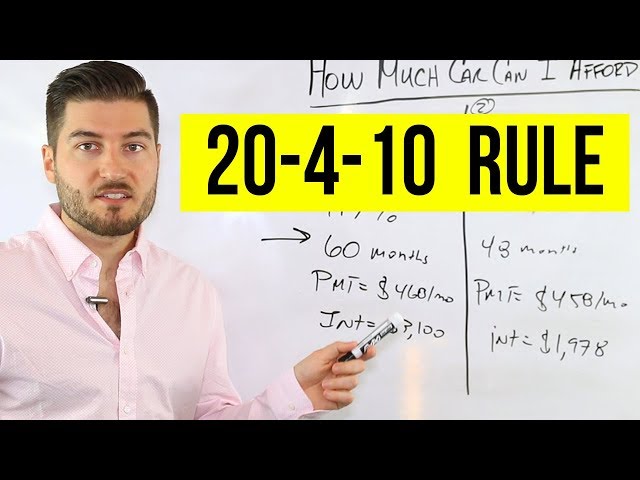

Checkout this video:

How much can you afford?

You’ve found the perfect car, and you’re ready to start the loan process. But before you fill out the loan application, it’s important to understand how much car you can afford. After all, you don’t want to end up with a car loan that’s too large for your budget. Keep reading to learn how to calculate how much car loan you can afford.

How much can you afford to pay each month?

Your monthly car payment is just one part of the equation when it comes to buying a car. You also need to factor in things like insurance, fuel, and maintenance. Use this calculator to estimate your monthly car loan payment, including principal and interest. Then, factor in things like gas, insurance, and repairs so you can create a realistic budget for your new ride.

What is your down payment?

Your down payment is the amount of money you’ll pay upfront for your vehicle. It’s important to remember that a higher down payment means a lower loan amount and a lower monthly payment.

You can make a down payment using cash, trade-in equity, or a combination of both. If you’re not sure how much cash you have available for a down payment, you can use our Down Payment Estimator to get an idea of what your monthly car payments might be.

Keep in mind that the amount of your monthly car payment will also depend on the length of your loan term, the annual percentage rate (APR) on your loan, and the type of vehicle you’re buying.

How much car can you afford?

It’s important to know how much car you can afford before you start shopping. This will help you stay within your budget and not overspend on your loan. The first step is to calculate your monthly budget. You can do this by adding up your total monthly income and then subtracting your total monthly expenses. Once you have your monthly budget, you can start looking at car loans.

How much car can you afford to buy?

The answer to this question depends on a variety of factors, including your income, debts, and monthly expenses. In general, you should spend no more than 10% of your monthly income on car payments. if you have other debts, you may want to lower that percentage to leave room in your budget for those payments as well.

To get an idea of how much car you can afford, find a loan calculator online and input some basic information about your finances. The calculator will give you an estimate of how much car you can afford based on the information you provide.

Keep in mind that this is just a estimate, and there are other factors to consider when budgeting for a car. For example, you will also need to factor in the cost of insurance, gas, and maintenance. If you are not sure how much car you can afford, it is best to err on the side of caution and choose a cheaper option.

How much car can you afford to finance?

The short answer is that you shouldn’t finance more than you can afford to pay back. But there’s a lot more to it than that, which is why we created this guide.

Here’s what you’ll find inside:

– How much car can you afford?

– What factors to consider when determining how much car you can afford

– How to calculate your monthly car payment

– The pros and cons of leasing vs. buying a car

– How to get the best deal on your next car loan

How much loan can you afford?

You can use an online calculator to determine how much of a car loan you can afford. Simply enter in your current monthly income, debts, and other financial obligations to get a clear picture of how much loan you can afford.

How much loan can you afford to take out?

The answer to this question depends on a few factors, including your income, debts, and the type of car you want to buy.

In general, you should plan to spend no more than 10% of your monthly income on your car loan. So, if you make $3,000 per month, you should plan to spend no more than $300 per month on your car loan.

Of course, this is just a general guideline. If you have other debts – such as a mortgage, credit cards, or student loans – you’ll need to factor those payments into your budget as well.

If you’re not sure how much car you can afford, there are a few ways to calculate it. One simple way is to use an online calculator, like the one at Bankrate.com.

Another way is to figure out the total amount you can afford to spend on all of your debts each month – including your car loan – and then divide that number by the number of payments you’ll need to make each month on your car loan. For example, let’s say you can afford to spend $500 per month on all of your debts combined. If you’re planning to finance your car for four years (48 months), that means you can afford to spend up to $500/48 = $10.42 per month on your car loan.

How much loan can you afford to repay each month?

To estimate how much car you can afford, start by looking at your monthly income and taxes. You’ll need to know your gross monthly income (before taxes) to estimate how much you can afford to spend on your car loan payment. Then, factor in whether you can make a large down payment or not.

If you have a down payment of at least 20%, you’ll likely qualify for a lower interest rate on your auto loan, and won’t need to finance as much money. This means you may be able to afford a higher monthly car loan payment. If you don’t have a down payment saved up, you may still be able to qualify for an auto loan, but will likely pay a higher interest rate and will need to finance more money.

Once you know how much money you can realistically afford to spend each month on your car loan payment, use an online auto loan calculator or monthly payment calculator to estimate your car loan amount, interest rate, and monthly payment. Doing this calculation will give you a good idea of what kind of car price range you should be shopping in.