What is a Grad Plus Loan?

Contents

A Grad Plus Loan is a type of federal student loan that helps graduate or professional students pay for their educational expenses.

Checkout this video:

What is a Grad Plus Loan?

The Federal Direct Grad PLUS Loan is a federal student loan that helps degree-seeking graduate and professional students pay for their educational expenses up to the cost of attendance, minus any other financial aid they receive.

Grad PLUS loans have a fixed interest rate of 7.08% for loans disbursed on or after July 1, 2019, and before July 1, 2020. repayment of Grad PLUS loans begins 60 days after the final loan disbursement for the period of enrollment for which the loan was received.

There are no annual or aggregate limits on the amount you can borrow through the Federal Direct Grad PLUS Loan Program. However, you may not borrow more than the cost of attendance (determined by your school) minus any other financial aid you receive.

How do Grad Plus Loans work?

Grad Plus Loans are federal student loans that can be used to pay for graduate or professional school expenses, up to the full cost of attendance. To get a Grad Plus Loan, you’ll first need to complete the Free Application for Federal Student Aid (FAFSA®) form.

How do Grad Plus Loans work?

The Grad Plus Loan Program is available to graduate and professional students who have exhausted their eligibility for federal Stafford Loans. Eligible students can borrow up to the cost of attendance, minus any other financial aid they receive.

Grad Plus Loans have a fixed interest rate that is set each year on July 1st. For loans first disbursed on or after July 1, 2019, the interest rate is 7.08%. Interest accrues on Grad Plus Loans from the date of the first disbursement until the loan is paid in full.

You can choose to defer payment on your Grad Plus Loan while you’re in school and during your grace period. You can also choose to make interest-only payments during this time. If you don’t make payments while you’re in school or during your grace period, your loan will enter repayment. You will have up to 10 years to repay your loan in full.

What are the benefits of a Grad Plus Loan?

With a Grad Plus Loan, you can borrow up to the total cost of your graduate or professional degree, minus any other financial aid you receive. This can be a great way to cover the full cost of your education and avoid having to take out private loans.

Grad Plus Loans also offer several other benefits, including:

-No need for a cosigner: You can get a Grad Plus Loan without a cosigner as long as you meet the credit criteria.

-Deferred repayment: You don’t have to start making payments on your Grad Plus Loan until six months after you graduate or leave school.

-Flexible repayment options: You can choose from a variety of repayment plans, including income-based repayment plans that can lower your monthly payment if you have a low income.

-No prepayment penalties: You can make extra payments on your Grad Plus Loan without penalty, which can save you money in interest charges.

How to apply for a Grad Plus Loan?

To apply for a Grad PLUS Loan, you’ll need to complete a Free Application for Federal Student Aid (FAFSA) form. You can complete the FAFSA online at www.fafsa.gov.

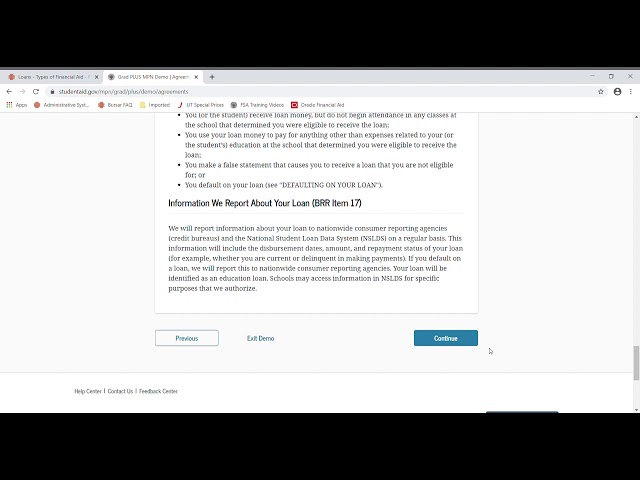

If you’re a first-time borrower, you’ll also need to complete a Master Promissory Note (MPN). The MPN is a legal document in which you promise to repay your loan(s) and any accrued interest and fees to the U.S. Department of Education. You can complete the MPN online at www.studentaid.gov/mpn.

FAQs about Grad Plus Loans

-What is a Grad Plus Loan?

A Grad Plus Loan is a federal student loan that helps graduate or professional students pay for their educational expenses. The loan allows you to borrow up to the full cost of your education, minus any other financial aid you receive.

-Who can get a Grad Plus Loan?

To be eligible for a Grad Plus Loan, you must be a graduate or professional student enrolled in an eligible program at an accredited school. You must also be a U.S. citizen or permanent resident and have good creditworthiness.

-How do I apply for a Grad Plus Loan?

To apply for a Grad Plus Loan, you must complete the Free Application for Federal Student Aid (FAFSA). You will then need to complete a Master Promissory Note (MPN) and submit it to your school’s financial aid office.

-How much can I borrow with a Grad Plus Loan?

The maximum amount you can borrow with a Grad Plus Loan is the cost of your education minus any other financial aid you receive.

-When do I have to start paying back my Grad Plus Loan?

You will have to start repaying your Grad Plus Loan six months after you graduate, leave school, or drop below half-time enrollment.