How To Calculate Finance Charge On A Credit Card?

Contents

- What is a finance charge?

- How is the finance charge calculated?

- What are the different types of finance charges?

- How can you avoid finance charges?

- What are the consequences of not paying your finance charges?

- How can you dispute a finance charge?

- What are some tips for managing your finance charges?

- What are the different types of credit cards and their associated finance charges?

- How do interest rates affect finance charges?

- What are some frequently asked questions about finance charges?

Finance charges on a credit card can be tricky to calculate. Here’s a helpful guide on how to figure out the finance charge on your credit card.

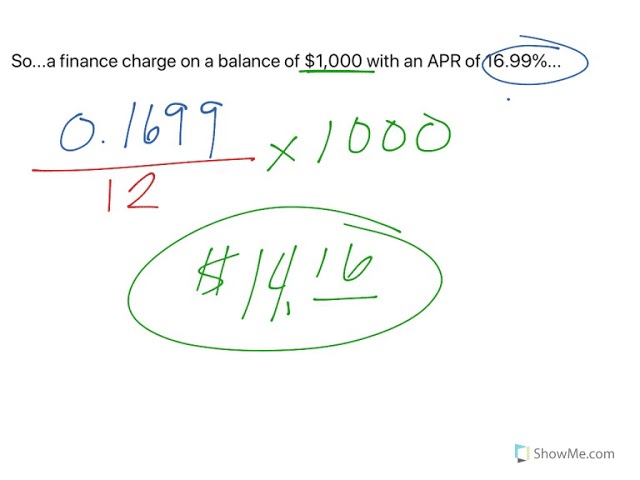

Checkout this video:

What is a finance charge?

A finance charge is the cost of borrowing money, which is expressed as a percentage of the total amount borrowed. For example, if you borrow $100 and the finance charge is 10%, you will owe $110 when the loan is due.

The finance charge can also be expressed as an annual percentage rate (APR), which includes any fees associated with the loan. For example, if you borrow $100 and the APR is 10%, you will owe $110 at the end of the year, plus any additional fees that may have been charged.

To calculate the finance charge on a credit card, you need to know your card’s APR and your average daily balance. The APR is typically disclosed in the credit card agreement or on your monthly statement. Your average daily balance is calculated by adding up your balance at the end of each day and dividing by the number of days in the billing cycle.

Once you have this information, you can use a finance charge calculator to determine your finance charges for a given period of time.

How is the finance charge calculated?

The finance charge on a credit card is the cost of borrowing money, which is calculated based on the annual percentage rate (APR). The APR is the interest rate plus any fees charged by the issuer, such as an annual fee. The finance charge is disclosed in the cardholder agreement and appears on each billing statement.

To calculate the finance charge, the issuer first applies a daily periodic rate to the outstanding balance. The outstanding balance includes any new purchases, cash advances, and balance transfers, minus any payments or credits. The daily periodic rate is determined by dividing the APR by 365 days (or 360 days in some cases).

Next, the issuer applies the daily periodic rate to the number of days in the billing cycle. This results in the periodic finance charge, which is then added to any previous unpaid finance charges and any new balances from transactions made during the current billing cycle. Finally, if there is a grace period (a period of time during which no interest is charged), the issuer may subtract any unpaid finance charges from that grace period before adding them to the balance due.

What are the different types of finance charges?

There are several different types of finance charges that can be applied to your credit card balance. The most common type of finance charge is an interest charge. This is a charge that is applied when you carry a balance on your credit card from one month to the next. The interest rate that is used to calculate your finance charge will be disclosed in your credit card agreement.

Other types of finance charges include fees for services such as cash advances, balance transfers, and foreign transactions. These fees are typically a flat fee, rather than a percentage of the amount of the transaction. You will also find fees for late payments and returned payments. These fees may be assessed on a per-transaction basis or as a percentage of your outstanding balance.

How can you avoid finance charges?

There are a few things you can do to avoid finance charges on your credit card. One is to pay your balance in full every month. This way, you’ll never be charged interest. Another is to keep your balance below your credit limit. This way, you’ll never be charged over-limit fees. Finally, you can always ask your credit card company to waive any fees they think are unfair.

What are the consequences of not paying your finance charges?

If you don’t pay your finance charges, you will be charged a late fee. You may also be charged a higher interest rate on your outstanding balance. This will increase the amount of money you owe on your credit card. The late fee and the increased interest rate will continue to apply until you make a payment that brings your account current.

