What Is The Monthly Finance Charge If The Average?

Contents

- What is the monthly finance charge if the average?

- How is the monthly finance charge calculated?

- What are the factors that affect the monthly finance charge?

- What are the benefits of understanding the monthly finance charge?

- How can you avoid paying a high monthly finance charge?

- What are the consequences of not understanding the monthly finance charge?

- How can you use the monthly finance charge to your advantage?

- What are some common misconceptions about the monthly finance charge?

- What should you do if you have questions about the monthly finance charge?

- 10)Where can you go for more information about the monthly finance charge?

If you’re wondering what the monthly finance charge is on your credit card statement, you’re not alone. Many people don’t know how this charge is calculated, or even what it is for. Keep reading to learn more about the monthly finance charge on your credit card statement.

Checkout this video:

What is the monthly finance charge if the average?

The monthly finance charge is the average of the monthly interest charges on your outstanding balance. It is important to remember that this is a finance charge, not an interest rate. Your interest rate may be lower, but if you have a high balance, your monthly finance charge will be higher.

How is the monthly finance charge calculated?

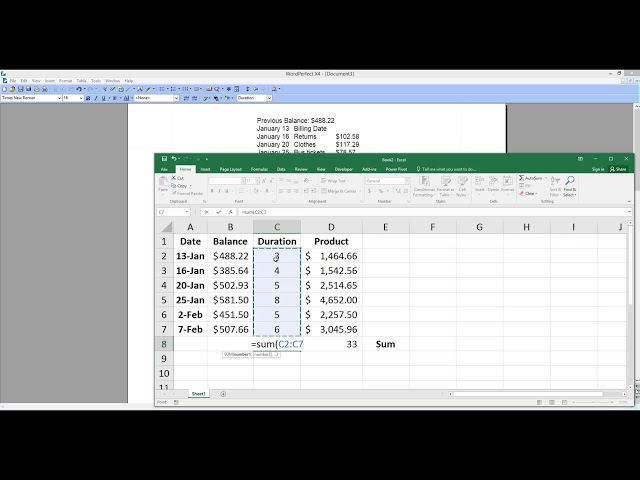

Your monthly finance charge is calculated by applying a periodic rate to the “average daily balance” of your account. The “average daily balance” is determined by adding each day’s balance during the billing cycle, and dividing that sum by the number of days in the billing cycle. This calculation excludes new purchases and balance transfers made during the billing cycle.

What are the factors that affect the monthly finance charge?

There are several factors that affect the monthly finance charge on your credit card statement.

The first factor is your APR, or annual percentage rate. This is the interest rate you’re charged on your outstanding balance each year. Your monthly finance charge will be a fraction of this APR, based on the number of days in the billing cycle.

The second factor is your daily periodic rate. This is simply your APR divided by 365 (the number of days in a year). To calculate your monthly finance charge, we multiply your daily periodic rate by the number of days in the billing cycle, and then multiply that figure by your average daily balance during the billing cycle.

The third factor is the number of days in the billing cycle. The longer the billing cycle, the more interest you’ll pay over time. For example, if you have an outstanding balance of $1,000 and an APR of 15%, you’ll pay $15 in interest over the course of a year with a monthly billing cycle. But if your issuer uses a 28-day billing cycle, you’ll end up paying $10.71 in interest charges over the course of a year – even though you’re being charged interest for only two extra days each month.

Finally, your monthly finance charge will also depend on your average daily balance during the billing cycle. The higher your balance, the more interest you’ll pay – even if other factors (like APR and billing cycle length) stay constant.

What are the benefits of understanding the monthly finance charge?

The monthly finance charge is the fee that is charged by the credit card company for the use of their credit card. This fee is based on the average daily balance of the account. The monthly finance charge is usually calculated by dividing the monthly periodic rate by the number of days in the billing cycle.

Understanding the monthly finance charge can help you to better manage your finances and avoid paying more than you have to in interest charges. Additionally, if you are carrying a balance on your credit card, understanding the monthly finance charge can help you to budget for your payments and avoid paying more interest than necessary.

How can you avoid paying a high monthly finance charge?

Your monthly finance charge is determined by taking the average daily balance of your account, multiplied by the monthly periodic rate, and then multiplied by the number of days in the billing cycle. To avoid paying a high monthly finance charge, you can do one of two things: keep your balance low or pay your balance off in full each month.

What are the consequences of not understanding the monthly finance charge?

If you don’t understand the monthly finance charge, you could end up paying more interest on your credit card balance than you expected. This can cause you to carry a balance for longer and end up paying more in interest and fees over time. It’s important to understand all the terms and conditions of your credit card before you use it, so that you can avoid any surprises down the road.

How can you use the monthly finance charge to your advantage?

The monthly finance charge is the amount of interest you will be charged each month on your outstanding balance. If you have a high balance, you will be charged a higher monthly finance charge. If you have a lower balance, you will be charged a lower monthly finance charge. The monthly finance charge is calculated by applying a periodic rate to the average daily balance of your account. The average daily balance is calculated by adding the beginning balance of your account for each day in the billing cycle and dividing that number by the number of days in the billing cycle.

What are some common misconceptions about the monthly finance charge?

There are a few common misconceptions about the monthly finance charge. One is that it’s always calculated based on the balance of your account. However, in most cases, the monthly finance charge is actually based on your average daily balance during the billing cycle.

Another misconception is that the monthly finance charge is always a flat fee. However, that’s not always the case. In some cases, the monthly finance charge may be a percentage of your overall balance.

Finally, many people think that you can avoid the monthly finance charge by simply paying your balance in full each month. However, this isn’t always true. In some cases, even if you pay your balance in full, you may still be charged a monthly finance fee.

What should you do if you have questions about the monthly finance charge?

If you have questions about the monthly finance charge, you should contact your credit card issuer. Your credit card issuer is the company that issued you the credit card. The monthly finance charge is the fee that is charged by the credit card issuer for using a credit card.

10)Where can you go for more information about the monthly finance charge?

There is no definitive answer to this question, as the monthly finance charge will vary depending on a number of factors, including the interest rate of the credit card, the balance of the card, and whether or not any promotional offers are currently in effect. However, you can usually get a good estimate of your monthly finance charge by using an online calculator or by contacting your credit card issuer directly.