What Does It Mean to Refinance a Loan?

Contents

When you refinance a loan, you’re essentially taking out a new loan to replace your existing one. The new loan pays off the balance of your old loan, and you’re then responsible for making payments on the new loan. Refinancing can be a good way to save money on your monthly payments, or to get a lower interest rate.

Checkout this video:

Introduction

When you refinance a loan, you’re essentially taking out a new loan to pay off your existing one. There are lots of reasons why people refinance products like mortgages, auto loans and even student loans. Some people do it to get a lower interest rate, others to shorten the length of their loan or to consolidate multiple loans into one. No matter the reason, it’s a big decision with lots of potential implications — both good and bad.

What is Refinancing?

Refinancing a loan means taking out a new loan to pay off an existing loan. The new loan should have terms that are more favorable than the original loan, making it a lower-cost way to borrow money. Homeowners often refinance mortgages, but refinancing is also available for cars, student loans, and business loans.

When you refinance your loan, you usually have to pay closing costs upfront. These can include appraisal fees, legal fees, and processing fees. You may be able to roll these into the new loan or finance them by paying a higher interest rate.

If you’re considering refinancing a loan, compare offers from multiple lenders to get the best terms. Make sure to compare the total cost of the loan, including interest rates, origination fees, and closing costs.

Reasons to Refinance

If interest rates have fallen since you originally took out your loan, you may be able to save money by refinancing. You may also be able to shorten the term of your loan, which can save you money on interest payments in the long run. There are a few things to consider before refinancing, but it can be a great way to save money on your loan.

To Get a Lower Interest Rate

The most common reason to refinance is to lower the interest rate on your loan. This can save you money over the life of the loan, and it can free up some cash each month so you can pay down other debts or make home improvements. You can also refinance to a shorter loan term if you want to be debt-free more quickly.

To Consolidate Debt

Debt consolidation is one of the most popular reasons to refinance. If you have multiple debts with high interest rates, you can use a lower-rate loan to pay off those debts. This will leave you with one payment to make each month, and over time, you’ll save money on interest. Just be sure that the terms of the new loan are better than the terms of the old loans — otherwise, you’re not really saving anything.

To Get a Lower Monthly Payment

If interest rates have dropped since you took out your first loan, you may be able to get a lower monthly payment by refinancing. reduced monthly payment could free up money for other purposes, like paying off debt or saving for a rainy day. You may also be able to shorten your loan term, which would save you money on interest over the life of the loan.

How to Refinance

Refinancing a loan simply means taking out a new loan to replace an existing one. When it comes to student loans , refinancing can be a great way to save money on interest, lower your monthly payments, or both. It’s not right for everyone, though.

Research Lenders

When you refinance a loan, you’re taking out a new one with terms that better fit your current financial situation. It’s important to compare interest rates and loan terms from different lenders to find the best deal possible. Once you’ve decided on the right lender, you’ll need to gather some financial documents and fill out an application. The lender will then run a hard credit check, which can temporarily lower your credit score by a few points. If approved, you’ll sign some paperwork and begin making payments on your new loan.

Compare Loan Offers

Before you refinance, make sure you compare loan offers from multiple lenders to ensure you’re getting the best deal. Keep in mind that the best refinance terms will usually be available to borrowers with excellent credit scores. When comparing loan offers, pay attention to:

-Loan terms: The length of your loan will affect the overall cost of your refinanced mortgage. For example, a 30-year mortgage will typically have a lower interest rate than a 15-year mortgage, but the monthly payments will be higher.

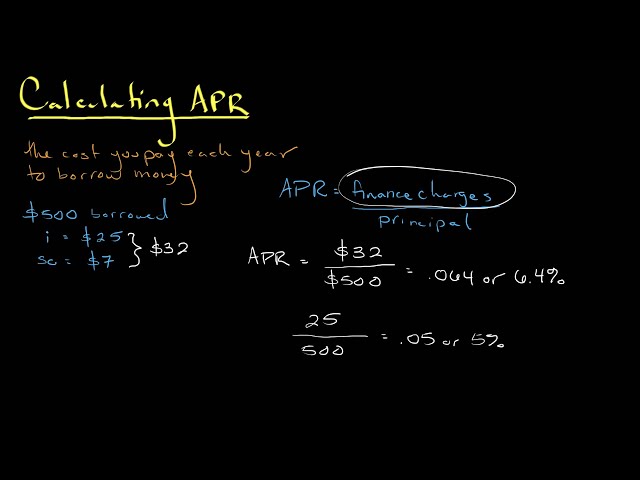

-Interest rate: This is the percentage of your loan amount charged by the lender for borrowing money. The lower the interest rate, the less you’ll pay in interest over the life of your loan.

-Closing costs: These are fees charged by the lender to cover the cost of processing and approving your loan. Closing costs can vary significantly from one lender to another, so be sure to compare offers carefully.

Once you’ve compared offers and chosen a lender, you’ll need to apply for a new loan. The process is similar to getting your original mortgage, but there may be some additional documentation required since your financial situation may have changed since you first bought your home.

Choose the Best Loan for You

There are many reasons to refinance, but the best loan for you depends on your individual financial situation. Some common reasons to refinance are to get a lower interest rate, shorten the loan term, or to cash out equity in your home.

You should also consider the fees associated with refinancing, as well as the type of loan that you currently have. For example, if you have a fixed-rate loan, you may not want to refinance into an adjustable-rate loan. Refinancing can be a great way to save money, but it’s important to make sure that it’s the right decision for you.

If you’re not sure whether refinancing is right for you, we can help. We’re happy to answer any questions that you have about the process or help you compare different loans. Give us a call today or fill out our online form to get started.

Conclusion

In conclusion, refinancing a loan simply means taking out a new loan to replace an existing one. There are many reasons why people refinance their loans, but the most common reasons are to get a lower interest rate, to change the repayment term, or to consolidate multiple loans into one.

If you’re considering refinancing your loan, be sure to compare offers from multiple lenders to get the best deal possible.