How can you dispute a finance charge?

If you’re being charged a finance charge on your credit card, it’s important to understand how that charge is calculated. You may also want to dispute the charge if you feel it’s unfair or inaccurate. Here’s what you need to know about disputing a finance charge on your credit card.

The first step is to contact your credit card issuer and explain the situation. You’ll need to provide documentation to support your case, such as receipts or invoices showing that you paid your bill on time. Once the issuer reviews your case, they will determine whether or not the charge is justified. If they find that the charge is indeed justified, you’ll be responsible for paying it.

However, if the issuer finds that the charge is not justified, they will reverse the charge and refund any money you may have already paid. You may also be able to negotiate a lower finance charge if you are willing to pay off your balance in full immediately.

What are some tips for managing your finance charges?

Here are some tips to help you keep your finance charges under control:

-Know when your billing period ends and make sure you don’t carry a balance over from one period to the next.

-Keep track of your credit card balance and know your credit limit.

-Pay more than the minimum payment each month to avoid paying interest on your balance.

-If you can’t pay your balance in full, try to pay as much as possible to reduce the finance charges you’ll accrue.

What are the different types of credit cards and their associated finance charges?

Credit cards come with a variety of different interest rates and associated finance charges. It is important to understand these charges before signing up for a credit card so that you can make an informed decision about which card is right for you.

Annual Percentage Rate (APR): The APR is the annual rate charged for borrowing, expressed as a percentage of the total amount of credit extended. For example, if you have a credit card with an APR of 20%, you will be charged 20% interest on any outstanding balance on your account.

Minimum Finance Charge: The minimum finance charge is the smallest amount that you will be charged for interest on your credit card account in a given billing period. For example, if your credit card has a minimum finance charge of $1, you will be charged at least $1 in interest even if your outstanding balance is very low.

Balance Transfer Fee: A balance transfer fee is a charge assessed by some credit card companies when you transfer the balance from one credit card to another. This fee is typically a percentage of the total amount being transferred (e.g., 3%), and it is added to your outstanding balance.

Cash Advance Fee: A cash advance fee is a charge assessed by some credit card companies when you use your credit card to withdraw cash from an ATM or to get cash back at a point-of-sale purchase. This fee is typically a percentage of the total cash advance amount (e.g., 3%), and it is added to your outstanding balance.

How do interest rates affect finance charges?

The amount of interest you’re charged on your credit card balance is called the annual percentage rate, or APR. Your APR is based on several factors, including:

-The prime rate, which is the interest rate that banks charge their best customers

-The margin, which is the percentage above the prime rate that your credit card issuer adds to determine your APR

-Your creditworthiness, which is how likely you are to repay your debt

Your APR will affect the amount of your finance charge. The finance charge is the total amount of interest and fees you pay on your credit card balance. To calculate your finance charge for a given month, your credit card issuer will:

-Multiply your average daily balance by the monthly periodic rate. The periodic rate is 1/12 of the APR.

-Add any fees charged for that month, such as an annual fee or a late payment fee.

The monthly periodic rate and any fees are then multiplied by the number of days in that billing cycle to calculate the finance charge.

What are some frequently asked questions about finance charges?

Q: What is a finance charge?

A: A finance charge is the cost of borrowing money, and it’s calculated based on your annual percentage rate (APR) and your credit card balance.

Q: How do I calculate my finance charge?

A: To calculate your finance charges, you’ll need to know your APR and your current credit card balance. The APR is the annual percentage rate charged by the issuer, and the balance is the amount of money you currently owe on the card. You’ll also need to know the number of days in the billing cycle, which is typically 30.

Here’s the formula for calculating a finance charge:

Finance Charge = (APR/365) * (Number of days in billing cycle) * (Balance)

For example, let’s say you have a credit card with an APR of 18%, and you currently owe $1,000 on the card. Your billing cycle is 30 days long. The calculation would look like this:

Finance Charge = (18%/365) * (30) * ($1,000)

Finance Charge = $8.16

Q: When am I charged a finance charge?

A: You’re typically charged a finance charge when you carry a balance on your credit card from one month to the next. In other words, if you don’t pay off your entire balance before the due date, you’ll be charged a finance charge for the remaining balance. Some cards also have annual or other fees that are considered finance charges.

Q: Can I avoid finance charges?

A: Yes! You can avoid finance charges by paying off your entire balance before the due date each month. If you can’t do that, try to keep your balance as low as possible to minimize the amount of interest you’ll be charged.