What Do You Need to Apply for a Personal Loan?

Contents

If you’re considering applying for a personal loan, there are a few things you’ll need to have in order. In this blog post, we’ll go over what you need to apply for a personal loan, so you can be prepared when you start the application process.

Checkout this video:

Introduction

If you’re thinking of taking out a personal loan, you might be wondering what kind of information you’ll need to provide in order to get approved. In this article, we’ll go over some of the basics of applying for a personal loan and what kind of information lenders will typically require.

When you apply for a personal loan, the first thing most lenders will do is pull your credit score. Your credit score is a number that represents your creditworthiness, or how likely you are to repay a loan. Lenders use this number to help them decide whether or not to approve your loan and how much interest to charge you.

In general, the higher your credit score, the better your chances of getting approved for a loan and getting a lower interest rate. If you have a low credit score, you might still be able to get approved for a loan, but you may have to pay a higher interest rate.

In addition to your credit score, lenders will also look at other factors such as your income, debts, and employment history when considering your application. They’ll want to see that you have a steady source of income and that your monthly expenses are manageable. They’ll also want to see that you have a history of making on-time payments.

When you’re ready to apply for a personal loan, make sure you have all of the necessary information handy. You’ll typically need to provide some basic information about yourself and your finances, including your Social Security number, employment information, and bank account details. You should also be prepared to answer questions about why you’re taking out the loan and how you plan on using the money.

If you’re not sure where to start when it comes time to apply for a personal loan, consult with your bank or financial institution first. They can help guide you through the process and answer any questions that you might have along the way

What is a Personal Loan?

A personal loan is an unsecured loan that can be used for a variety of purposes, from consolidating debt to financing a large purchase. Personal loans are repaid in fixed monthly payments and usually have lower interest rates than credit cards, which makes them a good option for borrowers who need to borrow money for a specific purpose.

Who Can Apply for a Personal Loan?

You may be wondering, can just anyone apply for a personal loan? The answer is, no. In order to be approved for a personal loan, you will have to meet certain criteria set by lenders. Keep reading to learn more about what you need to apply for a personal loan.

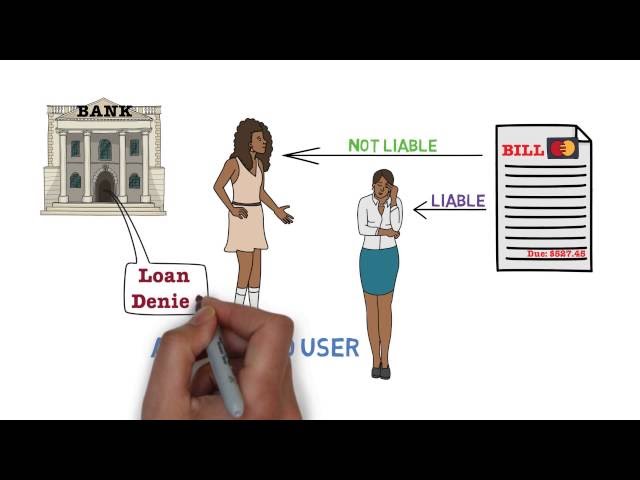

First, you will need to have a regular source of income. This could be from employment, retirement, or disability benefits. You will also need to have a good credit score in order to be approved for a personal loan. If you do not have a good credit score, you may still be able to get a personal loan by finding a cosigner with good credit.

Next, you will need to provide some documentation to the lender when you apply for the loan. This includes your identification, proof of income, and proof of residency. You may also be asked to provide your bank statements in order to show the lender that you have the ability to repay the loan.

Once you have gathered all of the necessary documentation, you are ready to apply for a personal loan! Be sure to shop around and compare rates and terms from different lenders before choosing one.

What Do You Need to Apply for a Personal Loan?

There are a few things you’ll need to have handy when you apply for a personal loan, whether you do it online, over the phone, or in person. Here’s what you need to apply for a personal loan:

Your Identification

When you apply for a personal loan, you’ll need to prove your identity. This can be done with a driver’s license, passport, or state ID.

Proof of Income

Lenders need to know that you have the ability to repay your loan, so they will ask for proof of income. This can be in the form of pay stubs, tax returns, or other documentation of earnings. If you are self-employed or have fluctuating income, you may need to provide additional documentation.

Banking Information

You will need to provide your bank account information so the lender can deposit your loan proceeds and withdraw your payments. Be prepared to provide your bank name, account number, and routing number.

Other Debt Obligations

Part of determining whether or not you can afford a personal loan is looking at your other debt obligations. The lender will want to know what other debts you have and how much you owe on each one. Be prepared to list out your other loans, credit card balances, and housing costs.

How to Apply for a Personal Loan

To apply for a personal loan, you will need to provide some basic information about yourself and your finances. This includes your contact information, income and employment information, and details about your debts and assets. You will also need to have a good idea of how much money you need to borrow and what you will use the loan for.

Conclusion

In conclusion, you will need to have a good credit score, a steady income, and a manageable amount of debt in order to qualify for a personal loan. personal loan. If you have all of these things in order, you should be able to get a loan with a relatively low interest rate and reasonable repayment terms.