How to Get a Business Loan with Bad Credit

Bad credit can make it tough to get a business loan. But it’s not impossible. Here’s how to get a business loan with bad credit .

Checkout this video:

Research Your Options

One of the most common questions we get from new business owners is “How can I get a business loan with bad credit?” Fortunately, there are a number of options available for business owners with less-than-perfect credit. However, it’s important to do your research before moving forward with any loan, as terms and conditions can vary greatly. In this article, we’ll provide an overview of a few popular lending options for businesses with bad credit.

Compare rates and terms from multiple lenders

There are many lenders who offer business loans to people with bad credit. However, not all of these lenders are created equal. It’s important that you compare rates and terms from multiple lenders before you decide on a loan.

Here are a few things to keep in mind when you’re comparing business loans:

-Interest rates: The interest rate on a business loan is one of the most important factors to compare. Make sure you know the interest rate you’re being offered and compare it to the interest rates offered by other lenders.

-Loan terms: The loan term is the amount of time you have to repay your loan. Most business loans have terms of 1-5 years, but some lenders may offer loans with terms of up to 10 years.

-Repayment options: Some lenders allow you to make weekly, bi-weekly, or monthly payments. Others require that you make one lump sum payment at the end of the loan term. Make sure you know how often you’ll be required to make payments and how much those payments will be before you agree to a loan.

-Origination fees: Some lenders charge an origination fee, which is a fee charged for processing your loan. This fee is typically a percentage of your total loan amount and can range from 1% to 5%.

-Prepayment penalties: Some lenders charge a penalty if you pay off your loan early. This penalty is typically a percentage of your remaining balance or a flat fee. If you think there’s a chance you may want to pay off your loan early, make sure there isn’t a prepayment penalty associated with the loan.

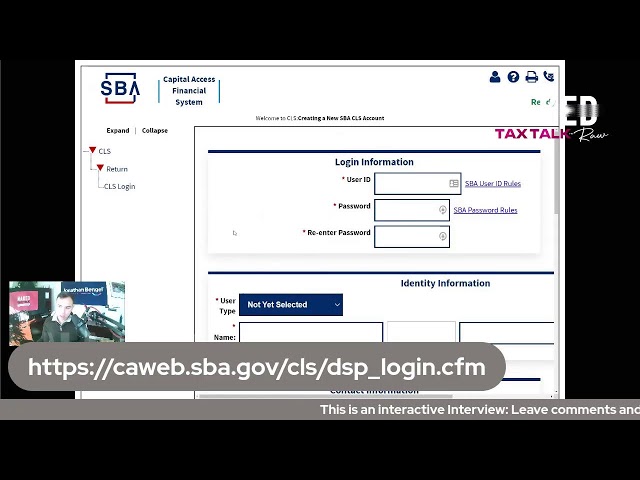

Consider government-backed loans

Government-backed loans are an option for those with bad credit. The Small Business Administration (SBA) guarantees loans for qualified applicants. This guarantee means that if you default on your loan, the SBA will pay back the lender.

There are two types of SBA-guaranteed loans: 7(a) and 504. 7(a) loans are the most common and can be used for a variety of purposes, including working capital, equipment, and real estate. 504 loans must be used for fixed assets, such as real estate or equipment.

To qualify for a government-backed loan, you’ll need to show that you have a strong business plan and a good credit history (despite your bad credit). You’ll also need to meet the SBA’s size standards, which vary by industry.

Improve Your Credit Score

Your credit score is one of the first things a lender will look at when you apply for a business loan—and it’s an important factor in getting approved. A high credit score shows that you’re a low-risk borrower, which means you’re more likely to repay your loan on time. If you have bad credit, there are steps you can take to improve your score and make yourself a more attractive borrower to lenders.

Check your credit report for errors

One of the best things you can do to improve your credit score is to check your credit report for errors. You can get a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once per year.

If you find any errors on your credit report, you should dispute them with the credit bureau. This can help improve your credit score by removing negative information that is not accurate.

You can also improve your credit score by paying down your debts. The lower your debt-to-income ratio, the better your credit score will be. You can also raise your credit score by increasing your credit limit or opening new lines of credit.

Pay off outstanding debts

One of the single most important things you can do to improve your credit score is to pay off any outstanding debts you may have. This includes both traditional loans and lines of credit, as well as any revolving debt such as credit cards. Not only will this reduce the amount of money you owe, it will also show creditors that you are actively working to improve your financial situation.

Create a positive credit history

If you have no credit history, you’re not alone. Many young adults find themselves in the same situation when they’re just starting out. The good news is, there are a few things you can do to establish a positive credit history and start building your credit score.

The first thing you should do is get a secured credit card. This kind of credit card is backed by a deposit you make with the issuer, so if you default on your payments, the issuer can use your deposit to cover the outstanding balance. Secured cards typically have lower credit limits and higher interest rates than unsecured cards, but they can be a good way to build your credit if used responsibly. Just make sure to make your payments on time and keep your balances low relative to your credit limit.

You can also become an authorized user on someone else’s credit card account. This means you’ll be able to use their account and their payment history will become part of your credit history. Just make sure the account is in good standing before you become an authorized user—you don’t want to inherit someone else’s bad debt!

Lastly, consider taking out a small loan from a lending institution or a friend or family member. Make sure you understand the terms of the loan and agree to make regular, on-time payments. A record of timely payments will help boost your score over time.

Building a positive credit history takes time, but it’s worth it in the long run. By following these steps, you can get started on the path to good credit—and eventually get business loans with bad credit!

Find a Cosigner

One way to get a business loan when you have bad credit is to find a cosigner. A cosigner is somebody who agrees to sign the loan with you and be equally responsible for repaying the debt. This can be a family member, friend, or business partner. The cosigner will need to have good credit and be able to show that they can repay the loan if you default on it.

Ask a friend or family member

If you have a friend or family member with good credit, you may be able to get them to cosign for your loan. This means they will be responsible for repaying the loan if you default.

Before you ask someone to cosign, make sure you understand the risks involved. Defaulting on a loan can damage your cosigner’s credit score and reputation, so it’s important to be sure you can afford the loan before you ask someone to cosign.

If you decide to ask a friend or family member to cosign, be honest about your financial situation and explain why you need a loan. If they are unwilling or unable to help, don’t force the issue— there are other options available.

Find a business partner

If you’re looking for a business loan with bad credit, one option you may be able to explore is finding a business partner who can cosign the loan with you. A cosigner is someone who agrees to repay the loan if you default on the payments.

The cosigner must have good or excellent credit in order to qualify, and must be willing to put their personal finances on the line in order to help you get the loan. You may need to offer collateral, such as property or equipment, in addition to finding a cosigner in order to get approved for the loan.

Even if you are able to find a cosigner, keep in mind that this is a high-risk option and should only be considered as a last resort. If you default on the loan, not only will your business suffer, but your cosigner’s personal finances will be at risk as well.

Use Collateral

If you have bad credit, your options for getting a business loan are pretty limited. One option is to use collateral. This means that you put up something of value (like your home or your business) as collateral for the loan. The lender can then seize the asset if you default on the loan.

Offer up personal assets

If you have bad credit, one option for securing a business loan is to offer up personal assets as collateral. This means that if you default on the loan, the lender can seize your assets in order to recoup their losses. Obviously, this is a high-risk option and should only be considered as a last resort.

Use business assets

If you have collateral, such as a house or a car, you may be able to use it to get a business loan with bad credit. This is because lenders see collateral as a way to reduce their risk — if you can’t repay the loan, they can seize the asset and sell it to recoup their losses.

Of course, using collateral comes with its own risks. If you can’t repay the loan, you could lose your house or car, which could make it difficult to continue running your business. As such, it’s important to carefully consider whether using collateral is the right choice for your business.